Introduction

At the end of 2014, the GSMA’s Mobile for Development Utilities Innovation Fund invited organisations to apply for funding to trial or scale the use of mobile technology across the water, energy and sanitation sectors. This was the second phase of funding following successful support to 13 grantees in the water and energy sectors during the first phase of the Innovation Fund. Increased interest in leveraging mobile technologies within the developing world led to tremendous growth in our application pool, both in terms of absolute numbers and geographical and sectorial diversity.

More Concept Notes in Phase 2

In Phase 2 we received 218 Concept Notes, reflecting a 30% growth compared with the earlier phase. The majority of organisations (77%) applied for the Seed Grant category to test early stage trials, 14% applied for Utility Partnership grants to foster partnerships between utility companies and innovators, and 9% applied for Market Validation grants to scale or replicate existing business models.

Africa continues to dominate

We received applications from 44 unique countries across Africa, Asia and Latin America. Africa continued to dominate as the proposed region of implementation with 58% of organisations proposing to implement in the continent. India, Kenya and Tanzania were the most dominant markets with more than 20 unique concept notes received from each of these countries. The West African region demonstrated substantial growth in the number of organisations applying to the Fund. The total number of organisations applying from Nigeria and Ghana grew from 9 to 22 between Phase 1 and Phase 2 signifying the growing interest in leveraging mobile technology in the utilities space in the West African region. Other key regions emerging beyond East Africa include South Asia and West Africa, a trend which is in line with the size of the addressable market. [1]

Mobile channel use is growing

Phase 2 applicants showed increased usage of mobile channels compared to Phase 1.[2] In Phases 1 and 2 energy organisations planned to leverage more channels than other sectors on average.[3] Energy service providers intended to leverage machine-to-machine (M2M) connectivity for remote monitoring, and mobile money for payments, more frequently than other channels. On the other hand, mobile services such as mobile data and voice were the preferred channels for water and sanitation sectors. This difference in application of mobile channels reflects varying needs across each sector. For instance, applications of mobile in the water and sanitation sectors are more often aimed at improving existing service delivery through communicating information to multiple stakeholders, building capacity of operators and users and operational management of infrastructure, which often require mobile services to relay information efficiently. Further analysis of Phase 2 Concept Notes revealed that use of mobile channels varies by geography. 52% of organisations planning to implement in Asia leveraged M2M compared to 43% in Africa. Availability and widespread adoption of M2M technology could explain differences in demand for M2M services between Africa and Asia: a recent report by GSMA Intelligence shows that about half of MNOs in Asia offer M2M services compared to only a third in Africa. Moreover, Asia accounted for 42% of all M2M connections globally during Q1 of 2014. [4]

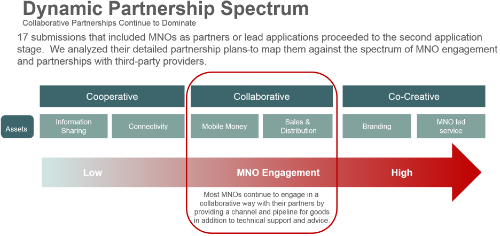

High latent demand for MNO partnerships

For the first stage of the application process 27% of organisations had an MNO partner in Phase 2 compared with 36% in Phase 1. Furthermore, in Phase 2, we found high latent demand for MNO partnerships with 42% of organisations planning to partner with an MNO, but yet to formalise the partnership. [5]

Dynamic business models

Analysis of business models revealed that for-profit models dominated in the energy sector, while water and sanitation business models were mostly not-for-profit, as customers may be less accustomed to paying for services. In addition, the water and sanitation sectors have more complex supply chains that often require government involvement for both regulation and provision of core infrastructure, making direct business to customer models more difficult. Pay-As-You-Go (PAYG) energy models constituted approximately 53% of the energy applications, with more than half of organisations targeting larger systems such as Solar Home Systems (SHS), microgrids and minigrids, as opposed to smaller lanterns. The cost of solar technologies has been continually dropping while PAYG business models are becoming more widespread. [6] To date, investors have committed over USD 200 million to energy PAYG business models further reducing working capital constraints for service providers. [7] Organisations therefore increasingly see an opportunity to supply larger systems that provide more than just basic lighting, ultimately leading to a movement of households up the energy ladder.

Conclusion

We continue to see interest in leveraging mobile in the water and energy sectors, as well as in the more nascent sanitation sector. Cost of technology, maturity of mobile-enabled models for each sector, availability of technology, and cultural and geographical differences affect how utility services leverage mobile technology. As more products and services are deployed across the globe and more innovative partnerships are forged between MNOs, utilities and service providers, mobile technology will continue to play a pivotal role in closing access gaps to underserved communities in the energy, water and sanitation sectors.

Notes:

[1] Mobile for Development Utilities internal data

[2] Mobile for Development Utilities 2013 Annual Report, Figure 1

[3] On average energy organisations intended to leverage 2.15 channels compared to 1.77 and 1.75 channels for water and sanitation organisations respectively.

[4] GSMA Intelligence

[5] The method of data collection employed in Phase 2 was different from that used in Phase 1. In Phase 1 organisations only stated whether or not they had an MNO partnership at the time of submitting the concept note. Some service providers confirmed an MNO partnership before signing a formal contract with the MNO. During Phase 2 we captured more information on partnerships between MNO and service providers at Concept Note stage by tracking finalised partnerships separately from those that were at various stages before final confirmation.

[6] Lighting Global Market Research Report, May 2015

[7] Mobile for Development Utilities internal data