For access to financial services, many Central American markets have lagged behind others in Latin America. However, the landscape is quickly changing, in part due to the efforts of mobile operators in the region.

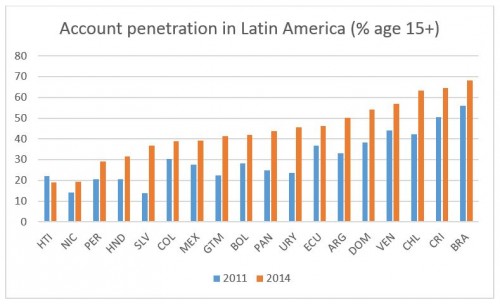

The World Bank recently released the 2014 Global Findex database, which measures financial inclusion around the globe. Latin America and the Caribbean (LAC) witnessed a significant jump in account [1] penetration, from 39% in 2011 to 51% in 2014.[2] Taking a closer look at the data, the most dramatic changes in financial access across the region have come from Central American markets.[3] In particular, El Salvador, Guatemala, Panama and Honduras have deepened account penetration by more than 50% in a three-year period.

El Salvador, the smallest and most densely populated country in Central America, has made the most outstanding progress in closing the financial access gap. It nearly tripled the percentage of adults with an account, from 13% in 2011 to 36% in 2014. This represents the highest growth rate of accounts amongst all LAC markets for which data is available.

Mobile money has played a key role in this advancement. The Global Findex reports that 4.6% of adults in El Salvador have a mobile money account, far exceeding the LAC average of 1.7% and representing the highest penetration rate of mobile money accounts in the region.[4]

Tigo has invested heavily in building out an extensive distribution channel for its mobile money service, Tigo Money, in El Salvador. Since its launch in 2011, Tigo Money has substantially expanded the access footprint with over 2,000 agents across the country. Having achieved over 20% penetration of Tigo’s mobile subscriber base to date, Tigo Money in El Salvador ranks amongst Millicom’s strongest deployments globally. [5]

Interestingly, domestic peer-to-peer payments have not been the key driver of growth for mobile money in El Salvador thus far. Tigo Money has gained traction with bill payment services and international remittances. Most strikingly, Tigo El Salvador receives a high volume of international remittance payments—predominantly from the US—through its partnership with Western Union. This is material given that remittance flows from abroad constitute more than 10% of the gross domestic product of most Central American economies, including 18% of El Salvador’s GDP.[6]

Today, with operations in El Salvador, Honduras, and Guatemala, Millicom counts roughly 2 million active mobile money accounts across Central America.[7] Tigo Money in Honduras recently crossed the 1 million active customer mark, and the Tigo Money service in Guatemala is distributing humanitarian aid in partnership with Oxfam.

Other mobile operators in the region are also investing in mobile money. For example, Cable & Wireless Panama launched Movil Cash in May 2014, together with Metrobank. It represents the first mobile money service in Panama. It is still early days and mobile money providers have a steep mountain to climb to build a digital financial services ecosystem.

Going forward, a key area of development for mobile money providers in Central America will be to expand the range of use-cases and products available to consumers. Partnerships with financial institutions, for instance, will be necessary. Much like we’ve seen in other regions, partnerships between mobile operators and financial institutions to offer mobile credit, savings and insurance can be a win-win. In Kenya, the joint product of the Commercial Bank of Africa (CBA) and Safaricom, M-Shwari, has significantly contributed to CBA’s retail banking portfolio. Just last month, M-Shwari reported 10 million accounts with over $1.6 billion USD in savings mobilized and over $300 million in loans. In Paraguay, Tigo’s partnership with Banco Familiar has resulted in nearly half a million new loan clients, most of whom were previously unbanked.[8]

Regulatory certainty will be essential for the continued development of a healthy digital financial ecosystem. To date, most markets in Central America region are not yet enabling for mobile financial services. That said, the GSMA and other financial inclusion stakeholders are encouraged by the progressive approach the regulators have taken and by their willingness to allow new business models to flourish. With adequate prudential regulations and risk-based know-your-customer procedures, mobile operators can safely issue e-money and contribute to financial integrity and stability. The industry eagerly awaits the regulatory certainty that will open the door to increased investment levels from mobile operators and more valuable products and services for consumers.

It is clear mobile money can play a critical role in kick-starting a digital financial ecosystem around the globe. As Melinda Gates wrote in a recent NY Times essay, “…digital financial services offer the world a huge chance to connect more than two billion people to their first bank accounts, lift millions of families out of poverty and accelerate the participation of developing countries in the global marketplace.” [9] In Central America, the 2014 Global Findex data indicates we’re heading in the right direction.

Notes

[1] An account includes those at a bank or another type of financial institution or with a mobile money provider.

[2] The Global Findex defines this metric as the percentage of respondents who report having an account (by themselves or together with someone else). For 2011, this can be an account at a bank or another type of financial institution, and for 2014 this can be a mobile account as well (% age 15+)

[3] Analysis was limited to countries with a population of over 3 million people for which data is available at two points in time (2011 and 2014).

[4] The Global Findex defines this metric as the percentage of respondents who report personally using a mobile phone to pay bills or to send or receive money through a mobile money service in the past 12 months; or receiving wages, government transfers, or payments for agricultural products through a mobile phone in the past 12 months (% age 15+). This data is only available for select markets in 2014.

[5] http://www.millicom.com/what-we-do/mobile-financial-services/

[6] InterAmerican Development Bank, Multilateral Investment Fund, “Remittances to Latin America and the Caribbean in 2013: Still below Pre-Crisis Levels” http://idbdocs.iadb.org/wsdocs/getDocument.aspx?DOCNUM=38842219

[7] http://www.millicom.com/what-we-do/mobile-financial-services/

[8] http://www.iadb.org/en/news/news-releases/2014-10-29/inter-american-awards-foromic-2014,10964.html