This post was written with contributions from Lara Gidvani.

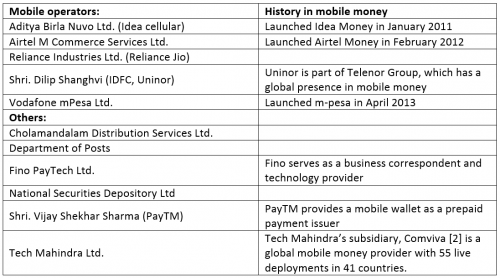

Mobile money in India has come a long way in the last eight years, with the landscape changing each time new regulations have been introduced. According to the GSMA’s mobile money tracker there are 14 mobile money services, of which six are led by mobile operators.

After lengthy policy discussions and consultation, the Reserve Bank of India issued the Guidelines for Payments Banks on November 27, 2014 and in February 2015, received 41 applications.

What are Payment Banks?

Payment Banks are a new kind of ‘narrow bank’, specialized in providing payments and transaction services. The primary objective of the new differentiated bank licenses is ‘to further financial inclusion by providing (i) small savings accounts and (ii) payments / remittance services to migrant labour workforce, low income households, small businesses, other unorganised sector entities and other users, by enabling high volume-low value transactions in deposits and payments / remittance services in a secured technology-driven environment’. [1] Payments Banks can build branches, ATM, and agent networks; issue debit cards and prepaid instruments; offer deposit accounts; process domestic remittances; process utility payments; and serve as an agent to distribute credit, insurance, and mutual funds. Payment Banks will not be able to lend funds or provide credit, except in partnership with licensed credit providers and require additional permissions to offer international remittances.

After a stringent selection process, last week RBI granted 11 “in-principle” approvals for Payment Banks, many of which have a track record in mobile money:

The “in-principle” approval granted is valid for a period of 18 months, during which time the applicants have to comply with the requirements under the Guidelines and fulfil the other conditions as may be stipulated by the Reserve Bank, before they can receive the final license begin their new operations.

Looking at the original list of 41 applications, some high-profile applicants with a history in mobile money who did not receive “in-principle” approval include: Itz Cash, Oxigen, Suvidhaa, Eko and MobiKwik. As a result, we expect to see a movement towards strategic partnerships in the near future, especially since Payments Bank licenses have a rural distribution requirement and some of these companies have a strong rural presence.

We are energized to see five mobile operators with “in-principle” approvals. The model aims to address some key challenges in the existing prepaid issuer (PPI) model and presents a new opportunity for mobile operators to drive the mobile money business in India, and to reach the scale needed in a country as large and diverse as India.

Notes:

[1] https://rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=32615

[2] Mahindra Comviva is a white label technology provider that offers its mobility solutions to over to mobile operators and financial institutions. Mahindra Comviva will provide its mobile money platform to enable Tech Mahindra to launch payments bank services in India.