Mobile operators from Latin America have developed roaming services in a remarkable way. Many of them- large, medium and small companies- offer services comparable (or superior in some cases) to operators in other regions with more developed economies such as Europe or America.

Latin America presents a distinctive feature that limits the potential roaming market growth: it has the lowest migration levels compared to other regions. The percentage of travellers on the total population in Latin America (5% in 2009 according to the World Tourism Organization) is far below the average of Europe (12 times more) and North America (7 times more). However, operators from Latam have reached an average of 200 roaming agreements, and that number is growing rapidly.

The low percentage of travellers on the total population of Latin America generates an exogenous limit that restricts the possibilities for growth in the number of roamers and investment that is necessary to provide the service. However, while trade and tourism are growing, more roaming routes are becoming economically viable allowing to extend the offer. The roaming market growth is due to the broader coverage of the service in the current travellers´ base and an increase in the habit of using the existing roamers. Latin America has a high amount of roamers in relation to the number of travellers.

The low percentage of travellers on the total population of Latin America generates an exogenous limit that restricts the possibilities for growth in the number of roamers and investment that is necessary to provide the service. However, while trade and tourism are growing, more roaming routes are becoming economically viable allowing to extend the offer. The roaming market growth is due to the broader coverage of the service in the current travellers´ base and an increase in the habit of using the existing roamers. Latin America has a high amount of roamers in relation to the number of travellers.

Most international services require investments in platforms and involve operating costs that cannot be justified in all cases. Smaller operators in countries with low international traffic cannot afford the investments that larger operators perform to provide a particular service. That is the reason why it is not expected that services and quality levels would be uniform in all markets in the region. However, there are certain common standards that must be met.

The Roaming market is characterized by significant pricing declines in all services and generalized innovation rates and packages. In the last few years, regional operators have been continuously improving Roaming offers and transparency to ensure that consumers receive the best pricing for services. In turn, Latin American operators are actively supporting initiatives to develop the Roaming industry, which was evident in the relative growth of this business and expanding the use not only among users with a contract but also prepaid ones.

Initiatives by operators in Latin America and the Caribbean for the development of Roaming services

The initiative “Better communication” has been developed by GSM mobile companies in Latin America and the Caribbean by providing clear and friendly information to users, especially in relation to pricing and purchasing options. There has been progress in developing innovative pricing designs for Roaming such as diverse packages, promotions and plans for different traveller profiles. The introduction of communication mechanisms based on the final price, the use of text messages on the arrival, unified and flat tariff offers, extension of Roaming for prepaid customers in more destinations, or prevention of bill shock are just some of the measures that operators of the region have been implementing to improve the experience of Roaming users.

In terms of quality, operators have worked to make the user enjoy a better customer service and be able to use mobile services while using roaming, in much the same way they would do in their country of origin.

In this sense, it is possible to say that mobile operators in Latin America are leading the industry in terms of innovation and improvements in roaming services in areas such as pricing, border roaming and roaming solutions for Inadvertent Roaming.

Border Roaming

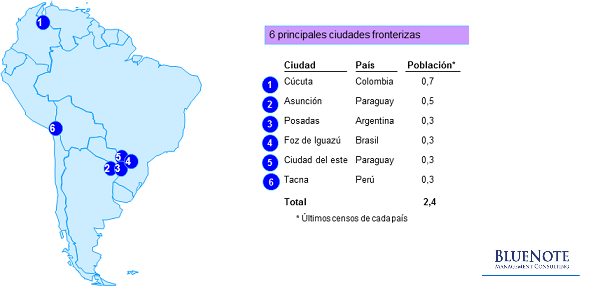

Border Roaming occurs when a client has to continually cross the border for business or other reasons, and needs to use roaming service to get in contact with his home country with prices that are higher than the local ones. It is estimated that between 4% and 5% of the Latin American population lives in border areas. Border areas are characterized by exchange relationships and border trade, as well as temporary migration of population (to work every day) from one side of the border to the other.

Main border areas of South America (Millions)

Mobile operators in the region are pioneers in solving the problem of Border Roaming, which has been trying to be addressed by commercial tools in several border areas in Latin America (e.g. Argentina and Paraguay, Brazil and Uruguay, Mexico and USA) although there is not a single and definitive solution. In all cases operators are working to expand the implementation of CAMEL / USSD to offer Roaming to prepaid customers in more destinations worldwide.

SThere are several regional operators that are working to identify more effectively users living in border areas to offer them discounts, SMS warnings and special border rates.

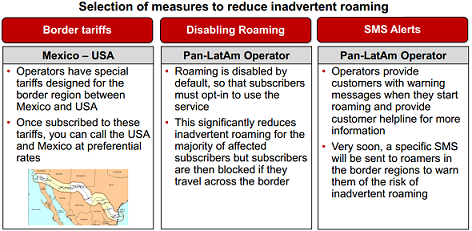

Inadvertent Roaming

In relation to mobile communications, border areas also pose the problem of inadvertent roaming: it occurs when the customer takes the neighbour operator signal and consumes, without wanting it or require it, its roaming service within his own country.

The mobile industry in Latin America is leading the way toward minimizing inadvertent border roaming through innovative initiatives. Some examples include special border rates, the option for each client to disable the Roaming service and early SMS warnings when customers begin to use Roaming in a network of the countries visited.

In the region there are several solutions to address the problem of inadvertent roaming. None of them, however, solve the problem completely. The solutions can be divided into:

- Commercial measures.

- Power and antenna routing adjustment in the border area.

- Elimination of Roaming service in border areas.

- Platforms and signalling solutions.

Pricing

The mobile industry in Latin America and the Caribbean is also innovating in fixing pricing with new mechanisms to improve the pricing and Roaming billing to customers. Monthly plans offers that include roaming minutes, billing communications based on the final price, prepaid roaming, unified or flat rates and prevention of Bill Shock are examples of the new tools used by operators.

The companies’ work focuses on developing rate models in accordance with the needs of the consumers, even taking some risks (exchange rate, higher costs) in order to provide understandable and predictable prices to users.

Simple access to current personalized tariffs and use of information allows consumers to quickly understand the range of options available in the market. Operators use various methods to ensure that consumers are aware of the latest offers such as friendly websites or welcome text messages to Roaming customers.

Today, there are rates for each operator in each country, but the implementation of standard rates is underway in each country and after that process is completed it will begin for the entire region.

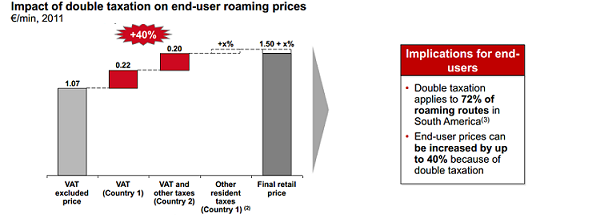

Taxation and Double Taxation

Tax rules are divergent throughout Latin America and that becomes a substantial burden on Roaming pricing. While taxes on items like leather jackets, among many others, may be reimbursed, the double taxation is applied in much of the region when it comes to mobile communication services. Taxes are a significant proportion of the cost of the service due to high taxation and double taxation.

Double taxation (produced in most cases on indirect taxes) impacts on the profitability of the plans, and limits the possibilities for innovation and reducing the pricing offer.

Roaming is a very complex ecosystem, with several entities and intermediaries involved in the process. Then, fluctuations in exchange rates and pricing control systems in different countries of the region, among other variables, generate business risks that operators assume.

Access costs on international termination exist and operators cannot avoid them.