Several mobile money providers have identified open APIs as the best way to integrate with other service providers – both financial and non-financial. Short for “Application Program Interface”, an API is a standard way for computer programs to communicate with each other. According to the GSMA’s 2021 Global Adoption Survey on mobile money, around two-thirds of mobile money providers offer an open API to third parties to boost transaction use.

The GSMA Mobile Money API was created to enable the entire mobile money industry to speak the same technical language. Developed by the mobile money industry and the GSMA, it provides easier management and better security for mobile money providers. This harmonised API aims to increase engagement between the mobile money industry and wider ecosystem partners by enabling easier integration. Over 50 per cent of mobile money providers surveyed by the GSMA in 2021 have either adopted the GSMA Mobile Money API or intend to do so in the near future.

Mobile money providers, particularly those led by mobile network operators, are keen to expand their products and services beyond the existing use cases on offer. Despite significant growth in use cases over the last five years, person-to-person (P2P) transfers, and cash-in and cash-out transactions dominate mobile money transactions. As of December 2021, the mobile money industry had processed $1 trillion in transaction values. Around two-thirds of these comprise P2P transfers, cash-ins and cash-outs.

While mobile money models have evolved to enable different types of payments, many services rely on fees generated from P2P transfers, cash-ins and cash-outs. Part of this may be due to mobile money services’ typical challenges in encouraging users to swap cash for digital payments. One reason for a lower incidence of other transaction types can be the absence of an ecosystem that offers multiple ways to use mobile money. For example, although the number of mobile money users in Bangladesh grew during the COVID-19 pandemic, due to a government drive to increase the use of digital payments, few used mobile money to pay merchants.

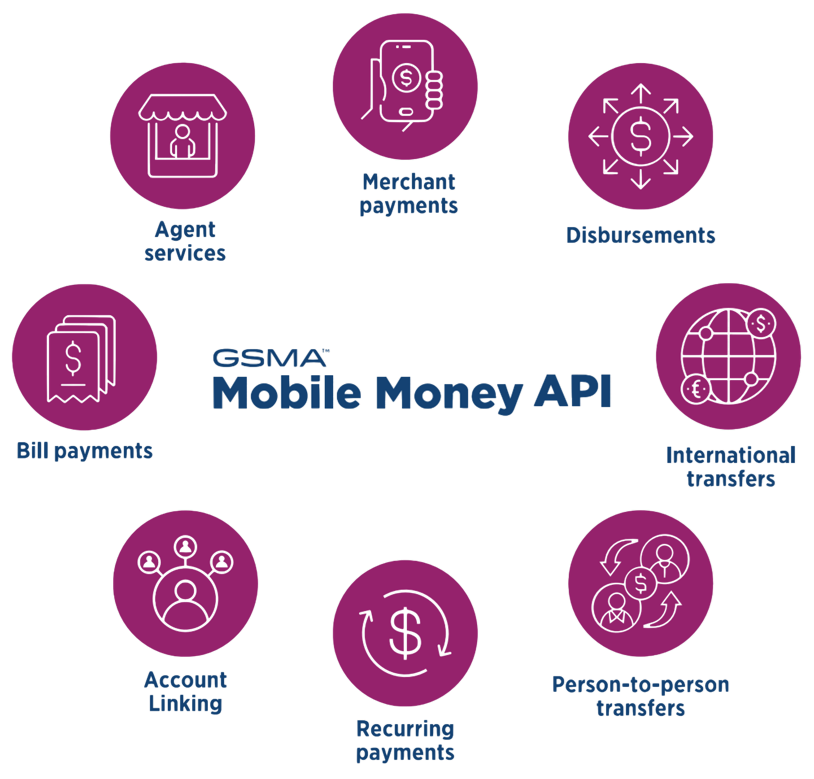

The GSMA Mobile Money API offers the majority of mobile money providers without an API proposition around core use cases (Figure 1) to develop a vibrant ecosystem. Many mobile money providers have grown their ecosystems, leading to increased use of their services, while some providers have started offering open APIs to boost ecosystem use. Despite this, direct integration with third parties is not yet the norm.

Figure 1: Use cases supported by the GSMA Mobile Money API

Analysis by the GSMA Inclusive Tech Lab found that several functional capabilities need to be added to new and existing use cases to increase their use via APIs. As e-commerce platforms are used to buy goods and services, functionalities such as recurring payments and split payments can offer users additional ways to pay merchants. Bulk disbursements and international remittances can be improved by building in partial debit functionality to APIs. This means that billers can charge an account or card the maximum amount of cash available on it, typically lower than the total amount to pay. This may reduce revenue losses and avoid manual attempts to retry failed transactions.

In addition to improving payments, there is an opportunity to use APIs to enhance other solutions: data, know-your-customer (KYC), channels and credit scores. Each solution can benefit from API functionalities in several ways:

- Data as an API service: Account balance retrieval at a merchant’s till can improve their offering. Additional data functionality includes viewing transaction timelines, getting refunds or reversal details and checking transaction fee details.

- KYC as an API service: Customers’ biometrics can be used as an alternative identification mechanism. An SDK can be used to take advantage of a device’s operating system’s native biometric functionalities to capture customers’ biometrics to validate against the mobile money provider’s database.

- Channel as an API service: Including both SMS and USSD channels on an open API allows API users to engage better with customers. Additional traffic via SMS or USSD also offers an opportunity for more sales.

- Credit scoring as an API service: Mobile money providers can offer credit scoring by partnering with financial service providers. Lenders can offer responsible credit based on the wealth of data the mobile money provider holds.

Some mobile money providers, such as MTN MoMo, Airtel and M-Pesa, have identified API-based partnerships through a dedicated API platform as an alternative revenue stream. A platform-based approach would allow providers to charge a variable fee for any risks they assume, for example, credit scoring-as-a-service, or a flat fee for using a specific API. A commercial example of this could involve a fintech offering loans to mobile money users and collecting repayments via the provider’s API platform. Platforms would also allow providers to focus on growing use cases that would benefit from partnerships. However, a platform-based approach for risk-based variable fees is one of several API pricing models. Others include free, freemium, fee per call and fee per volume, among others.

The GSMA Mobile Money API offers a specification that allows easy integration between third-party vendors and all mobile money services that implement the API. The Mobile Money API is based on best-practice API design, which includes flexibility and scalability as core benefits. The API also includes the latest security recommendations for implementation. The core design principles of the API follow best practices for data transfer over a network (REST architectural principles) and data formats for web services (the JSON data format for requests and responses).

The GSMA has a dedicated developer portal that offers a starting point for interested mobile money providers and vendors. This includes access to the Mobile Money API Specification assets and a full suite of documentation and tools to guide developers in implementing the specification. The documents are aimed at both mobile money providers and third-party vendors looking to build solutions for the mobile money ecosystem. The developer tools include the GSMA Simulator, which provides several examples:

- A simulated API implementation that was developed to facilitate API adoption and testing,

- An Authentication Gateway which adopts the best practice security recommendations of OAuth 2.0,

- Use cases which include Postman Collections enabling developers to test the simulated APIs directly or through the authentication gateway, and

- Software development kits (SDKs) to support developers in building applications using prebuilt components, allowing the rapid integration of different mobile money functionalities and services into new applications.

The latest version of the API (1.2) includes new features and improved consistency. For instance, the new API allows mobile money customer accounts to be created, while existing accounts can be updated if there is a change in the customer’s KYC verification status. Mobile money providers can now send bill payments to billers without a bill reference. New fields, such as Quotations and Transactions, were introduced to identify the origination and destination of a request. Finally, API readability was improved through harmonious field ordering, and additional API and field descriptions.

Several mobile money providers and technology partners have already adopted the GSMA Open API specification, while others are in the process of doing so. Recent examples include Afrimoney and Comviva. Afrimoney, a mobile money provider, has already adopted the GSMA Open API Specification and is working to maintain compliance with the specification in three different markets: the Democratic Republic of Congo, Gambia and Senegal. Comviva, a leading mobile money platform provider, follows the GSMA’s specification and is already compliant with merchant payments.

The GSMA offers support for mobile money providers and vendors looking to adopt its Open API specification. The Inclusive Tech Lab, which manages the specification, welcomes requests for more information or support. Click here to learn more about the Lab’s work and here for the latest version of the GSMA Open API specification.