GSMA Connected FinTech and Commerce Forum

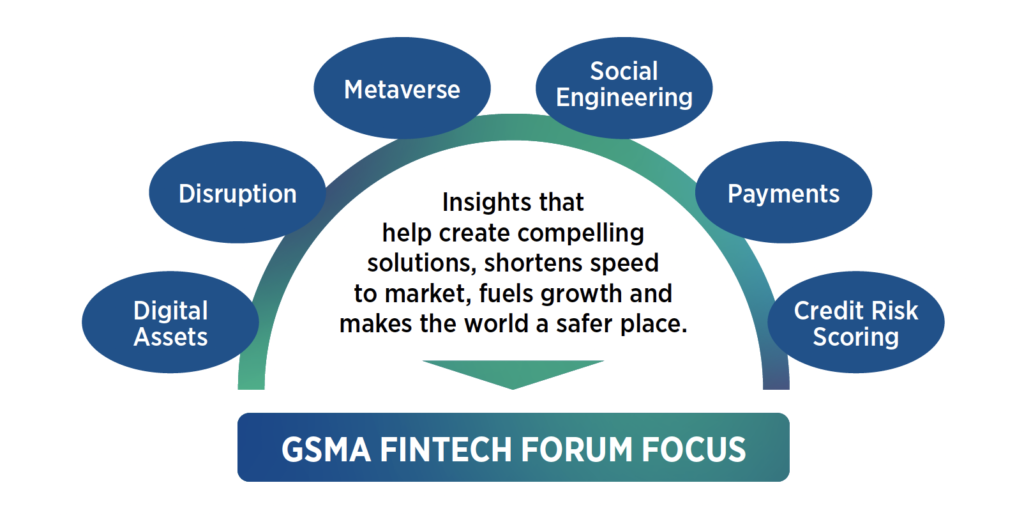

We are shaping the fintech and mobile economy. The mobile ecosystem is at the heart of fintech and GSMA members and partners have seen great value in coming together to review areas of common interest.

The GSMA Connected FinTech and Commerce Forum community has a strategic priority to support partners to explore areas of common interest and key issues, monitor insights and share use studies, create new collaborative opportunities, and drive exciting innovative projects.

By promoting agile working group opportunities, we can support new solutions in line with the GSMA Foundry such as :

- Creating new propositions to power financial inclusion by entering or disrupting the fintech marketplace

- Delivering enterprise solutions to the fintech vertical to support challenges and threats

- Fintech products to help run business as usual operations – banking, payments, mobile insurance

Our working model of the forum forms a key part of upcoming GSMA events strategy including MWC ecentw, M360 and FinTech Forum Meetings and, as a forum member, we will provide the latest opportunities to showcase your solutions and developments.

Based on GSMA standard operating model of supporting the mobile eco-system to explore opportunities, with the added support of GSMA Foundry to create a proof of concepts, accelerate and scale solutions.

We will hold virtual and in-person events throughout the year scheduled around GSMA events. For full details about the Terms of Reference click here.

Join the forum today

If you would like to join the FinTech Forum to collaborate, share ideas and fintech developments from your organisation, we would like to hear from you.

Simply share your details on the form below and our team will be in touch.

Please note that this forum is open to all GSMA Members. If you would like to learn more about becoming a GSMA Member, please contact [email protected].

Previous Events

Launched in 2022, the GSMA FinTech Forum has hosted seven successful meetings with super case studies from our forum members.

Following the success at MWC Barcelona including the GSMA Strategy Group and our FinTech Summit on the Industry City Stage, we shared some of the insights from speakers including Accenture, Deutsche Telecom, Celo and Mawari.

Speaker shared an insight into the current FinTech landscape including metaverse, digital assets and services that are being developed around the globe.

Speakers

Building on the success of FinTech Forum Meeting #1, our guest speakers included Citi, Vodafone and Worldpay from FIS.

We discussed:

– The trends in digital currencies including the huge interest in Central Bank Digital Currencies – What are they and the benefits? – Which central banks have projects? What do they mean for the mobile eco-system?

– How to utilise network insights to help FinTech fight fraud with collaborative strategies

Our Speakers

In our third meeting, we brought together partners to share key insights and case studies that are accelerating the growth of fintech adoption including the creation of brilliant solutions and services especially within the Africa region.

Our session deep-dived into:

– The VodaPay Super-app that is revolutionising South Africa’s ecommerce landscape – Vodacom Financial Services

– Accelerating growth in the M-Pesa ecosystem through an open API strategy – M-Pesa Africa

– Leveraging AI and alternative data analytics to create scalable digital lending programs – Yabx and MTN Zambia

After a successful MWC23 Barcelona FinTech Summit, we will be bringing key partners to deep-dive further into the topic of non-core revenue growth, explore new market opportunities and strategies.

Our session deep-dived into:

– Accelerating new revenue streams from fintech – Alipay+

– Collaborating to create rapid speed to market and drive adoption – Huawei and Ethio Telecom presentation

Our session deep-dived into:

– Global payment trends 2023

– API Marketplace

– GSMA Foundry

– GSMA FinTech update

Upcoming Events

FinTech Forum Meeting #8 – 18th April 2024

Join us for the GSMA Connected FinTech and Commerce Forum Meeting #8 on Thursday 18th April 2024 from 13:00 – 14:30 (GMT) which will bring together partners to share key insights and case studies that are accelerating the growth of fintech adoption including the creation of brilliant solutions and services.

Register Now to Join