The average tax burden on mobile consumers is higher today than in 2007 according to a new global benchmark study undertaken by Deloitte for the GSMA. The benchmark of 111 countries found that the average increase in tax, as a proportion of mobile usage costs, rose by over one per cent from 16.9 in 2007 to 18.0 per cent today, and that taxation as a proportion of the total cost of mobile ownership (TCMO), increased from 17.4 per cent in 2007 to 18.1 per cent today. Some 63 countries levy mobile-specific taxation in addition to general sales taxes.

“In this period of fiscal consolidation it is paramount for governments to foster, not hinder, economic growth,” said Gabriel Solomon, the GSMA’s Head of Regulatory Policy. “A healthy mobile industry is a proven economic growth engine; our previous studies have shown that a 10 per cent increase in mobile penetration boosts a typical developing country’s gross domestic product (GDP) by 1.2 per cent and an increase in the tax burden on mobile consumers can stall this growth. We therefore call on governments to review the effect of these levies immediately in order to maximise the mobile industry’s economic impact.”

Since 2007, 56 countries have increased the level of taxation on mobile consumers. For instance, mobile users in the Democratic Republic of Congo and Madagascar are paying 50 per cent more tax today than they did in 2007. In countries such as the Gabonese Republic, Pakistan and Sierra Leone, mobile consumers are paying almost twice as much tax in 2011 compared to 2007, while the rate in Malaysia has almost tripled. In all of these countries, the increases are due to the introduction of excise duties on mobile usage known as “airtime taxes”. Increased levels of taxation makes mobile services less affordable and cuts the potential associated economic impact of mobile phones and mobile broadband services.

Airtime Taxes Present Barriers to Mobile Development

The study found that 21 countries now levy airtime taxes in addition to general sales taxes, including 12 in sub-Saharan Africa, up from six in 2007. Consumers in Turkey continue to pay the most airtime tax at 43 per cent, followed by the Gabonese Republic at 36 per cent, Pakistan at 31 per cent, Uganda at 30 per cent, Croatia at 29 per cent, and Tanzania, the Dominican Republic and the Democratic Republic of Congo all at 28 per cent.

“Many governments continue to tax mobile services as a luxury, putting air time in the same bracket as jewels and caviar. But mobile services are key enablers for a country’s economic and social development and are a vital tool that can deliver healthcare, education, financial inclusion and stimulate entrepreneurship, especially for those at the base of the economic pyramid,” added Solomon.

Where applied, airtime taxes represent a large proportion of the total level of taxation. They can represent a barrier to development of services by reducing consumers’ usage, especially in developing countries where consumers have lower income levels and are highly price sensitive. Airtime taxes are typically added to retail prices, raising the cost of mobile services and contributing to a reduction in their consumption.

Handset Taxes Restrict Access to Mobile Services

Lowering mobile-specific taxes can have significant benefits, as demonstrated in Kenya, where the Kenyan government removed the 16 per cent general sales tax on mobile handsets in 2009. As a result handset purchases increased by more than 200 per cent and with mobile operators contributing a third more in taxes in 2011 than in 2009, mobile generated around 8 per cent of Kenya’s GDP. Ecuador, the Gambia and Thailand have all cut mobile taxes by half since 2007.

Despite the positive example of Kenya, mobile consumers pay an average of 23 per cent tax on handset purchases and 37 countries are above the global average. Mobile consumers in the Gabonese Republic pay 80 per cent tax on handset purchases, followed by Niger at 65 per cent and Argentina at 62 per cent. Consumers in Brazil, Cameroon, Congo Brazzaville, the Democratic Republic of Congo, Guinea, Madagascar, Rwanda and Uzbekistan all pay more than 40 per cent tax on handset purchases. In Latin America, taxes as a proportion of handset costs are also high

“This study has found that taxes on buying handsets are notably proportionatly higher than taxes on usage of mobile services in developing markets, leading to unbalanced taxation profiles for mobile-related services. Higher handset taxes increase the retail price which limits access to mobile services in developing markets where consumers are particularly price sensitive. Tax cuts in this area have the potential to significantly boost access to mobile services and their consumption,” said Chris Williams, Deloitte Telecoms partner.

High TCMO Can Restrict Potential Economic Impact of Mobile

Countries with the lowest taxation as a share of mobile costs are those with low VAT levels and no other tax, such as China, Lesotho and Nigeria. In Lesotho, mobile services attract a lower VAT as the government here has recognised the social importance of mobile communications.

Regionally, Central and Eastern Europe shows the highest average tax as a proportion of TCMO, with Turkey maintaining the top spot as mobile consumers pay nearly 50 per cent in taxes. In the European Union, higher VAT rates, rather than mobile-specific taxes, are responsible for the relatively high level of tax as a proportion of mobile service costs. The Middle East/Maghreb and Africa are the regions where the two biggest increases have been experienced, where TCMO is driven by usage taxes.

The study found that Asian consumers generally pay the lowest tax as a proportion of mobile service ownership, due to relatively low VAT rates and limited mobile-specific taxation, however Pakistan ranks third with tax as a proportion of TCMO of 32 per cent, due to high fixed and variable taxes on mobile ownership and usage. Of the ten countries with the highest tax as a proportion of TCMO, five are African nations.

The GSMA welcomes the United States government’s recent decision to a five-year freeze on any new state and local taxes imposed on mobile phones and services. The vote reflects a consensus that new taxes on mobile services have so far outpaced average sales taxes that they are deterring the spread of mobile technology.

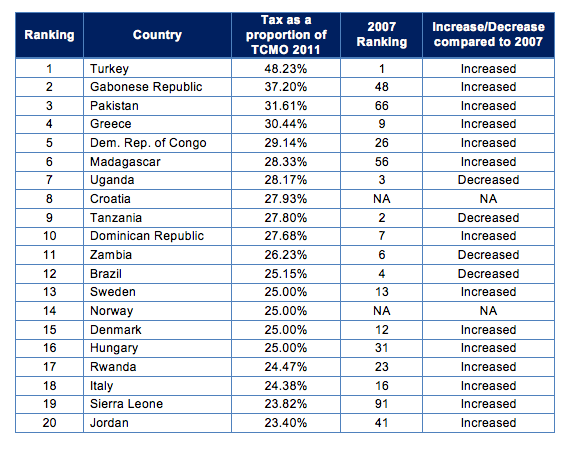

The countries with the highest levels of taxes on the total cost of mobile ownership are:

The report and full regional analysis can be downloaded at: www.gsmworld.com/tax

About the GSMA

The GSMA represents the interests of mobile operators worldwide. Spanning more than 220 countries and territories, the GSMA unites nearly 800 of the world’s mobile operators, as well as more than 200 companies in the broader mobile ecosystem, including handset makers, software companies, equipment providers, Internet companies, and media and entertainment organisations. The GSMA also produces industry-leading events such as the Mobile World Congress and Mobile Asia Congress.

For more information, please visit Mobile World Live, the online portal for the mobile communications industry, at www.mobileworldlive.com or the GSMA corporate website at http://www.gsmworld.com.

Note to Editors:

This study describes consumer taxation globally, and focuses on special mobile-specific taxes on access, e.g. handset, and usage, e.g. airtime, that contribute to reduce penetration and consumption of mobile services. As such, the objective of this study is to measure the taxes paid by consumers as a proportion of ownership and usage costs of mobile services.

In line with the 2007 study carried out by Deloitte and the GSMA, this study calculates how much of a consumer’s Total Cost of Mobile Ownership (“TCMO”, consisting of handset, connection, rental and usage costs), Total Cost of Mobile Usage (“TCMU”, consisting of rental and usage) and of Total Cost of Handsets is made up of taxes.

To do so, consumption profiles, prices and taxes were analysed in 111 countries in Europe, Central and Eastern Europe, Africa, Latin America and Asia for pre-pay and post-pay mobile users. Taxes that typically apply to mobile telephony are Values Added Tax / General Sale Taxes on all components, custom excises and luxury taxes on imported handsets, as well as host of mobile-specific taxes ranging from airtime excises applying to usage, to fixed contributions on connection, handsets and rental.

For further information, please contact:

Abigail Faylor: +44 (0)2070 670 851

[email protected] or [email protected]