We launched the 2015 State of the Industry Report on Mobile Money at Mobile World Congress, last month. The key highlights and insights from the report will be shared with you in a blog series in the coming weeks. In this -the first post of the series – I’ll discuss the global availability of mobile money services in 2015.

What is the global landscape for mobile money in 2015?

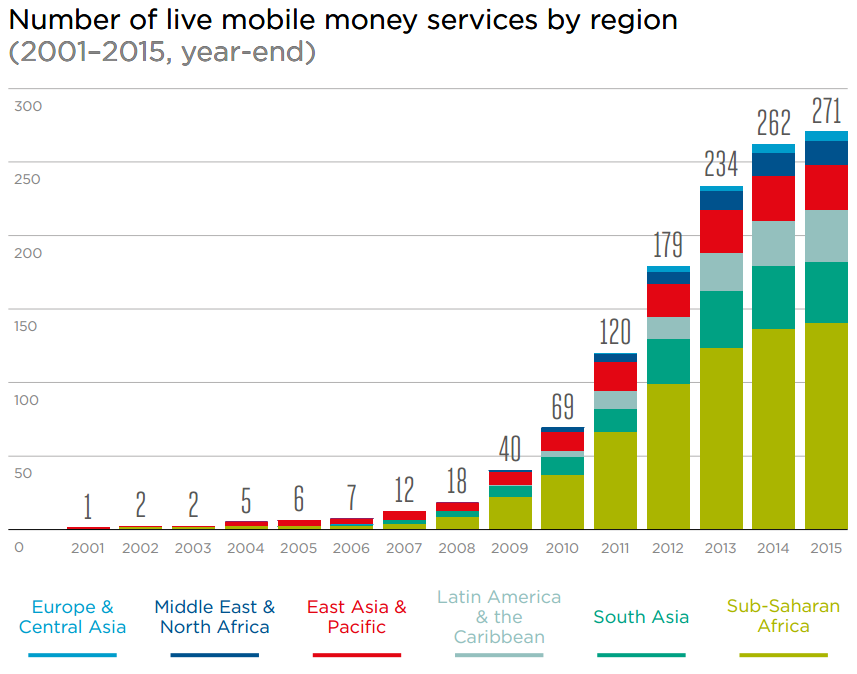

In 2015, the number of mobile money services increased to 271 in 93 countries (up from 262 services by the end of 2014). Moreover, mobile money continues to deepen financial inclusion: according to World Bank data, mobile money services are available in 85% of countries where the number of people with an account at a financial institution is less than 20%. [1]

Mobile money was launched in four new markets: Albania, Myanmar, Peru, and Seychelles. As the mobile money industry matures, the launch of new services has been slowing each year. In 2015, 13 new services were launched, compared to 30 services in 2014 and 58 services in 2013.

In terms of global availability, mobile money services are live in 64% of developing countries (86 of 135 countries), [2] a small increase from 2014 (61%). When looking at income classifications for these developing countries, mobile money is most widespread in low-income economies (81%) compared to lower-middle income and upper-middle-income economies, where mobile money is available in 71% and 47% of markets respectively.

Sub-Saharan Africa continues to account for the majority of live mobile money services (52%), however, more than half of new services launched in 2015 were outside this region, primarily in Latin America & the Caribbean. Looking ahead, new mobile money services are expected to grow by as much as 50% in Europe & Central Asia as well as the Middle East & North Africa.

Cross-border mobile money remittances expand mobile money availability

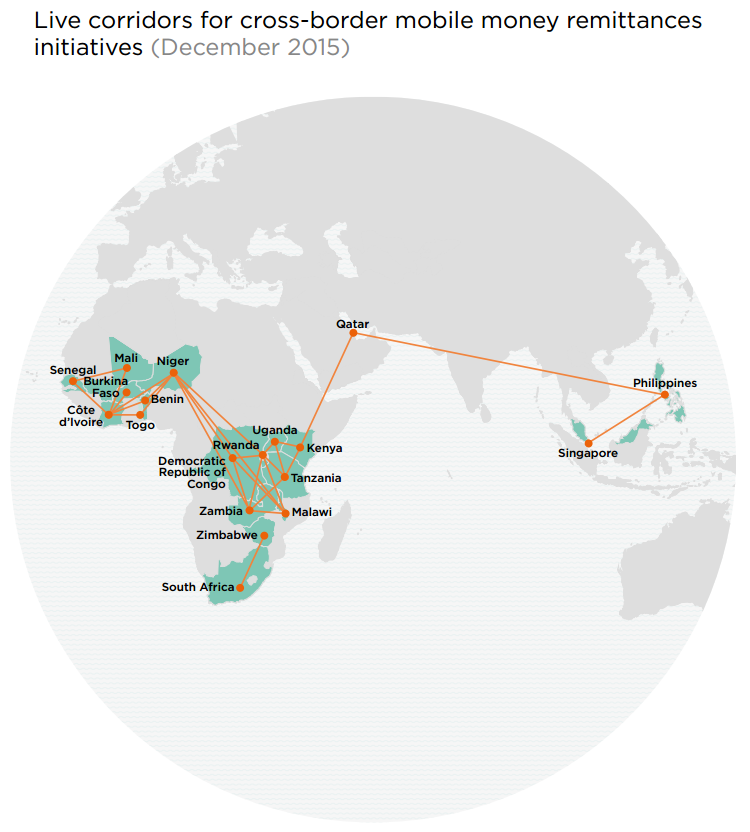

Cross-border mobile money remittances, whereby mobile money is both the sending and receiving channel for international remittances, also gathered momentum in 2015. As of the end of December, the GSMA tracked at least 29 cross-border mobile money remittance corridors connecting 19 countries.

The majority of these initiatives are in West Africa, though more providers in East Africa are following suit. West Africa is well positioned to enable cross-border mobile money remittances, as member states of the West African Economic Monetary Union (WAEMU) are socio-economically integrated and the adoption of mobile money has been rapid in recent years. Initiatives are also live in the Philippines and Singapore, as well as in Qatar (where international migrants make up 74% [3] of the population).

Interoperability and collaboration: increasing momentum in 2015

As of December 2015, almost two-thirds of markets where mobile money is available have two or more live mobile money services (60 of 93 markets) and more than one-third have three or more live mobile money services (35 markets, with a median of five services per market). With competition continuing to intensify in markets, so too does interest in interoperability. In 2015, account-to-account interoperability launched in three new markets— Madagascar, Rwanda, and Thailand. Last month, interoperability was announced in the Philippines as well. This follows the implementation of interoperability in Indonesia, Pakistan, Sri Lanka, and Tanzania in 2014 and 2013.

Additionally, survey respondents were asked this year to report whether they collaborate with other mobile money services on a specific product in their markets. Almost one-quarter of respondents reported that they currently collaborate with other mobile money services, and an additional 31% of respondents reported they were planning to collaborate in the next 12 months. Industry collaboration is critical for domestic interoperability as well as launching a new product with other mobile money providers.

In our next blog post in the series, we’ll look at the accessibility of mobile money services, particularly around the physical and technical access to services. Continue to follow us @gsmammu and join the conversation using #mobilemoney and #SOTIR2015.

Notes

[1] World Bank, Global Financial Inclusion Database (2015), Account at a financial institution (% age 15+) [2014]. Source: http://databank.worldbank.org/data/reports.aspx?source=global-findex

[2] Based on the World Bank’s country classification. For more information on World Bank’s classification: http://data.worldbank.org/about/country-and-lending-groups

[3] United Nations (2013), “International Migration 2013”. Source: http://www.un.org/en/development/desa/population/migration/publications/wallchart/docs/wallchart2013.pdf