This post is the second in a series on smartphones and mobile money. Read the first post in the series here.

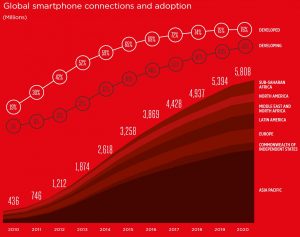

Mobile money providers have traditionally used USSD, STK and SMS as access channels because of their ubiquity and availability on low-cost phones (though not because of their ease of use). However, this is changing fast, and it is estimated that by 2018, 56% of all connections in emerging markets will be smartphone connections. [1]

Image source: GSMA Mobile Economy Report 2016

First, competition is rising. We know the disruptive nature of smartphones has already transformed service models in different industries such as communications, entertainment, and transport through the likes of WhatsApp, Spotify and Uber, among many others. Competition is now poised to disrupt the traditional banking and payments industry: according to an Accenture report, global investment into fintechs rose to USD 5.3 billion in Q1 2016 and 62% of this investment was in Europe and Asia. The same report cites that in 2015, 56% of all fintech investment was in ventures that were competing against the existing financial institutions, i.e. disruptive ventures.We have been discussing the implications of smartphones for the past couple of years, and the complexity of capturing the smartphone opportunity has consistently been at the centre of that discussion. Today, smartphones continue to hold significant potential to innovate faster and more efficiently than USSD or STK allows – however, it is how the landscape has changed which makes investing in and prioritising a sustainable smartphone strategy more critical than ever for mobile money providers.

Second, as of June 2015, mobile money providers have not yet been successful in capturing the smartphone opportunity and creating meaningful impact. According to the 2015 State of the Industry Report on Mobile Money, while smartphone apps were the second-most offered channel by providers after USSD, usage [2] via apps was low. Only eight providers had more than 1,000 active customer accounts [3] in addition to more than 15% of total transaction volumes being processed via the app.

Third, further technology development may remove USSD and STK as viable delivery channel options. Discussions about the level of backward compatibility in 5G networks may affect support for a USSD channel. While in majority of markets where mobile money is live today, 3G technology has either not been launched or has limited coverage, yet some markets may leapfrog directly to 5G within the next decade. Where these markets have live mobile money services, providers would need to be ready to relinquish their reliance on USSD and move to a data channel, such as an app.

Lastly, smartphones are becoming a mass market product. As mentioned, smartphone adoption and broadband connectivity are increasing dramatically, particularly in emerging markets. In these markets, mobile operators are investing heavily in connectivity, and vendors are pushing affordable smartphones to the market. Even the sub-$20 smartphone is now a reality – the Freedom 251 smartphone costs just $4 in India. This shift means that smartphones are reaching new demographics and unbanked or underbanked customers will soon be smartphone users too, if they aren’t already.

By prioritising and investing in a robust smartphone strategy, mobile money providers will be better positioning themselves to:

- Future-proof their service proposition from emerging competition

- Drive ecosystem volumes through a more accessible interface that offers greater flexibility on product development

- Develop a more usable service, which enables mobile money products and services to further reach underserved segments.

As capturing this opportunity continues to be complicated and market-specific, the GSMA Mobile Money programme continues to commit to working with providers to better understand the smartphone opportunity in order to unlock its potential. To all providers who see opportunities for us to assist or support you on capturing the value of smartphones, please get in touch.

Notes:

[1] GSMA Mobile Economy Report 2016

[2] Usage via apps is arguably a more meaningful metric.

[3] Active on a 90-day basis.