There are now 2.2 billion people around the world using mobile broadband (defined as a 3G or 4G connection). Thanks to the falling cost of access and the large investments made by mobile operators in their networks, growth has been staggering: 4 times more people are using mobile broadband than just 5 years ago. Nonetheless, a significant disparity between the world’s regions remains, with Africa experiencing the lowest levels of connectivity and adoption in the world. Today, only 47% (or 565 million) of Africans are using mobile services, with only 25% (303 million people) across the continent accessing the internet via mobile.

A key reason for this is low network coverage, an issue that is particularly pronounced with mobile broadband: only 50% of the continent’s population are covered by 3G networks, compared with a global average of 78%. Challenging terrain and low population densities work against commercially viable expansion into rural areas, something that the Connected Society team are working with mobile operators in the region to address.

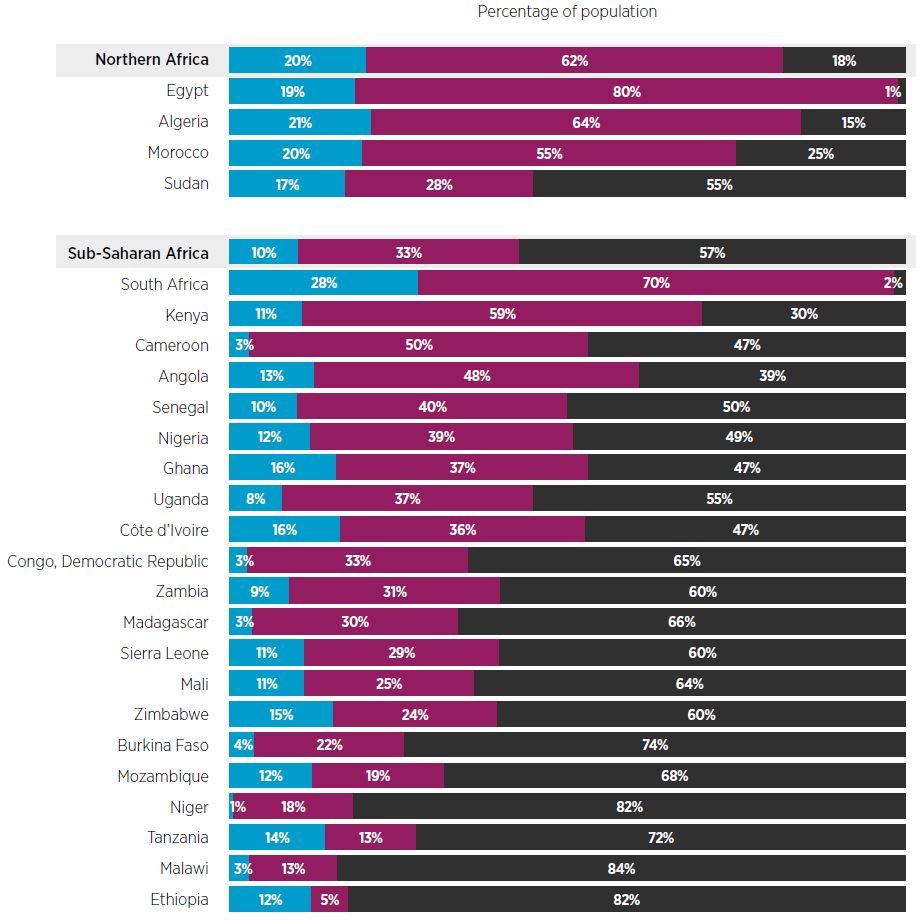

This lack of coverage doesn’t fully explain the comparatively low levels of usage. This is because there are a large number of people across Africa that are already covered by a mobile broadband network, but who aren’t currently using it. As Figure 1 (below) demonstrates, 62% of people in North Africa, and 35% in sub-Saharan Africa, have access to 3G or 4G but aren’t taking advantage of it. Moreover, within the latter, there are large difference between countries, with this issue particularly pronounced in South Africa, where 70% are covered by mobile broadband but aren’t subscribing, Kenya (59%) and Cameroon (50%).

Figure 1: Network coverage in Africa

Source: GSMA Intelligence

This is an issue for two reasons. Firstly, for operators this means a lost source of revenue, and it is a missed opportunity to recoup some of the significant investments they have made. Secondly given the way that the internet enables socioeconomic growth, this also represents a missed opportunity to enrich millions of lives across the region.

In order to understand why non-users weren’t taking advantage of the mobile broadband opportunity we surveyed consumers in 13 countries across Africa as part of the GSMA Intelligence Consumer Survey 2015: 3 in North Africa and 10 in Sub-Saharan Africa. In each country approximately 1,000 people were interviewed face-to-face, and were selected so that they were representative of the urban-rural and gender splits of the population. Those who had never used the internet were asked what was stopping them.

The results from the survey can be explored further in in our recently published report: Consumer barriers to mobile internet adoption in Africa. The 3 most important findings were:

1. In North Africa, a lack of awareness and locally relevant content (which we take to be any form of electronic media: pictures, music, text, videos, games, maps etc) was the main barrier for those not currently using the internet. Fundamentally, there remains a strong perception among many non-users that the online content and services currently available are largely irrelevant.70% of Egyptians, 51% of Moroccans and 46% of Algerians highlighted this as the reason they weren’t online. While this wasn’t quite as keenly felt in sub-Saharan Africa, it was a major issue for non-users in the continent’s two largest economies: 57% of those surveyed in South Africa, and 53% in Nigeria, highlighted a lack of relevance as being a key issue.

2. A lack of digital skills represented the main barrier for non-users in sub-Saharan Africa. 38% of those surveyed gave this as there reason for not coming online, with this a particular issue in Ethiopia (62%) and Sierra Leone (60%). In some ways this is not a surprise. The region has some of the lowest levels of primary and secondary school enrolment and literacy in the world. In North Africa, this represented this second largest barrier, with non-users in Morocco (53%) feeling that this was a particular concern.

3. Affordability was the third largest concern in both. While low household budgets are an issue here, there remain issues around taxation – which remains high in many countries; pricing, the cost of devices and charging. Progress has been made in these areas, but it is clear that affordability remains a significant issue for consumers.

Figure 2: Barriers to coming online for non-mobile internet users in Africa

These findings should be a wake-up call for those working in and with the mobile industry in Africa, including policy makers. While expanding network coverage should remain an industry priority, it underlines the key message of the Connected Society team: digital inclusion is about more than just coverage. It is also about the affordability of services, ensuring users are equipped with digital skills and that there are opportunities for users to create and consume relevant local content.

We have previously published results from Asia and Latin America in the following reports:

Consumer Barriers to Mobile Internet Adoption in Asia

Digital Inclusion in Latin America and the Caribbean

Consumer Barriers to Mobile Internet Adoption in Africa