Key messages

- Vodafone’s resurgence is putting pressure on market leader Ooredoo to maintain its performance lead. Vodafone’s Turnaround Strategy has created a more level competitive playing field in Qatar, helping it increase its market share and drive strong growth in top-line revenues and net profit so far this year. Vodafone’s improving performance in median 5G network speeds is driving Ooredoo to react in order to maintain its lead.

- Strong 5G network investment in Qatar, as both operators seek to gain the upper hand, with all eyes on the up-coming FIFA World Cup™. This major event gives both operators a chance to demonstrate the capabilities and resilience of their 5G networks to a global audience. They have already driven median 5G download speeds in the market to over 400 Mbps so far in 2022, and with mmWave spectrum due to be allocated in 2023, consumers should expect faster performance to come.

- Perfect storm has helped propel Qatar to second place globally in mobile download speeds. A desire to rapidly transition their customer bases to 5G has boosted 5G Availability in the market, and has helped Qatar climb to second place in Ookla’s Speedtest Global Index™ as of July 2022.

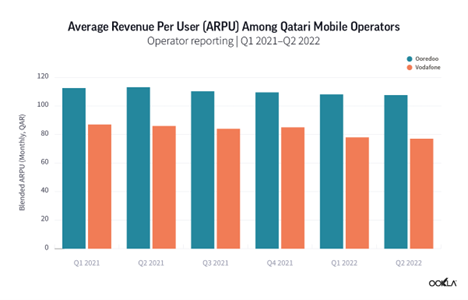

- Beyond faster speeds, consumers are paying less and have access to unlimited 5G tariffs. While headline median 5G speeds impress, strong competition is also driving improved outcomes for consumers, as ARPU falls quarter-on-quarter. Both operators have also introduced unlimited 5G tariffs, including voice, SMS and data, albeit with fair usage caps.

Vodafone’s resurgence has forced Ooredoo to respond and helped drive network speeds to new highs

Vodafone Qatar’s resurgence as a stronger competitor to market leader Ooredoo Qatar has taken place at a key juncture for the Qatari market — the arrival of 5G. Qatar’s Communications Regulatory Authority (CRA) amended the mobile licenses held by Vodafone Qatar and Ooredoo Qatar in early 2019. The new licenses included harmonized terms and conditions for both companies, authorizing each to utilize 100 MHz of C-band spectrum and committed them to roll out commercial 5G networks before the end of 2020 in all densely populated areas. It also required they provide coverage of all primary roads and highways as well as all venues associated with the up-coming FIFA World Cup. This was updated in May 2022 to plan the allocation to both operators of additional spectrum in the C-band as well as high frequency (26 GHz) spectrum by 2023, while their license obligations require their 5G networks to cover 99% of Qatar with minimum download speeds of 100 Mbps by 2024.

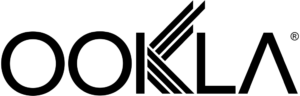

Both network operators have invested heavily in their 5G networks, with Ooredoo attaining 99.5% population coverage in Q1 2022, and Vodafone committed to near universal coverage by the end of 2022. This drive to increase coverage and rapidly migrate users to 5G means that Qatar is among the top markets globally in terms of 5G Availability, (the percentage of users with 5G-capable devices who spend a majority of their time connected to 5G networks), which stood at 46.8% as of Q2 2022 according to Speedtest Intelligence®. Ooredoo maintained an advantage over Vodafone in median 5G download speeds in Q2 2022, recording 450.08 Mbps compared to Vodafone’s 426.04 Mbps, while Vodafone maintains an advantage in upload speeds of 28.61 Mbps to Ooredoo’s 26.76 Mbps.

Ookla® Speedtest Intelligence data shows that Vodafone’s renewed position within the market is helping spur network investment from both operators. In early 2021, Ooredoo had the upper hand in terms of 5G download performance, while in Q4 2021 Vodafone’s performance jumped considerably, prompting Ooredoo to strengthen its position in Q1 2022. Monthly Speedtest® data shows that the performance gap between the two operators is beginning to narrow once more. At a national level, this has helped Qatar maintain a top-five position in Ookla’s Speedtest Global Index (a global ranking of median download speeds based on all mobile technologies), and as of July 2022 it ranked second globally.

Vodafone targeting market share gains, helping drive ARPU in the market lower

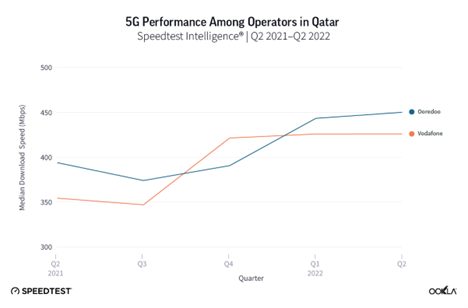

Qatar has been a challenging market for Vodafone Group. Vodafone Qatar launched in 2009 as the second mobile network operator in the country. While it was able to grow market share, it consistently made losses — in the nine months to December 2017, the company made a loss of QAR 182.16 million (~$50 million), which led to Vodafone Group selling its share in the operator in 2018. The Qatar Foundation took control of the company, having increased its shareholding to 50%, maintaining the Vodafone brand but also implementing a Turnaround Strategy, designed to reverse the company’s fortunes, with a focus on cost containment and revenue growth.

Vodafone Qatar’s operational and financial performance has gone from strength to strength over the five years since then. Costs have fallen from close to 75% of revenues in 2017, to under 60% during 1H 2022, spurred by a rigid focus on cost containment. During the first half of 2022, Vodafone Qatar grew top line revenues by 23.5% (year-on-year, with service revenues increasing by 14%), while net profit rose by 61.3%.

The company is reaping the benefits of an aggressive move to capture new customers — in Q1 2022 its mobile connections base topped 2 million for the first time, representing 18.6% growth year-on-year, well above Ooredoo’s 6.8% growth. Vodafone was the first to introduce “unlimited” tariffs to the market in 2019 across voice, SMS, and data (subject to a fair usage policy), while it has also allowed users across all its tariffs to access 5G. Vodafone’s 5G Availability, the proportion of its users with 5G capable devices which spend a majority of time connected to 5G networks, hit 53.0% during Q2 2022, ahead of Ooredoo’s 42.0%. Vodafone’s drive to acquire new customers has come at the expense of average revenue per user (ARPU), as it is clear it is undercutting Ooredoo in the market. Vodafone’s ARPU fell by 10.3% in the year to Q1 2022, while Ooredoo’s only declined by 3.9%, despite being almost 40% higher.

Focus currently on FIFA World Cup Qatar 2022, but more to come

A large part of 5G network investment in the country is targeted at the upcoming FIFA World Cup, scheduled to take place in November and December 2022. The award of the world’s premier global football tournament was a significant coup for Qatar, and is predicted to attract around 1.5 million visitors, a significant increase on the local population of 2.93 million. In addition to covering all fan zones related to the event, both operators have been investing heavily in increasing the capacity of their networks and in building enhanced network assurance capabilities, to make sure their networks can cope with the strain of the additional connections and traffic from the event.

Ooredoo announced in March that it had been selected by the FIFA World Cup organizers as the Official Global Connectivity Services Provider. This will involve providing connectivity services to all media rights licensees in Qatar, and it is building a dedicated network to support broadcast video production and distribution. In order to further boost its network capacity for users at the event, Ooredoo signed a partnership agreement with Ericsson in November 2021, where the vendor will provide network optimization and event management services, covering 5G services in fan zones, stadiums, airports, and major tourist attractions. While not an official partner, Vodafone Qatar’s role in delivering a successful event should not be overlooked. It has tapped the experience of the wider Vodafone Group in delivering connectivity at major events, has been aggressively densifying its 5G network (with over 50% more radio access network sites deployed since 2017), and has also been expanding the reach of its GigaNet fiber network.

The failure to allocate mmWave spectrum in time for the World Cup has disappointed, however this will now take place in 2023, and consumers should expect further 5G performance gains once both operators begin deployment. We will continue to look at performance on both operator’s networks as we draw closer to the World Cup, and at how they handle the deluge of visitors and traffic that it will bring. To stay abreast of Ookla’s latest content, you can subscribe to our updates here.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.