There is a common belief that the lack of rural network coverage in emerging markets is the result of under-investment by mobile network operators (MNOs). But is this actually the case? In this blog post, I look at how the GSMA is trying to answer these questions using high-resolution coverage maps.

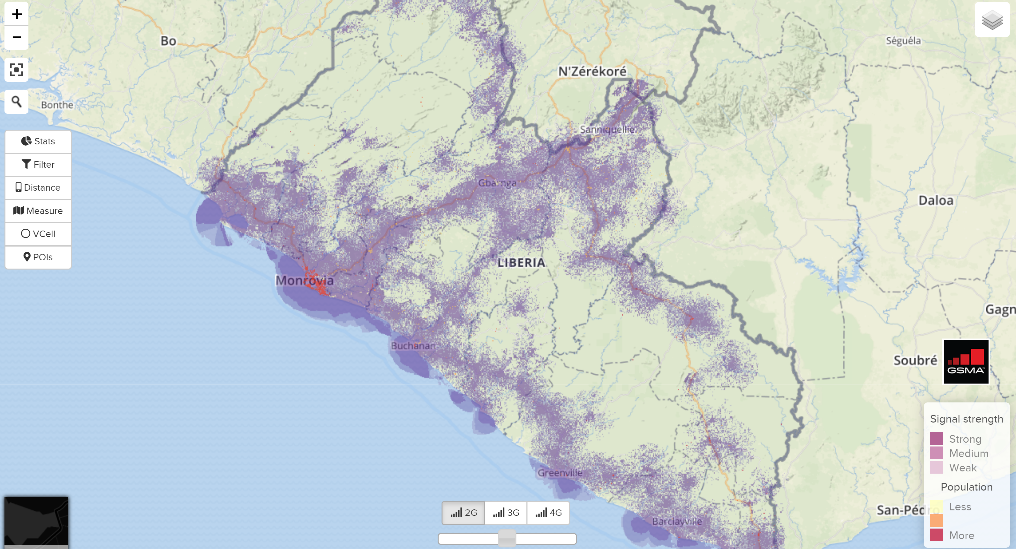

Image 1: Actual network coverage for Liberia

The GSMA’s Connected Society Programme created the Mobile Coverage Maps Platform to support MNOs in their efforts to extend coverage in rural areas. The tool overlaps high-granularity population and coverage data[1] to determine the location and population size of areas that currently lack mobile coverage, or uncovered settlements. It also provides a set of tools to analyse this data and help MNOs identify the best locations to deploy new sites. We recently updated the platform to add new functionalities and five new countries: Nigeria, Rwanda, Zambia, Liberia and Ivory Coast[2].

The term under-investment refers to a situation where firms forgo valuable investment opportunities i.e. the level of investment is lower than it should be. In the context of connectivity, this means that MNOs would refrain from investing in the deployment of new rural sites, even if those sites could be profitable in the long term, thus resulting in lower-than-expected levels of coverage. So, is there under-investment in coverage in rural areas?

In order to observe the level of under-investment, we used data from our high-resolution coverage maps to compare the actual level of coverage with the expected level of coverage. Below I explain in simple terms the process and the results of this analysis. But first, it’s important to define what the “expected level of coverage” means.

The mobile telecommunications business has a very specific investment structure. When launching a new business, MNOs have large fixed investments to deploy the core network, which is the part of the network that hosts the intelligence functions (switching, value-added services). After this, MNOs have to deploy mobile sites (a radio tower with network equipment, antennas, etc) to provide mobile signal to its customers. For each new mobile site deployed, MNOs incur an incremental cost and generate incremental revenues. As with any private entity, MNOs will try to maximise their revenues by deploying every possible site that can deliver incremental revenues larger than its incremental cost. We can define the “expected level of coverage” as the total population covered by each individual site where this profitability condition holds.

Using this definition for the expected level of coverage, we can estimate the level of under-investment with the following process:

- Estimate the actual coverage in the country using our coverage maps (see Image 1).

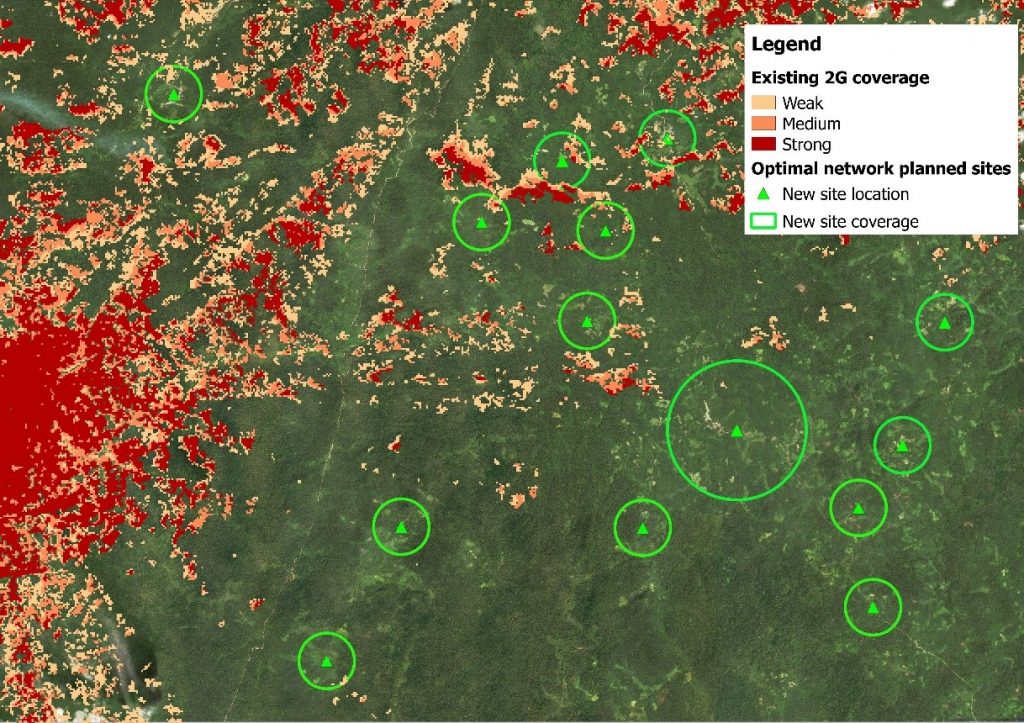

- Estimate the expected level of coverage by modelling an “optimal” network[3] where every profitable site is deployed (see Image 2).

- Calculate the difference between the observed coverage and the expected level of coverage[4].

Image 2: Optimal network simulation results for Liberia

We applied this methodology to Liberia, a country where the GDP per capita is one of the lowest in the world (which limits the income share that rural populations can spend on mobile services). The main findings of this analysis are:

- The observed coverage in Liberia is 75.6% and the expected coverage is 79.3%, resulting in an under-investment gap of 3.7 percentage points.

- 94% of the settlements with a population above 4,000 people are already covered, and the uncovered population live in 16,000 settlements with an average size of 80 people.

Looking at these results, we can draw two main conclusions regarding the level of investment in Liberia:

High-granularity coverage mapping has the potential of finding new commercially viable areas. The low level of under-investment (3.7% of the population) can be explained by the lack of reliable population statistics. New options for imagery analysis that provide a highly-granular view are a promising way of closing this information gap and can help inform better investment decisions.

The level of under-investment is relatively small. The low level of 2G coverage in Liberia is not driven by under-investment. Rather, it is the consequence of a challenging business case for connectivity, which naturally results in lower levels of investment and coverage (compared to more densely-populated, urban areas).

Addressing the connectivity gap in least developed markets requires a rigorous assessment of the status of connectivity and the barriers for investment. While the private sector needs to keep innovating to improve the business case of investing in rural areas, the common belief that MNOs are chronically and heavily under-investing does not hold for Liberia. Similar results were obtained for other markets such as Ghana or DRC, showing that MNOs have been quite effective at reaching the expected coverage. Closing the connectivity gap will require a deeper look into the root causes behind this lack of profitability, as well as new approaches to public-private collaboration, which may increase the sustainability of investing in connectivity solutions in these geographies. Over the next year, the GSMA will continue to develop mobile coverage maps to develop more insights into these root causes and assess the level of joint effort that the private and public sector will need to make in order to close the connectivity gap.

Interested in finding out more about the Mobile Coverage Maps Platform and learning best practices for using the tools? Watch the recording of a recent webinar I hosted by clicking here.

You can also subscribe for updates here. You’ll be the first to hear about new maps, tools and features and we’ll send you related reports as soon as they’re published.