This is the second of a series of blogs on e-commerce which will focus on how mobile money and e-commerce providers are uniquely placed to collaborate, not only in payments and logistics, but also in business intelligence. Read the first blog in the series.

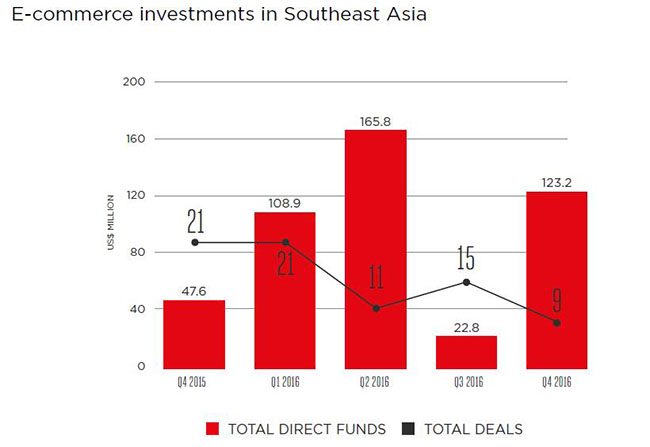

Southeast Asia is one of the fastest growing regions for e-commerce based on investments. However, e-commerce service providers have been facing challenges due to the lack of the robust infrastructure that was behind the success of e-commerce in developed markets and now in India and China. Cash on delivery and logistics are eating up the bottom line of these ventures.

Below, we suggest three ways in which e-commerce could become a driver for mobile money adoption in Southeast Asia while leveraging the accounts and widespread agent network offered by the mobile money ecosystem. This region that is home to 24 mobile money deployments and accounts for 34.3 million registered accounts and 6.5 million active accounts has the potential to become a success story for mobile money and e-commerce partnerships.

(1) Payments: Only 36.9% of the adult population in the region has access to financial services. Such low penetration, coupled with poor integration with e-commerce providers, has led to higher usage of cash on delivery. Friction in the customer journey can be reduced by integrating mobile money accounts with e-commerce payment portals that allow seamless online payment transactions in just a few steps. User experience can be further improved by providing timely information about transaction limits and account balances to customers. Pairing mobile accounts with e-commerce has already gained popularity in nearby India, where large e-commerce providers such as Snapdeal and PayTM have seen the value in leveraging a mobile account to facilitate payments, promotions and returns. Once integrated, mobile money and other digital payments simplify the reversal of payments and facilitate digital reimbursements.

(2) Logistics: The Logistic Performance Index of countries in Southeast Asia is generally below 3, indicating poor infrastructure for trade. E-commerce providers are investing heavily in logistics and warehousing, which once again impacts their bottom line. Mobile money providers have already established an agent network with considerable rural and remote coverage. These agents with considerable financial services acumen can become touch points for e-commerce customers not only for delivery of goods to customers but for handling returns as well. This “order and pick up” model can be used to recruit new customers who can order, pay for, pick up and return goods at a mobile money agent outlet.

(3) Business Analytics: E-commerce companies use discounts as their main customer acquisition strategy. Mobile money providers hold important customer insights about their base. This knowledge and access to their mobile money customer base has the potential to improve customer experience and reduce marketing and acquisition costs for e-commerce providers, while generating adjacent revenues for the mobile money providers.

Mutually beneficial partnerships can be established between mobile money and e-commerce providers, although there is a narrow window of time for mobile money providers to best capitalise on this opportunity due to increasing market competition and current levels of e-commerce investment. That said, the potential benefits of doing so are evident. Such partnerships can create new revenue opportunities for mobile money players, in addition to consolidating their presence in the payments space.

Read the related report ‘Mobile money and e-commerce: Three areas of partnership in Southeast Asia’ to gain a deeper insight into the ever-changing e-commerce industry in this rapidly developing region.