At the end of 2021, there were 3.2 billion people living in areas with mobile broadband coverage but not using mobile internet. This is equivalent to 40% of the global population who are missing out on access to information and services, and all the benefits that internet access can bring. This usage gap is critical to address.

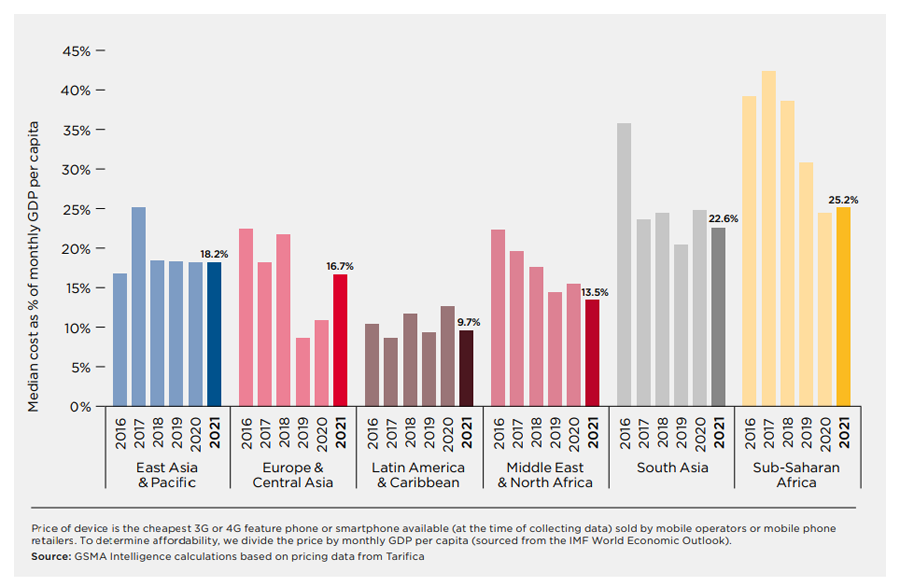

Across low- and middle-income countries, for mobile users who are aware of mobile internet, but don’t use it, the affordability of internet-enabled handsets is a critical barrier. The cheapest internet-enabled handset costs, on average, 19% of monthly income across low- and middle-income countries, but in Sub-Saharan Africa, it is as high as 25%, making it the region with the least affordable handsets (Figure 1). [1]

While affordability of internet-enabled handsets in Sub-Saharan Africa had significantly improved year-on-year between 2017 and 2020 due to the increased availability of lower cost smartphones and smart-feature phones, there have been no significant improvements in cost or affordability in 2021. Across low- and middle-income countries, women and rural populations – who tend to have less disposable income – are disproportionately affected by this barrier.

Figure 1: Affordability of an entry-level internet-enabled handset in LMICs (by region), 2016-2021

Given this, it’s easy to assume that cheaper handsets will lead to increased adoption. However, affordability is not only about the cost, but also the buyer’s willingness to pay, and whether the handset meets their needs and preferences. Unlocking affordability can be achieved in several ways.

In our report ‘Making internet-enabled phones more affordable in low- and middle-income countries‘, we identified three levers to make handsets more affordable:

- Reducing handset costs

- Improving access to financing

- Strengthening the enabling environment

While various approaches and business models continue to bring down the cost of a device, there will be a point at which costs can’t fall further, making handset financing a huge opportunity.

Reaching the underserved through handset financing

Device financing is gaining traction, particularly in Sub-Saharan Africa, bringing together mobile operators, PAYG solar companies, finance providers, remote locking technology companies and others. For example, in Kenya, Safaricom, with its Lipa Mdogo Mdogo financing scheme[2] was the first operator to scale, in partnership with Google. Safaricom has now 500,000 active customers paying for their handset in instalments. This type of intervention benefits from a strong enabling environment in the region: a thriving mobile money ecosystem which allows for digital payments of installments; favourable regulations for non-traditional financial service providers and remote handset locking mechanisms. But functional handsets financing schemes cannot be achieved overnight. As Davide Tacchino, Terminals Director at Vodacom puts it:

“Handset financing schemes are a successful reality in some markets… but they are quite complex economically speaking. For example, the impact on cash flows and on bad debt, and quite complex in terms of platforms and technologies to assess customer credit profile and lock the phone… but they can really move the needle and reduce the cost to connect.”

Davide Tacchino, Terminals Director, Vodacom

Handset financing is a promising way to improve affordability. However, underserved customers are more likely to face a range of barriers to accessing financing, which well designed handset financing schemes have the power to overcome, including:

- Lack of creditworthiness: Using non-traditional data allows those who don’t have enough financial data to be credit scored.

- Lack of a collateral: By using the phone as a collateral, financing options can be extended to almost anyone, including customers who cannot be credit scored. The expansion of remote locking technologies allows lenders to lock the handset.

- Challenging repayment terms: Offering micro-repayments (such as daily instalments) or flexible payments can reduce the burden for those who receive daily wages or who earn their income irregularly (e.g. seasonal effect of farmer’s income).

- Limited understanding of financing schemes: Partnering with organisations and distributors (formal and informal) that have extended their network in underserved areas to educate retailers and customers, particularly to explain the repayment process and modalities.

Implementers should assess the context in which they operate and take a customer-centric approach to the development of financing schemes. Customers may also face other barriers such as not being aware of the scheme or not understanding the value proposition, lack of ID, being unbanked, or inability to make a down payment. These factors need to be considered when designing financing schemes. In addition, any such scheme must ensure consumer protection, communicate the terms and conditions clearly, and intentionally design for customers with low financial and digital literacy.

There is no one-size-fits-all solution

Most importantly, there is no one-size-fits-all solution when it comes to handset affordability. Country and regional contexts differ substantially. For example, pay-as-you-go schemes may struggle to scale in countries without a thriving mobile money ecosystem and good network coverage. People also have different needs, preferences and constraints – as well as different perceptions of what is affordable. Furthermore, regulations can inhibit innovation, through high taxes on imported handsets or laws forbidding device locking. All these factors influence the design of handset affordability initiatives.

Greater industry collaboration is critical to improve handset affordability. Holistic, multi-stakeholder approaches that address the range of issues, not only the cost of a handset, but also access to appropriate financing and strengthening the enabling environments have the potential to drive greater digital inclusion for all.

Related resources:

- Report: Making internet-enabled phones more affordable in low- and middle-income countries

- Webinar recording: How to make internet-enabled handsets more affordable in low- and middle-income countries

[1] GSMA (2022). The State of Mobile Internet Connectivity 2022.

[2] Lipa Mdogo Mdogo enables prepaid Safaricom customers to purchase a smartphone and pay for it in instalments, either daily, weekly, in part or in full via M-PESA.

The Connected Society programme is funded by the UK Foreign, Commonwealth & Development Office (FCDO) and the Swedish International Development Cooperation Agency (SIDA), and is supported by the GSMA and its members.