The Mercy Corps Agri-Fin Mobile Programme supports partners in providing market information and financial support to smallholder farmers and small businesses in Indonesia, Uganda and Zimbabwe. The primary method through which this is achieved is a suite of bundled services, including: the provision of regular, current agricultural and agronomic information, including up-to-date crop prices; and, financial support and services that inspire and maintain the economic activity and inclusion of their customers. Through doing so, Agri-Fin believes that it can bring about economic improvement and increased food security for individuals and organisations across the agricultural sectors of these 3 countries.

Year Launched: 2012

Business Model: Consumer-led, P2P, P2B, B2P (varies)

Targeted Device: Basic Phone, PC/Laptop

Primary Delivery Technology: SMS, USSD, Mobile Web

Products & Services: Information access, Financial services

Markets Deployed In: Indonesia, Uganda, Zimbabwe

Estimated Number of Users: As of September 2014, 230,000 people have received info only services, with a further 50,000 subscribed to combination of info and financial services.

BACKGROUND AND OPPORTUNITY

Agri-Fin launched in June 2012 fully aware that the political, economic and mobile money landscapes across the three countries in which it would be operating varied considerably. However, there were certain commonalities which led to their being selected as targets, namely their significant agriculture sectors and relatively immature commercial financial services for smallholder farmers.

The project was inspired by a realisation that many mobile-for-development (M4D) projects across the world were working in and around the agricultural sector and mobile agriculture, but were not supplementing this work with financial support and advice. Should there exist services that combined these components, it would be possible to help users of mobile agriculture projects to ensure that they are also safely and effectively managing their finances.

In response to this, Agri-Fin was launched simultaneously across Indonesia, Uganda and Zimbabwe with the explicit aim of combining financial support with agricultural services. From this point onwards, the team sought to realise their vision of a world where farmers in traditionally underserved communities are helped to escape poverty through improved technical knowledge and financial literacy.

OBJECTIVE

Agri-Fin seeks to empower smallholder farmers to make better-informed technical and business decisions – and to ensure that they have enough information to do so. This brings improvements in farmers’ productivity and stabilisation of their incomes, which in turn contribute to increased food security.

RESULTS

- Since the programme’s launch in mid-2012, 285,000 farmers have been reached.

- Currently, there are 16,720 farmers registered in Uganda, 18,900 in Indonesia, and 29,330 in Zimbabwe

- In June 2014, 231,000 Zimbabwean farmers received Agri-Fin’s agricultural information services, and 1,600 received financial services.

IMPACT

Agri-Fin’s vast reach allows them to bring greater financial inclusion and higher levels of financial literacy to those working in agriculture across Indonesia, Uganda and Zimbabwe. This in turn increases financial and food security.

LESSONS LEARNED

1. Stay on top of your partnerships:

- Ensure that objectives are aligned – All parties working on a project’s different components must be fulfilling their roles with the same goals in mind, and this must fit into what your service practically needs.

- Monitor the behaviour of your partners – It’s important to retain a degree of awareness of this in order to ensure that partners are performing to an expected standard and are still bringing value to your service.

2. Be flexible – Initial assumptions can sometimes become a hindrance. It’s therefore important to be willing to adapt and evolve as the service grows.

3. Don’t force change – In acquiring new users, Agri-Fin has found that pushing farmers to change their SIM cards is often ineffective. Instead, the best action to take was to provide a starter package through the MNO, improve promotional materials, and include training activities to increase farmers’ loyalty. This lesson now informs how Agri-Fin goes about seeking new users.

APPROACH

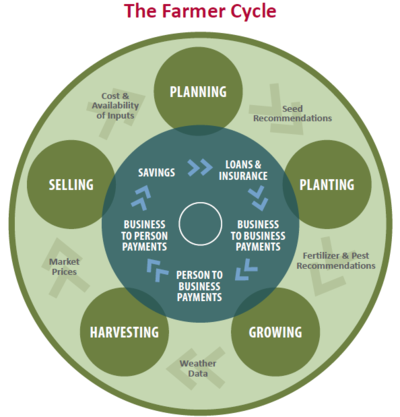

A combination of market research with information regarding political and economic landscapes helps Agri-Fin to create distinct services across the three countries in which they operate. What remains consistent throughout, though, is the medium for delivery of these services. This is achieved through the distribution of four services in the form of a bundle, delivered in four stages: agri advice, financial advice, agri payments, and credit facilitation. Agri-Fin is not a distinct service as such. Rather, it sees itself more as working behind the scenes to help its partners – most of whom, such as Econet and 8villages are for-profit – to create, deliver, and promote services that benefit farmers. Agri-Fin sees this as the most effective way to counter the inaccessibility of technical and market information, as well as a lack of knowledge around what can be done with this information.

The models through which the services operate vary slightly across countries. In Uganda, Agri-Fin operates a subscription model through mobile payment for agricultural information. Here, customers are allowed a trial period in order for them to understand the benefits of subscribing. This has resulted in over 1,000 trialists signing up for the full service, or showing a willingness to do so. In contrast, the Indonesian programme’s business model is based on usage fees for financial services. Agri-Fin and its partner Bank Andara earn commission on customers sending remittances, collecting savings and paying loan instalments through the AndaraLink mobile platform.

USER CENTRIC ATTITUDES

The design of Agri-Fin’s approach was borne out of extensive market research that helped the team to understand precisely what could benefit target customers across the three countries. For example, this led to the discovery that farmers were generally more receptive to financial advice than simply being given capital with which to work. A further outcome of this prior research is the slight differences found between operations in the three countries. When combined with information regarding political and economic landscapes, this research helped Agri-Fin to create distinct services, each offering some combination of the following: market information, learning and advisory services, weather information, and financial services and support.

THE USE AND VALUE OF DATA

Agri-Fin recognises the importance of user data in shaping its methods, something which is reflected by the amount that they collect. In order to ensure that their services are benefitting individual customers, they collect such information as: where the user is from, the number of children that they have, the value of their crops, their income levels, yield levels, what kind of financing they have, and what kind of information they access. This information allows Agri-Fin to create a poverty index to map the statuses of their farmers, and to better understand the experiences of farmers – including their level of access to technical and financial services.

Additionally, Agri-Fin collects transactional and post-transactional behaviour data. This can then be used for trend analysis, for example to mark any land that is experiencing particularly high yields. Agri-Fin can then utilise the findings from this analysis to help farmers to benefit themselves and their produce, in this case by ensuring that they know the correct value of their crops.

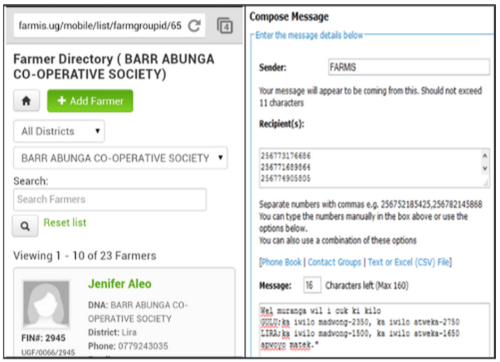

In spite of this, the Agri-Fin team doesn’t contain an individual who leads on data analysis as such. However, partners and content providers contribute considerably. For example, the Ugandan programme works with its partner FIT Uganda’s FARMIS platform to generate aggregated dashboards, updated in real time with such information as: the number of farmers profiled and receiving information, the percentage of male-female farmers profiled, the number of messages pushed and pulled, and the number of farmer associations and cooperatives contacted. The Indonesia programme uses 8Villages’ LISA platform for similar purposes. Additionally, its MNO partner in Zimbabwe, Econet, generates a lot of agricultural data which Agri-Fin collects.

However, this data is not currently utilised to its fullest potential. Their current funding limits them from collecting much more data, and their capacity limits the amount of analysis that they are able to carry out. This remains the case in spite of a programme-wide recognition that further utilisation of data would enhance the solutions that they are able to provide to farmers. That said, Agri-Fin is planning on undertaking some data analysis for the purposes of monitoring and evaluation with Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) later this year.

SUCCESS AND SCALABILITY

Agri-Fin currently has two key metrics in place for measuring their success. The first of these is the number of farmers who have been reached by their content. This was decided upon as a useful metric due to the direct visible benefits that it brings, particularly through the provision of agricultural information. To this point, 285,000 farmers have been reached across Indonesia, Uganda and Zimbabwe.

The second key metric is the number of farmers trained by the service in financial literacy. This was chosen as it represents a distinguishing component of the Agri-Fin service through its supplementation of market information with the necessary knowledge and support to control and plan one’s finances. Recently, there has been a focus on delivering this to female farmers, who commonly lack the same access as men to this kind of information. In that vein, the Indonesia programme is currently delivering financial literacy training to 10,000 female farmers across three districts.

These shorter-term metrics feed into the overall direction of Agri-Fin, which helps the programme to crystallize their plans regarding scaling the service. Its income streams are now allowing it to move away from searching for – and relying on – donor money. Instead, they can turn their attention to other areas in which they may be able to replicate the service. In searching for possible for areas of expansion, Agri-Fin considers the area’s economic situation (including the weight of the agricultural sector), MNO coverage, the number of legally recognised farmer organisations, and the frequency of microfinance institutions which could partner with commercial banks to develop mobile financial services. Whilst Agri-Fin has no concrete plans for geographical expansion at this stage, the team are open to the idea of developing the service in areas which meet these criteria.

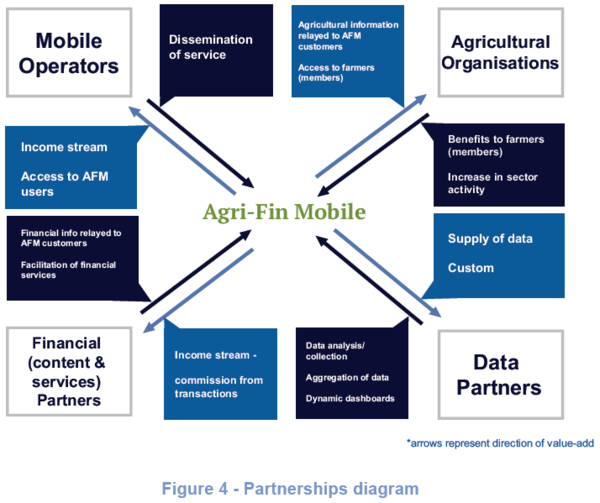

PARTNERSHIPS

Certain key partnerships have played vital roles in Agri-Fin’s success to this point, and will continue to do so in the future. Indeed, the ‘bundled’ nature of Agri-Fin’s service reflects the importance of partnerships, as the information included therein is both sourced from and delivered through various different parties. Agri-Fin’s services are essentially commercial offerings from its content providers to its end users. This financial element makes these partnerships more sustainable, as well as incentivising partners’ continued involvement with the service.

Agri-Fin’s partnerships can be separated into three categories. The first of these is financial content and services partnerships, which are important for two reasons: they provide valuable financial information which Agri-Fin can relay to their customers, and they facilitate Agri-Fin’s financial services. In Indonesia, for example, Agri-Fin works with Bank Andara – a commercial bank which partners with microfinance institutions and is able to provide mobile payment services through their AndaraLink platform. Relationships with such organisations are necessary if Agri-Fin is to properly meet their objective of combining agricultural and financial information and delivering it to customers.

Similarly, the service has established partnerships with local agriculture experts, community organisations and farmer unions. These groups act as one of the sources of agricultural information on which Agri-Fin relies. They also increase the access that Agri-Fin has to farmers, many of whom are located in quite remote areas. In the case of local market experts, Agri-Fin works with AgriNet Uganda, a transparent broker of agricultural commodities and services. Additionally, the Zimbabwean programme works with the Zimbabwe Farmers’ Union, who provide valuable information on the ground as well as acting as a channel through which Agri-Fin can reach the union’s members.

Finally, Agri-Fin could not properly operate if not for the MNOs which disseminate their service. It is therefore expedient for Agri-Fin to establish fluid working relationships with them where possible. One such operator is Econet in Zimbabwe, whom Agri-Fin identified as a suitable partner due to their position as having the furthest-reaching network in the country – making them most able to develop new far-reaching products and services. Indeed, Econet’s widest subscriber base is in rural areas of Zimbabwe, which is significant for two main reasons. Firstly, these are the areas which Agri-Fin is naturally most eager to penetrate. Secondly, at the beginning of their partnership, Econet were in the process of developing a product specifically designed to reach out to smallholder farmers – a product from which Agri-Fin could themselves benefit. Broadly speaking, the provision of Agri-Fin services across Indonesia, Uganda and Zimbabwe has consistently relied on – and benefitted from – functional working partnerships with one or more MNOs.

CHALLENGES

In terms of running and sustaining the project, Agri-Fin initially relied on donor funding for its continued survival. As discussed above, whilst broadly positive and extremely valuable, this brought with it certain drawbacks. For example, extension of their data analysis practices is dependent on external donations. However, this extension can’t take place unless Agri-Fin is able to find the money and time to evaluate the need for it, and test any pilots. Today, sufficient money to do this is still not forthcoming. Indeed, the actual time required to identify and secure funding for this is a further barrier. However, the income arriving through usage and subscription fees is transforming their models into ones that are self-sustaining, meaning that problems originating from a reliance on donor funding are likely to diminish.

A further challenge that has been faced by Agri-Fin is the levels of mobile literacy in their areas of operation. Despite high levels of access to mobile phones in these countries, Agri-Fin found that people’s actual ability to make use of the technology was often limited to making and receiving calls. In light of this, Agri-Fin is now including mobile literacy training in their programmes. This is carried out across a number of media, including by agents who deliver it face-to-face with customers. Although their current capacity limits how much training they are able to offer, this nevertheless represents a valuable addition to Agri-Fin’s services.

FUTURE PLANS

In the coming months, Agri-Fin will be working with the Swiss Agency for Development and Cooperation on a programme review, and with GIZ on data analysis for the purpose of monitoring and evaluation. In addition, the organisation will be pursuing opportunities for further partnerships, with the likes of The Mastercard Foundation, CGAP and the Bill and Melinda Gates Foundation having already expressed interest. As such, there are many exciting prospects afoot for the near future, which will enable the enhancement and expansion of the Agri-Fin service.

Looking forward, Agri-Fin has a positive outlook for the coming years. Amongst the team, there is a demonstrable excitement for the learning of more valuable lessons and the establishment of more useful partnerships, both of which will contribute to the continued growth and increasing impact of their service.

This document was originally produced as part of the former Mobile for Development Impact programme.