Our mAgri program is currently supporting six Mobile Network Operators (MNOs), two in Sub-Saharan Africa and four in South Asia, in launching and scaling agricultural Value Added Services (Agri VAS). One of the key challenges many MNOs face is to market these services to the target segment – smallholder farmers – in a cost effective manner.

This blog highlights an innovative customer segmentation approach designed and implemented by GSMA mAgri Challenge Fund grantee, Telenor Pakistan, in order to market their Agri VAS, Khushaal Zameendar (Prosperous Farmer), more effectively. Marketing to this segmented base has improved conversion rates on Outbound robo-Calls/Outbound Dialing (OBDs) almost six-fold and has generated extremely high ‘word of mouth’ sign ups by capitalising on the social nature of farming communities – every two out of three new subscriptions are through word of mouth.

The blog will start by providing a background to the service, then move onto the segmentation approach, present aggregated results and, finally, share the impact on key business and performance indicators.

Background

Telenor Pakistan launched Khushaal Zameendar in December 2015, with GSMA and its consortium partners providing grant funding, consulting, service design and content production support for the service. Subscribers receive two alerts daily – a morning weather forecast and farming tip for their preferred crop and an evening alert regarding livestock management. Subscribers can choose to receive the alerts through SMS or OBDs, while also having access to an Interactive Voice Response (IVR) number (7272) where they can access content for multiple crops, manage their profile and receive product support through a manned helpline. The content has been stylised to replicate regional language conversations in a typical Pakistani rural household, with discussions focused on questions and answers related to agriculture, nutrition and livestock.

Telenor first piloted the service in six districts of Central Punjab, Pakistan’s farming heartland, and marketed it through promotional OBDs to existing Telenor subscribers in these districts. This effort led to more than 50,000 subscribers signing up for the service and further marketing was then halted in January 2016. The next five months focused on education and engagement of existing users, while successive product iterations led to multiple improvement in service design, content enhancements and platform development.

By June 2016, the Telenor team was confident enough in the service to scale it up to a wider audience encompassing 35 districts in Punjab. By this time, word of mouth subscriptions had increased the user base to 60,000. It was at this stage that the mAgri Product team approached the Telenor Business Intelligence team, formally called Customer Value Management & Analytics (CVM&A), to provide them with customer segmentation data. Telenor does not have the professions of its 38 million subscribers profiled so it is not possible to identify farmers directly. This segmentation would therefore allow the product team to target only those users within this large base who would truly benefit from the service. Such targeted marketing would also avoid unnecessary spamming through promotional calls – a key challenge faced by VAS providers in South Asia – while allowing the team to scale up the service rapidly by improving conversion rates on promotional OBDs.

Advanced Analytics Propensity Model

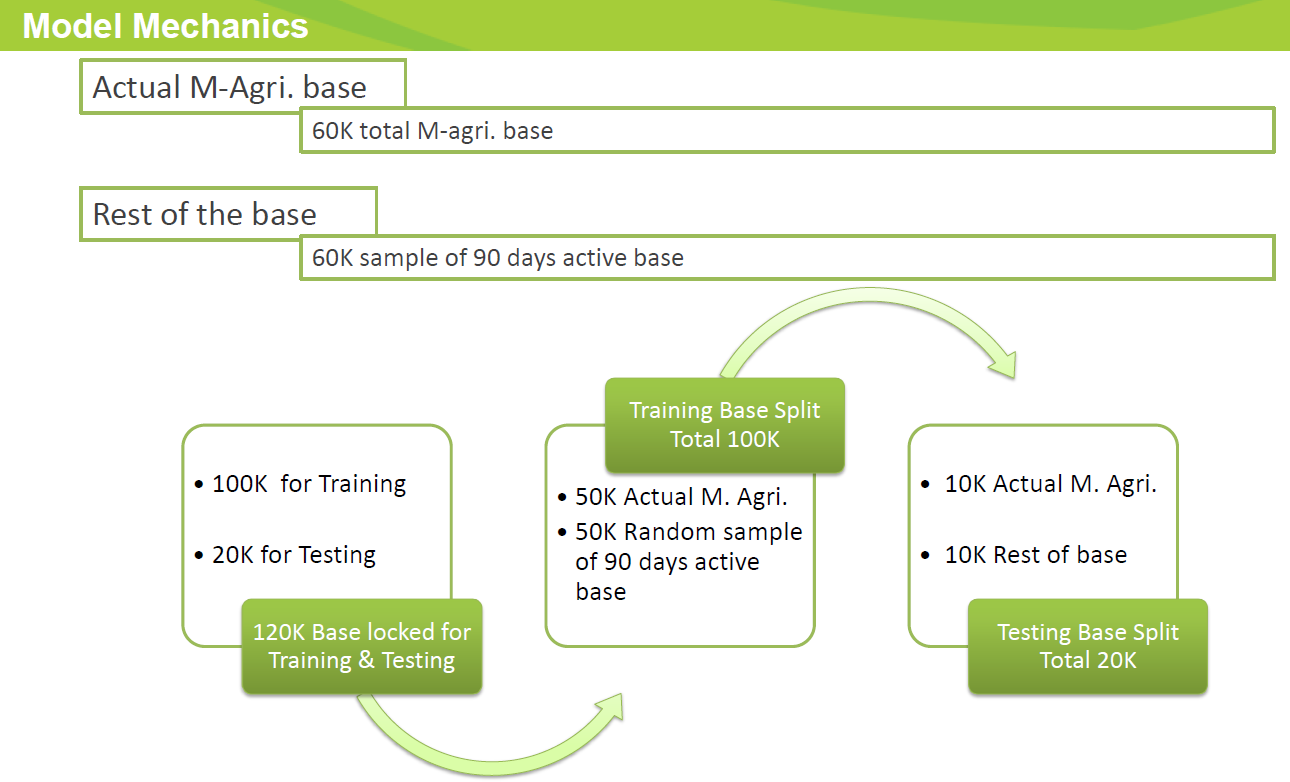

The Advanced Analytics team within Telenor’s CVM&A function started off by randomly selecting 60,000 users from amongst those who did not use the Khushaal Zameendaar service to set up its segmentation model. This non-user base of 60,000, combined with the 60,000 Agri VAS base, provided the CVM&A team with 120,000 to train and test the model.

The 120,000 base was then split into 100,000 users (50,000 from mAgri and 50,000 from non-mAgri base) to train the model and the remaining 20,000 users (10,000 from each base) to test the resulting model. Here’ a visual description of this random split:

The team then assessed the Agri VAS test base on 1,000 plus GSM variables, which can broadly be split into the following categories:

1. Voice usage – such as inbound, outbound, peak and off-peak usage & calling circles;

2. SMS usage – such as inbound, outbound & peak and off-peak usage;

3. Data usage – such as amount of data used, major websites/apps accessed and timing of access;

4. VAS usage – such as VAS usage and major value added services subscribed to;

5. Engagement indicators – such as average revenue, churn and days of activity on network; and

6. Types of handsets – divided into four segments (non-internet enabled; “entry low” feature phones; “entry high” smartphones; and “high end” smartphones).

The aim of the exercise was to identify variables that truly differentiated those users signing up for the service from those who did not. Through repeated iterations, a total of 36 variables were determined to be significant to this differentiation. These variables displayed significantly higher or lower values for the mAgri base when compared to the mean for the Telenor base.

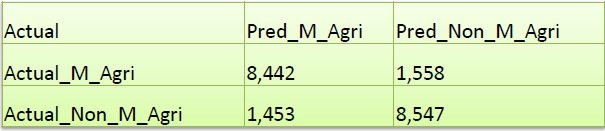

The key question now was to see how accurately this model predicted if a user will sign up for the mAgri service, based on these differentiating variables. In order to test this, the model was applied to the testing base of 20,000 users mentioned above. The model was not aware of which 10,000 of these Telenor users were Agri VAS subscribers and which 10,000 were non-AgriVAS subscribers. The model accurately predicted approximately 85 per cent of the users in both base i.e. actual users who were predicted to be users and actual non users who were predicted to be non-users.

The resulting output provided the Telenor Pakistan products team with a valuable list of 1.1 million (at 0.7 percentile) “potential” Agri VAS subscribers. These are existing Telenor Pakistan customers whose GSM behaviour matches very closely to existing Khushaal Zameendaar users but who are not yet subscribers.

Applying Theory to Practice

The products team has applied the results in two key ways:

First, the results showed that the level of digital literacy of the potential mAgri base was low. This was evidenced by low data and SMS use and the prevalence of basic and feature phones which characterise the rural segment in Pakistan. Acting on this, Telenor decided to increase its marketing focus to OBD calls, rather than SMS, for users showing high inbound call usage. This ensured that they received the marketing message through a channel they were comfortable with (inbound calls).

Second, to reach the entire 1.1 million potential users, OBD calls were supplemented by on-ground field events in high density farming areas (in collaboration with a rural NGO) where Telenor would showcase the service, register new users and teach them how to use the service. This ensured that users with low digital literacy got face-to-face guidance and the product generated increasing word of mouth as well.

The Results

Through a combination of these two practices, Telenor was able to improve the conversion rate on outbound calls from less than 1 per cent to over 5 per cent. This means that for every one hundred OBD promotional calls going out, five users are signing up for the service, compared to less than 1 previously. Starting mid-June, the user base grew from 60,000 plus to 800,000 plus by mid-October.

Initial analysis of early adopters coming onto the service through this marketing push showed an increase in average revenue per user of 4.8 per cent. The churn of mAagri users with respect to its base is 1.77 per cent which is lower than that of the comparable non-user base whose churn with respect to base is 3.10 per cent. This needs to be further tracked and monitored in the coming months for more relevant comparisons.

The targeted outbound calls, field events and the quality and relevance of the content generated significant Word of Mouth for the service. It was observed that users not targeted by the OBD calls were signing up for the service in in a ratio of 2:1 compared to targeted users, re-affirming the team’s initial hypothesis that farming is an inherently social experience and word travels fast if the content is deemed usable and relevant. Finally, such accurate segmentation meant that the service has grown by focusing specifically on “high potential” users while allowing other services to target their potential target base in a similarly targeted manner, thereby avoiding spamming.

The service is currently adding almost 10,000 users a day, far exceeding the business forecasts and GSMA-assigned targets.