Previously, we looked at the landscape of government payments via mobile money in Pakistan, sharing early observations on two services, Easypaisa’s traffic challan initiative and JazzCash’s passport payment initiative. In this post, we’d like to discuss the global landscape of government payments, including both person-to-government (P2G) and government-to-person (G2P) initiatives.

Digitising government payments via mobile money offer benefits to governments, mobile money providers, and citizens alike. Governments can increase tax collection and other revenue streams (aligned with the UN Sustainable Development Goal 17.1) from its citizens by offering faster, more secure, less expensive and more transparent payments via mobile money. For providers, government payments are an important driver for the mobile financial ecosystem. Finally, citizens benefit from a quicker, safer, more efficient way of making and receiving payments to and from government entities.

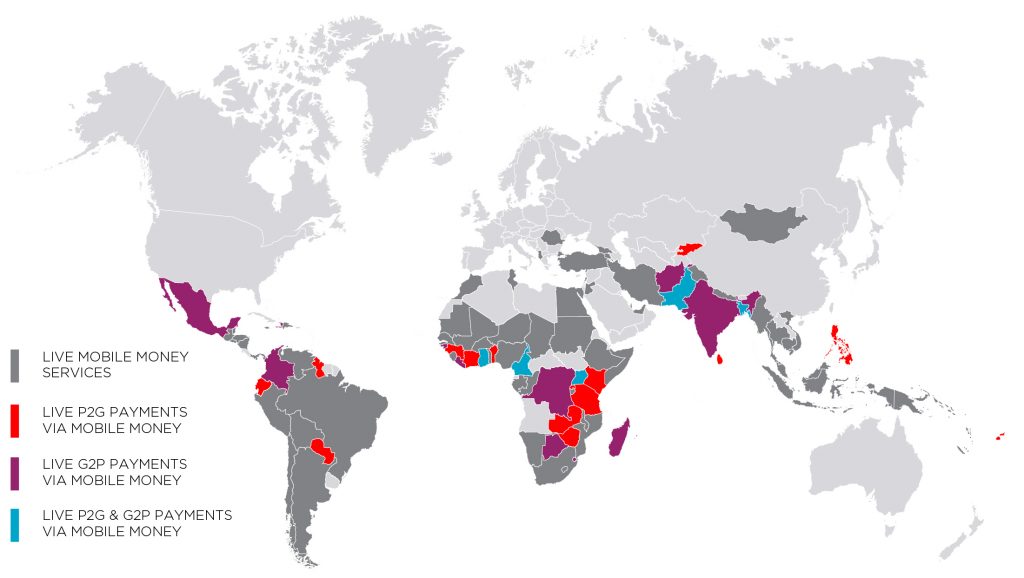

As of September, we are aware of 80 government payments initiatives in 29 countries where mobile money is available (see figure above). Just over half of these initiatives are in Sub-Saharan Africa, followed by South Asia and Latin America & the Caribbean. At the market level, Pakistan has the greatest number of live government payments initiatives (a total of 18), followed by Kenya and Tanzania, with 7 initiatives each.

Globally, the majority of government payment initiatives (55%) are P2G, with tax collection being the most frequent. However, we also see P2G payments facilitated through e-government portals, as well as license fee payments and education fee payments as common initiatives. Regionally, 70% of P2G payment initiatives are in Sub-Saharan Africa, followed by South Asia (11%) and Latin America & the Caribbean (9%).

For G2P initiatives, the majority are in South Asia (53%), followed by Sub-Saharan Africa (28%) and Latin America & the Caribbean (19%). We see a balanced mix of G2P disbursement types, including grant disbursements, social benefit disbursements, and salary or stipend disbursements (either for government officials or students). We’ve also seen pension and loan initiatives as well.

We will continue to watch the government payments space and share insights from specific markets or payments initiatives. If you are aware of a government payment via mobile money, be sure to get in touch at [email protected]