In the past months, the GSMA Inclusive Tech Lab made various announcements about the GSMA Interoperability Test Platform, talking about the importance of testing, our Beta release and the first version of the platform. But as an innovation lab for inclusive technologies, why did we decide to build the platform? How did we get here? And what were our critical decisions during product design and development? If you are curious to understand more about this journey, this blog is the right place.

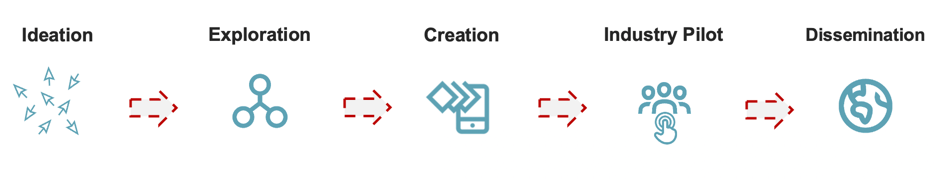

The Lab works with a common innovation framework across our innovation projects; this framework provides the guiding principles and processes to innovate on the most pressing topics for financial and digital inclusion, as it steers towards putting people first and reaching maximum impact. It works with five stages: Ideation, Exploration, Creation, Industry Pilot, and Dissemination. In this blog, we focus on how this framework guided the development of the Interoperability Test Platform from inception to launch.

Ideation

Account-to-account interoperability has been a hot topic since the early days of mobile money, and the GSMA has actively monitored this space in support of its members. For instance, at the end of 2018, the GSMA was actively involved in the creation of Mowali, the joint venture between MTN and Orange, which aims to enable interoperable payments across the African continent. At its technological foundation, Mowali is built on open-source software Mojaloop.

Simultaneously, another hot topic in the industry concerns the use of open APIs, enabling third-party service providers to integrate with mobile money providers. To facilitate a seamless and interoperable integration across providers, the GSMA has developed a harmonised industry specification known as the GSMA Mobile Money API.

Looking at this from a business perspective, we identified a need from the industry to further end-to-end ecosystem interoperability. From a technological perspective, we posed the question how the Lab could support the industry to drive scale of these technologies?

This question sparked the conceptualisation of the first-ever joint test environment for financial inclusion, combining two key technologies: the GSMA Mobile Money API, a harmonised industry specification for all standard mobile money use cases, and Mojaloop, an open-source code, developed to accelerate financial inclusion through digital payments.

Conceptualising the idea showed the Lab at its best, through a creative and efficient journey based on the knowledge we had at the GSMA as well as past experience from adjacent financial services. To ensure the initial concept was aligned with the industry needs, we consulted various stakeholders. More so, we validated the project proposal with our Lab Advisory Group of industry experts, before moving to a more in-depth study.

Exploration

Following this validation, our first action for the project was to understand the market needs in closer detail, in line with the GSMA’s work from past years but with different optics, now looking at it from a technical perspective.

Internally, we decided to further analyse Mojaloop and study the technology to gain a deeper understanding. Externally, we sought consultation from several mobile money providers to learn where they stood regarding their implementation efforts on the technology, and in turn where and how our platform could add the most value. The findings were that while some operators were merely trying to gain initial understanding, others were ready to bring their services, built on this technology, to production.

Based on this market feedback, we decided to build a solution which could support the operators during their whole journey towards building an interoperable ecosystem. That is, we would create an end-to-end test platform that operators new to the topic could use as a playground to explore those technologies, while operators that are advanced practitioners could use it as a test validation platform for their software before going live.

The concept was hence sharpened and we started sketching the initial scope and architecture.

Creation

We were now ready to start planning how to do it, and to find the right vendor to develop this platform and support us to technically validate our idea.

With the vendor onboard, we set up a discovery session, in which we shared more details of the vision, the product, the architecture and our timelines. As an outcome, this led to a clear roadmap for the product, a modern UX/UI and wireframes, and the essential feature definition for the minimal viable product (MVP).

The build of the MVP was the most critical phase for this product, which was developed over a series of agile sprints. The MVP was defined to quickly generate value to our users and validate our ideas. With the MVP in our hands, we had a way to prove the concept and get feedback and buy-in from the stakeholders in the market. So, a vital part was engaging with users to retrieve feedback and plan the necessary updates for the final product.

For this reason, we also pre-released a Beta version to a limited user group, who registered their interest through our early access campaign. That approach was conducive to ensure we could interact with each of them to explain the platform and its features. During this Beta period, the onboarded users supported us with invaluable feedback and helped to improve the platform.

Since the roadmap for the platform was already planned, achieving the first full version was straightforward and, for the most part, only required refining the product requirements and improving the architecture.

On 1 July, we launched the full version of the platform, supported by a marketing campaign to reach potential users and show the value it brings. Since, the number of registered users and companies has increased steeply.

Now we have the platform ready, but what’s next?

A Product’s development never ends. We can always improve it with new features and functionalities, and even different flavours based on the initial one. Currently, our team is working on the roadmap and is creating new features and additional use cases in support of mobile money interoperability. And we always welcome new contributors, so if you want to join us on this free and open-source journey, check our GitHub and the documentation.

This project demonstrated the strength of the Inclusive Tech Lab’s innovation framework. In this blog, we presented the account from three stages of it, Ideation, Exploration and Creation. Now it’s time to follow through on the next steps and move towards Industry Pilot and Dissemination

Stay tuned to learn more about the next steps!