By capitalising on mobile’s widespread nature, the mobile money industry has made significant progress in extending the reach of financial institutions through the provision of mobile money services. To date, mobile money is present in 93 countries with 271 services, serving, 61 per cent of the developing world and over 400 million customers.

However, as highlighted by the Global Findex 2014, segments like women tend to consistently be left behind – the gender gap in mobile money adoption and usage currently stands at 36 per cent in low-and middle-income countries. This is not only a loss to women, who are yet to reap the benefits from financial inclusion via mobile money, but a loss to the mobile industry as well, who could unlock significant revenues by tapping into this market segment.

Collecting and analysing reliable customer data can significantly help develop strategies to drive adoption and usage of the service among untapped segments of the market, such as women. This can be done through transactional data analysis with a gender lens. There are three steps to this analysis:

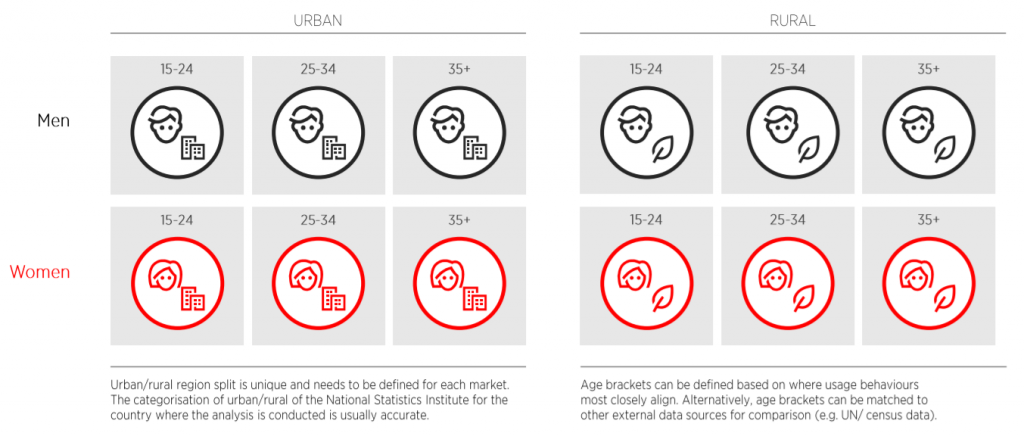

1. Segmenting your customers

Segmenting your customers not only by gender but also by demographic profiles and usage patterns will help you identify priority customer segments where there are opportunities for growing the subscriber base, and to create a baseline and a target for reducing the gender gap. Valuable demographic data for segmenting your customers includes gender, age groups and location of your customers. An example of potential demographic profiles which can used for the segmentation is provided below although you should use the segments which are most applicable in your context. You can also segment by usage patterns such as type of transaction, average number of monthly transactions, volume and value of transactions and number of parties that users interact with.

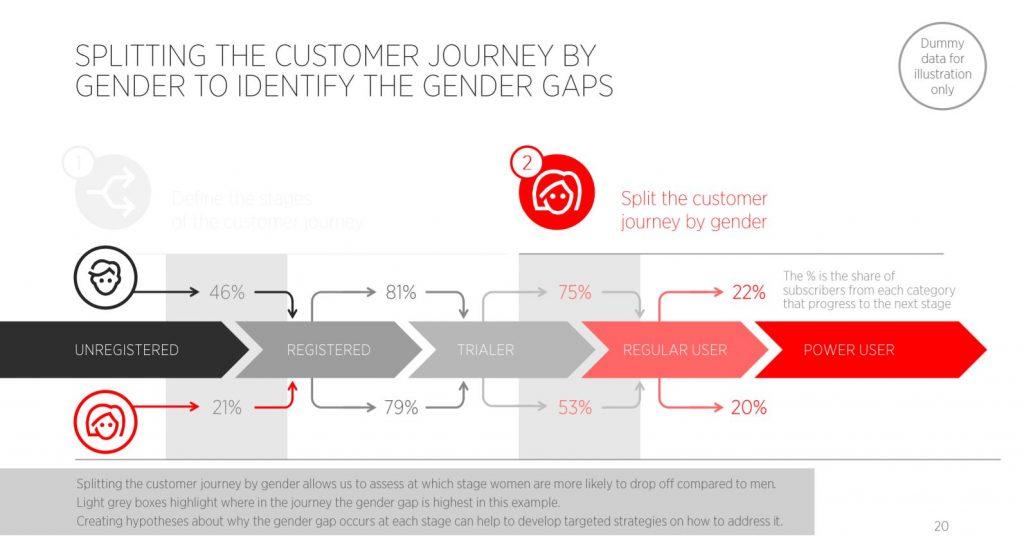

2. Mapping your segmented customer along the mobile money customer journey

Taking a gendered approach to the traditional mobile money customer journey from registration to more advanced use, will help you identify stages at which women tend to drop off more often than men. This will, in turn, help pinpoint where to focus efforts to assist in reducing the gender gap. An example of the mobile money customer journey showing this is provided below:

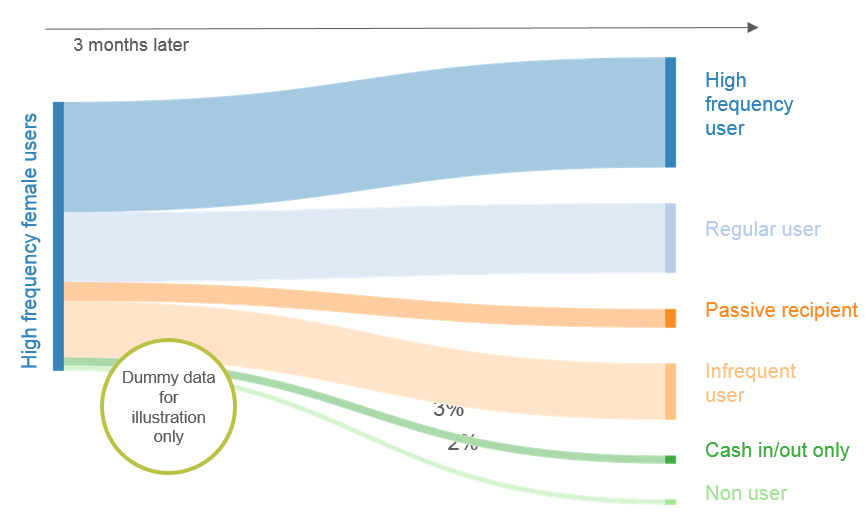

3. Deep dive on specific segments

This is the most in-depth part of the analysis, and it allows you to further explore any questions raised during the initial analysis. For instance, you can look at what the uptake is of different uses cases from a gender perspective, or how your customers interact with agents, and spot any gender differences. You can also look at how customer behaviour changes over time to, for instance, better understand who becomes a lapsed user versus who becomes a more active user. An example is provided below.

Investing in follow up research

While analysing transactional data with a gender lens is an effective way to pinpoint what is happening with your customers and where women are dropping off in the journey from registration to greater mobile money usage, it doesn’t explain the reasons behind this drop off. As such, we encourage mobile money providers to consider investing in follow up research that can help test hypotheses developed during the data analysis and distil insights on how to better reach women with mobile money services.

The need for reliable gender data

Reliable gender data is important for this analysis. However, according to the 2015 State of the Industry Report, 41 per cent of survey respondents said they knew the gender composition of their customer base. While this is significantly higher than in previous years (in 2014, only 28 per cent (24 out of 85) had this information and in 2013, only 32 per cent (29 out of 91)), indicating that a growing number of mobile money providers are tracking gender data, this also means that 59 per cent of operators who participated to the survey don’t know the gender of their customers. This highlights a challenge with the how customer data is collected, stored and analysed.

While gender data is usually available, it can be difficult to access, as it is often recorded in paper forms that don’t get digitised, or because it’s recorded in different databases that are difficult to harmonise (for instance, CDR databases are often not merged with transactional databases). Also, the available data can be unreliable, as there may be a tendency of men to register on behalf of women (especially in countries where culture makes it inappropriate for women to interact with males outside of the family) and because of human errors when collecting customer information. In many cases, even when operators collect data on the gender of their customers, they don’t have enough time or resources to analyse it.