This blog was originally been published by the International Water Association (IWA) as part of our contribution to the IWA’s Digital Water Programme Steering Committee.

Despite some progress in extending access to safely managed water services in developing countries, the world is not on track to meet SDG 6 (Clean Water and Sanitation for All by 2030) according to the UN SDG 6 Synthesis Report 2018 on Water and Sanitation.

This is partly because water utilities in developing countries face a range of interrelated challenges that they are struggling to overcome:

- High non-revenue water: A key constraint to more inclusive water service delivery among utilities in developing countries is non-revenue water (NRW), water that has been produced but ‘lost’ (due to leakages, faulty meters, or non-payment) before it reaches the customer. These commercial losses are estimated to cost utilities in developing countries $3 billion per year.

- Ineffective billing collections: The cost of cash collections for utilities in developing countries can range from 3 – 20 percent of total revenue, severely constraining their ability to extend their reach to poorer customer and invest network maintenance and innovation.

- Lacking access: Many underserved population living in rural-or peri-urban areas lack a nearby safely managed water source. This means that considerable time is spend on finding and accessing water, a task that is often undertaken by women. In a recent study in Kenya, women reported spending an average of 4.5 hours per week collecting water, causing 77 per cent to worry about their safety while fetching, and preventing 24 per cent from caring for their children.

- Expensive connection costs: The infrastructure capex requirements to provide basic services such as water are “acutely sensitive to the density at which urbanisation occurs”. In many rapidly growing developing countries, extending connections in informal settlements can involve large up-front costs, which are difficult to finance.

- Low willingness to pay for poor service: When customers are disappointed by their service, or are often confronted with faulty meters/inadequate bills, their willingness to pay diminishes substantially. This in turn constrains the water utilities’ ability to invest in improved service leading to a vicious cycle of service degradation and non-payment.

- Insufficient investments: Investments in urban water supply in particular have not kept up with urbanisation and population growth. This explains why, according to the World Bank, the proportion of urban residents with access to safely managed drinking water in sub-Saharan Africa has barely increased over the past 15 years.

A woman fetches water in Niger’s capital Niamey

Emerging digital solutions for water utilities in emerging markets

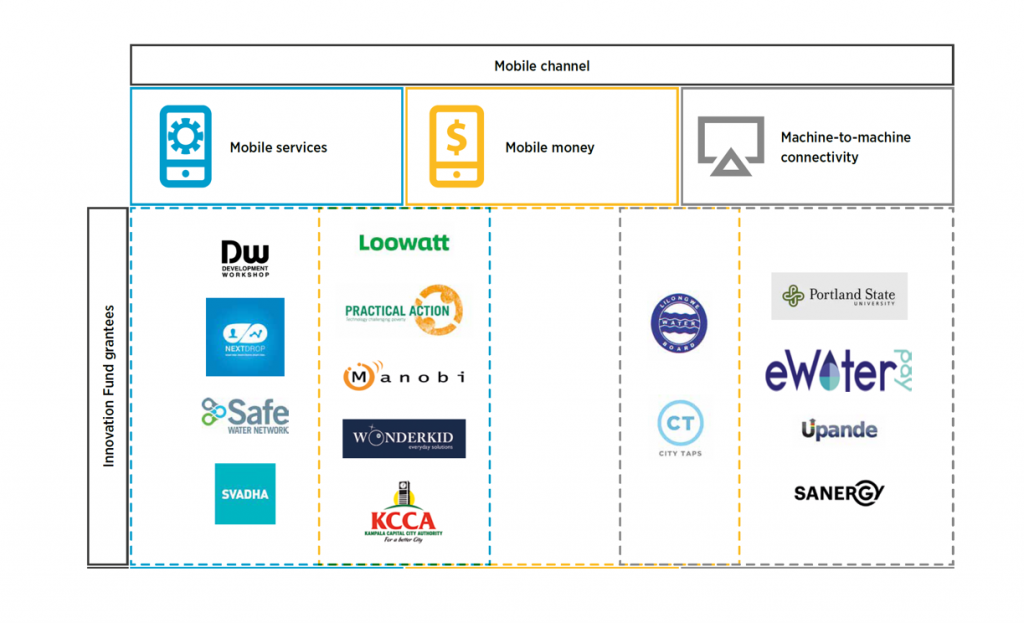

Digital solutions can be critical to confront these challenges. For instance, mobile technology is a key component of the ongoing digitisation of water utilities and service providers (underlined in the recent IWA paper), particularly in developing countries where mobile services are critical infrastructures in people’s daily lives. The GSMA Mobile for Development Utilities programme promotes the use of mobile technology to open new pathways for affordable and reliable energy, water, and sanitation services to reach the underserved. To achieve this objective, our GSMA Mobile for Development Utilities Innovation Fund has supported 20 projects that leverage innovative technologies in the WASH (water, sanitation and hygiene) sector across sub-Saharan Africa and emerging Asia. These solutions have the potential to address some of the key challenges facing water utilities in developing countries in a cost-effective manner, while also ensuring the inclusion of the most vulnerable populations.

Mobile Channels deployed by our Innovation Fund grantees

Source: Key trends in mobile-enabled water services

Digital solutions do not always have to be flashy or capital-intensive, but rather should maximise value for low-income customers and be tailored to their realities. Over the course of our Innovation Fund, we have identified three key digital use cases that have unlocked more efficient and more affordable water services for the water service providers we’ve been supporting:

- Digitisation of utilities: Digitising processes, such as meter reading, billing, payments and complaint management systems, have shown a clear reduction in NRW for many utilities. For instance, Wonderkid, a Kenyan company offering Integrated Mobile Utility Management (IMUM) software systems to water utilities, developed a digitised complaint management system for water utilities in Kenya. By fostering transparency, traceability, and accountability, IMUM makes water utilities become more accountable to their customers, which in turn increases their willingness to pay. (Read our case study)

- Pay-as-you-go water: For low-income customers, it is easier to pay for what they consume in smaller amounts rather than a lump sum at the end of a billing cycle, especially for a service that may not necessarily have provided a steady, timely and safe supply of water. Using mobile payments also saves customers time and money by providing a secure channel to pay for water at a fair and set price without the need to travel to a local utility office. In September 2015, the GSMA M4D Utilities Innovation Fund awarded CityTaps a grant to launch smart prepaid water meters in Niamey, Niger, in partnership with the local water utility, Société d’Exploitation des Eaux du Niger (SEEN) and Orange Niger. Following the grant, seventy-two per cent of users opened mobile money accounts for the first time and nearly 90 per cent indicated that they preferred to pay with mobile money. The prepaid service was popular due to its flexible payment schedules and 16 per cent cheaper water than piped water.

In our case study video, a CityTaps customer describes the benefits of CityTaps’ prepaid smart metering system

- Water Point Monitoring: A variety of mobile-enabled use cases support the exchange of valuable real-time data for efficient water monitoring and delivery, such as monitoring the functionality of water delivery points, water consumption patterns, leakages, broken meters and user feedback on a regular and on-demand basis. This can be done manually by water service attendants or end users who report it through mobile channels (voice, SMS, apps) to water service providers, or remotely and automatically using machine-to-machine (M2M) technology without human intervention at the reporting stages. One of our grantees, Uduma, is trialling e-pumps across different municipalities in Burkina Faso. These hand pumps are equipped with a water meter and an automatic meter reading device (data logger), making it possible to monitor water consumption and pump breakdowns.

Are digital payments worth it?

Unpaid water bills, complicated payment procedures, and long-waiting times are some of the key obstacles confronting water utility customers in emerging markets on a regular basis.

Most utilities fail to effectively communicate with their customers, and are not offering them a convenient, secure channel to pay. In a recently published joint-paper with CGAP, we show how digital payments can reduce operational expenses of and streamline service delivery. We surveyed and studied 25 water service providers (both centralised utilities and decentralised water service providers), and identified the following benefits associated with the introducing digital payments for water services:

- Digital payments reduce collection costs by 57 – 95 per cent;

- Digital payments increase revenues (between 15 and 37 per cent) and enable new business models; and

- Digital payments increase customer reach.

Mobile money has been a key enabler of digital payments and financial inclusion in sub-Saharan Africa. According to the GSMA 2018 State of the Industry Report on Mobile Money, there are over 145.8 million active mobile money accounts making transactions worth $26.8 billion each year. Though we are encouraged that there are more and more utilities scaling and piloting digital payment solutions, there is still tremendous scope for growth.

Driving the digitisation of water utilities forward

Recently, the World Bank Lead Water economist Caroline Van Den Berg published an interesting blog entitled “Is the urban water and sanitation sector frozen in time?”, in which she lamented the risk averseness and path dependencies preventing some water utilities to apply more innovative technologies. At GSMA Mobile for Development Utilities, we are committed to help overcome these challenges, and we are excited about the potential of our work with and our participation in the IWA’s Digital Water Programme’s steering committee.

The GSMA Mobile for Development (M4D) Utilities programme is funded by the UK Department for International Development (DFID), USAID as part of its commitment to Scaling Off-Grid Energy Grand Challenge for Development and supported by the GSMA and its members.