Each year Financial Inclusion Week convenes organisations from around the world into a global conversation exploring the progress made and the remaining challenges to building a more inclusive financial ecosystem. This year we explored the theme of “Financial Inclusion: For What?” by showcasing how mobile money is contributing to the Sustainable Development Goals (SDGs).

For the second year in a row we hosted a live ‘Twitter Chat’, bringing together members from the diverse financial inclusion community to discuss how mobile money is contributing to achieve the SDGs. We invited industry experts to reflect on its impact on some of the world’s greatest development challenges, such as gender equality, humanitarian assistance, rural development, access to clean energy and safe drinking water, among many others. Over forty participants joined from all over the world, tweeting from London, Washington, DC, Nairobi, Dubai, Brussels, Paris, Niamey, Delhi, Asmara, Accra, Lusaka, Harare, Cape Town, Dar es Salaam and Abidjan. In this blog, we share some of the key insights and conclusions drawn from the Twitter chat in the context of the SDGs.

To kick-off the conversation, we asked participants to share their views on how mobile money empowers vulnerable groups and help them gain access to life-enhancing services. Many perspectives were shared on the transformative ability of mobile money to empower people with disabilities, migrant workers, refugees, and women to actively participate in the digital economy.

MFS Africa and Amolo N’gweno, CEO of BFA Global highlighted how it is facilitating access to financial services to hundreds of millions of underserved people, enabling them to be more productive with their time and money and to withstand unexpected life events, contributing to SDG1 (No Poverty).

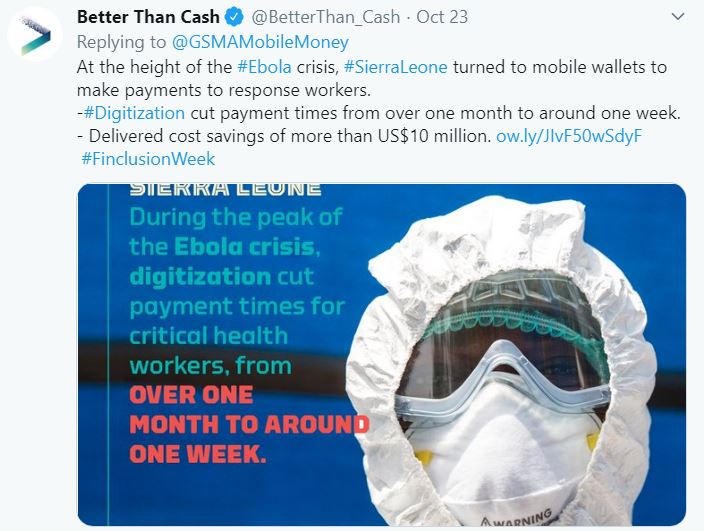

Better than Cash Alliance and BIMA Mobile noted mobile money’s contribution to SDG 3 (Good Health and Wellbeing) by facilitating access to funds for health emergencies, such as the Ebola crisis. As well as by enabling access to health insurance and helping health providers and governments make health programmes more efficient.

Catherine Wines, Co-Founder of WorldRemit, highlighted how mobile money also plays a key role in supporting the achievement of SDG 10 (Reduced Inequalities) and SDG 5 (Gender Equality) by empowering women and enabling them to become recipients of remittances. For migrants and their families, mobile money is an important tool to receive faster, cheaper and safer international remittances.

Mobile money also contributes to achieve SDG 10 by providing an efficient delivery mechanism for humanitarian assistance and by helping persons with disabilities access financial services.

What is more, mobile money has transformed the utilities sector. It facilitates access to affordable and reliable water and sanitation services, and clean energy, which can mitigate the detrimental effects of dirty energy sources on the environment. This has a direct impact on SDG 6 (Clean Water and Sanitation), SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action).

For the second question, we challenged our participants to discuss how mobile money-enabled solutions drive economic growth and foster innovation and rural development. Many pointed towards the power of these services to fuel economic growth by creating employment, driving business productivity and entrepreneurship, formalising the economy and becoming a gateway to the digital economy.

As highlighted by Serigne Dioum, Group Head of MFS at MTN Group, mobile money contributes to SDG 8 (Decent Work and Economic Growth) by increasing the productivity of micro, small and medium enterprises (MSMEs), creating jobs and stimulating economic growth. Mobile money also contributes to achieving SDG 9 (Industry, Innovation and Infrastructure) by spurring local entrepreneurship and innovation and building a stronger payments ecosystem.

When it comes to rural development, responses called attention to the power of mobile money to achieve SDG 2 (Zero Hunger) by making agricultural value chains more efficient, helping farmers become climate resilient and enhancing the welfare of smallholder farm households, which constitute the majority of the rural poor.

The current impact of mobile money on the SDGs could not have been achieved without multi-stakeholder partnerships between the public and private sector, and collaboration between different industries and sectors. The penultimate question explored the partnerships needed to continue to advance the power of mobile money to achieve the SDGs. Barbara Rambousek, Director of Gender and Economic Inclusion at EBRD, Ahmed Dermish, Policy and Digital Ecosystem Specialist of UNCDF and Greta Bull, CEO of CGAP, highlighted the need for more cooperation across the mobile money ecosystem to scale up impact.

To wrap up the conversation, we asked participants to reflect back on the discussion and share their one main takeaway.

It is clear that the vision for mobile money is to create a highly interconnected mobile financial ecosystem where transactions are digitised, providing a solution to the challenges faced by customers and businesses across the developing world. Seizing mobile’s unparalleled potential to reach the 1.7 billion people who remain financially excluded requires collective cooperation across the mobile money ecosystem, while keeping the needs of the underserved at the very centre of this evolution.

On behalf of the GSMA Mobile Money team we want to thank all of our insightful discussants for their unique perspectives on how we can leverage the power of mobile money to achieve the SDGs. We invite you to learn more about the dynamic ways in which mobile money is contributing to the achieve the SDGs in our new report.

Don’t forget to check out our series of 60 second videos on the power of mobile money to harness digital finance for sustainable development.

- Serigne Dioum, Group Head of Mobile Financial Services of MTN Group

- Greta Bull, CEO of CGAP

- Catherine Wines, Co-Founder of WorldRemit

- Amolo Ngweno, CEO and East Africa and Regional Director at BFA

- Barbara Rambousek Director of Gender and Economic Inclusion at ERBD

- Ahmed Dermish, Policy and Digital Ecosystem Specialist at UNCDF

- M-KOPA Solar

- ClickPesa

- Max Cuvellier, Head of Ecosystem Accelerator and M4D Utilities at the GSMA

- E-Water

- MFS Africa

- KOPAGAS

- BIMA Mobile

- Ruan Swanepoel, Head of Mobile Money at the GSMA

- USAID Digital

- Safe Water Network

- Mildred Kujinga, Business Development Manager of OneMoney

- William Makubalo of VITALITE

- Abigail Komu, Digital Finance and Financial Inclusion Consultant

- CityTaps

- Shadrack Danford Kamenya at Eversendapp

- Sam Carter, Finance Lead at JPAL

- Dominique Paterne, Digital Finance Expert at UNCDF Mobile Money for the Poor

- Kipkirui Messi

- Ray Besiga of Opareta

Receive the latest insights on mobile money straight to your inbox by subscribing below.