Research shows that accessing finance is a critical barrier limiting mobile tower owners from adopting on-site renewable energy solutions. Typical fossil fuel powered solutions like diesel generators are relatively cheap to buy; the materials are readily available, and the installation and maintenance processes needed to operate the solutions are well established. However, renewable energy solutions typically require more upfront investment, in part because they utilise high value materials – particularly solar panels and batteries.

Where renewable energy solutions become highly appealing is that – unlike diesel – the fuel for renewable energy systems is free, making their relative operational costs far lower. Although they lack their fossil fuel counterparts’ moving parts, renewable solutions must still be maintained. It is therefore critical that the system owner be able to fund maintenance throughout the system’s life. This creates a challenge: renewable energy solutions need a high upfront investment as well as a recurring income stream to ensure the system can be maintained.

With targets to achieve net zero emissions by 2050, the telecoms industry will need to consider all feasible tools and mechanisms to address this challenge and give investors the confidence that renewable solutions can successfully replace fossil fuels in off-grid locations. We are pleased to introduce the Distributed Renewable Energy Initiative, and share a guest blog that the team has written. For more information, please visit the D-REC Initiative website.

On the cusp of COP26, it is clear the world must do more to achieve the goals laid out in the Paris Agreement, and renewable energy has a major role to play. While more than 300GW of new renewable capacity was installed in 2020, more than double this – or nearly 660GW – must be installed on an annual basis to decarbonise the energy sector[1][2]. Moreover, nearly 75 per cent of this activity was concentrated in the US, Europe, and China, while many of the most vulnerable countries in Asia and Africa continue to lag behind in attracting much-needed investment. The world is unfortunately far behind on achieving Sustainable Development Goal 7, ensuring all have affordable and sustainable access to modern energy, with nearly 800 million without access to a most essential service.

However, one bright spot in a challenging climate landscape is the increasing leadership role of multinational corporations. Through power purchase agreements, corporates were responsible for supporting more than 24GW of new renewable capacity in 2020. More than 300 corporations have joined RE100, pledging to power their global operations with renewable energy. More than 1,000 companies with a combined market capitalisation of $20 trillion have pledged to reduce emissions under the Science-based Targets Initiative, while 128 investors with more than $43 trillion under management have pledged to have their portfolios go net zero.

The importance of DRE

The next several years will witness significant growth in distributed renewable energy (DRE). DRE is located close to load centres, such as residences and businesses in a village. Particularly in emerging markets, DRE can offer a more cost-effective solution than grid extension to provide power to rural communities that need it. As evidence of the social and economic impact supported by DRE, the next several years will see distributed solar grow by over 250 per cent, to nearly 45 per cent of total solar installations[3].

For the telecom sector, the value of DRE is already being leveraged. Tower companies and operators, for example, increasingly rely on distributed generation in areas of unreliable or unavailable grid power to more effectively meet growing power demand. Unfortunately, global environmental markets, which serve as the gateways for corporations and others to achieve their net zero or other climate targets, are not amenable to DRE systems and generally lack feasible instruments for DRE systems to align with their respective governance rules as well as achieve the scale needed to justify transaction costs… until now.

The (Distributed) Renewable Energy Certificate

A key mechanism utilised by corporations with renewable energy targets is the Renewable Energy Certificate (REC). RECs allow electricity buyers to make reliable claims about their energy usage by transparently tracking a unit of electricity from its origin through to its use; this metadata also adds additional value to each unit of renewable energy. This tracking process takes place for electricity within a regional grid, with the governance rules in place for REC standards unfortunately not allowing off-grid and other DRE systems to efficiently participate in REC markets.

The D-REC Initiative sets out to address this barrier and make DRE an appealing investment option for corporates and other climate investors while providing direct community-level benefits. The D-REC Initiative is a unique collaboration among private-sector entities, global foundations, environmental experts, and international financial institutions that aims to unlock climate finance for energy access and DRE more broadly. The initiative addresses a gap in the market where current REC and other carbon environmental standards are not ‘fit for purpose’ when it comes to connecting corporate sustainability engagements with distributed small-scale renewable energy.

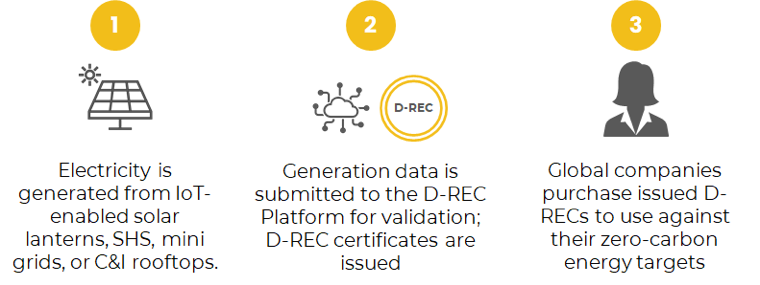

The initiative seeks to address this gap via a Distributed Renewable Energy Certificate (D-REC). A D-REC is a certified, verifiable, tradable market instrument which represents 1kWh of renewable energy aggregated from multiple DRE assets. In a typical scenario, DRE assets measure the amount of generation as they operate, and this data is then submitted to an automated digital platform which will verify the data submitted and subsequently issue a D-REC. This certificate then becomes a trade-able entity; for example, it can then be sold to a corporate, who can then use it to address their own renewable energy or net zero targets with the knowledge that their purchase went towards fostering greater DRE access. The following diagram further illustrates the process:

Successfully financing DRE projects, particularly in emerging markets, requires overcoming several obstacles. Projects often suffer from uncertain revenues, particularly those selling electricity to residential customers. Domestic lenders may be unfamiliar with energy projects, while foreign lenders must address foreign exchange risk, as revenue often is collected in the local currency. In such an environment, D-RECs can serve as an effective project de-risking tool. As electricity is generated, D-RECs can be certified and then sold in hard currency, thereby providing an additional source of revenue for project developers. Corporates who agree to a multi-year purchase of D-RECs can help de-risk the project for other investors, as there is a guaranteed revenue stream that isn’t dependent on electricity sales. As D-RECs are delivered to a corporate buyer, they can be retired against the purchaser’s scope 2 climate targets. A D-REC purchase commitment may even take the shape of a project equity or debt investment, in which the D-REC purchase receives both a financial return as well as the associated stream of D-RECs.

Renewable energy trends in the mobile sector and the potential for D-RECs

While the GSMA and its members have crafted ambitious climate targets to achieve net zero by 2050, several hurdles remain in accelerating the deployment of renewable energy. Firstly, nearly 70 per cent of towers are owned and managed by TowerCos; with capital-efficient approaches, the higher CAPEX and slightly longer payback time periods of renewable energy solutions push TowerCos to prefer non-renewable alternatives. Further, while pilots have been underway around the Anchor-Business-Community mini grid model, in which a DRE solution provides power to the credit-worthy TowerCo in addition to the surrounding commercial and residential loads, results have been mixed, in part because of the continued challenge around retail sales to low-income customers.

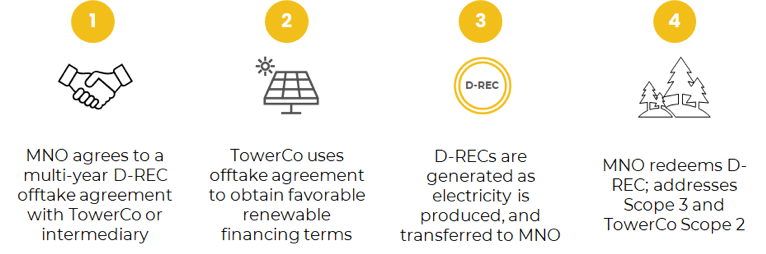

The D-REC instrument has the potential to help overcome these obstacles. For example, an Mobile Network Operators (MNOs) may decide to enter into a D-REC purchase agreement with a TowerCo. The upfront agreement, which serves as an additional revenue stream, allows TowerCo to acquire lower-cost financing, thereby making the renewable energy solution more attractive. In turn, the MNO will receive the D-RECs, which can then be retired to reduce scope 3 emissions. An MNO may even decide to invest in a renewable project, receiving not only the D-RECs but also a financial return. In such a case, the TowerCo can obtain high-risk capital, allowing it to source other senior debt, again making the renewable solution more economically attractive. In such an instance, the MNO will not only receive a potential financial return, but also receive the D-RECs which can be retired against the net zero targets.

Along similar lines, the additional revenue stream offered by a D-REC off-take agreement can help make ABC models more financially viable. With the TowerCo as an electricity off-taker, which financiers would consider a credit-worthy counter-party, combined with a D-REC off-take agreement from an MNO, another credit-worthy off-taker, the project developer may be able to obtain financing on more favourable terms, as there are now two dependable revenue streams from credit-worthy entities. Project financiers may also consider the D-REC off-take agreement as a mechanism to mitigate the risk from selling electricity to residential or small commercial customers, who may have difficulty paying in certain instances.

The way forward

The GSMA and the telecommunications sector have a strong role to play in the renewable energy transition and in meeting the goals of the Paris Agreement. Just as the mobile sector plays a fundamental role in connecting people from all corners of the globe, tools like the D-REC Instrument allow the sector to increase the strong positive impact achieved through renewable energy rollout for remote communities and distributed populations. As the sector increasingly seeks to expand its services while reducing emissions in line with a 2050 net zero target, every feasible tool needs to be considered. With the broad range of benefits afforded by the D-REC – in terms of climate impact, improved financing, and tangible benefits for electrified communities – it deserves immediate consideration and planning to begin integrating into the business model of every company with strong climate ambitions or commitments to improve electrification in underserved communities. For more information, please visit the D-REC Initiative website or get in touch with me at [email protected].

[1] BNEF. “Energy Transition Investment Hit $500 Billion in 2020 – For First Time.”

[2] IRENA. “Investment needs for global energy transition.”

[3] IEA. “Renewables 2019 – Analysis and forecast to 2024”

By

By