To mark the second annual International Day of Family Remittances, today, we are highlighting the key role of the mobile money industry within the global remittances space. This post is the first in this series, and focuses on the customer benefits of sending and receiving international remittances using mobile money.

International remittances at a glance

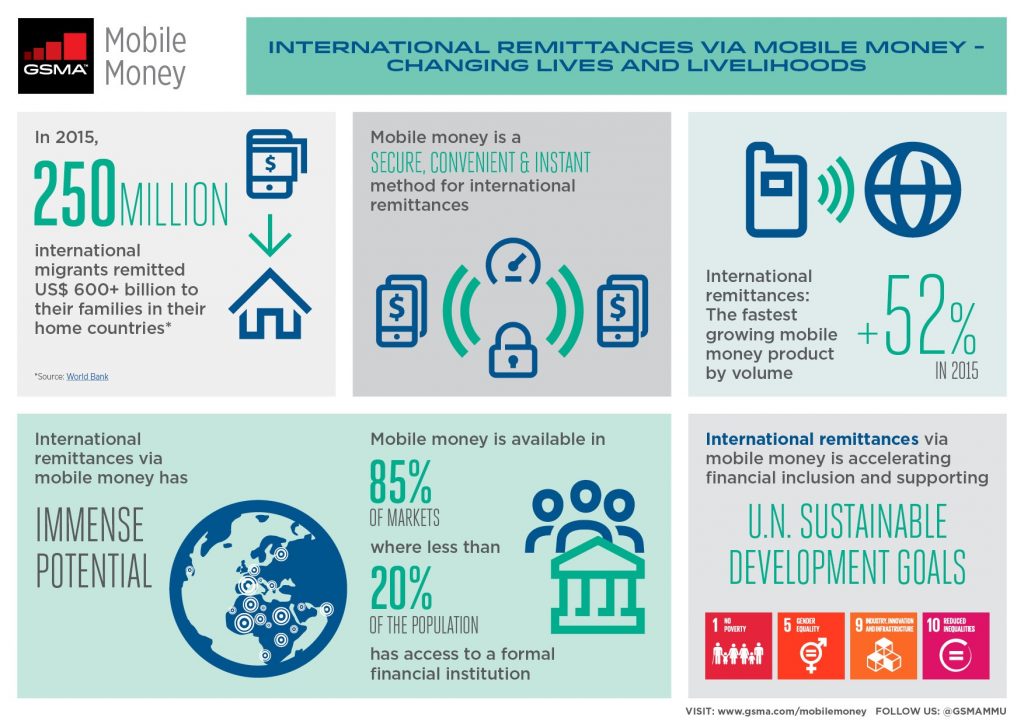

More than 250 million people (or 3.4% of the global population) live outside their countries of birth. Migrants often send money back home, providing a financial lifeline to their families, as well as contributing to the economies of their home countries by paying for health, education or investing in trade.

Traditionally, formal remittances could only be sent by two main channels: banks and money transfer operators (MTOs). The remittance industry has evolved in recent years, with mobile operators and fintech companies providing attractive alternatives to the traditional models by offering more convenient and cheaper methods of sending remittances via mobile phones.

Despite these changes, costs remain very high—in 2015, the global average cost of sending $200 in remittances (including all fees and charges) was 7.4 percent. This average masks regional differences—for instance, Sub-Saharan Africa remains the most expensive region, with an average cost of 9.5 percent for sending $200.

Global efforts to drive down costs

Many international stakeholder groups have launched campaigns to improve the environment for international remittances, such as the G8’s 5×5 Objective, the G20’s ‘Plan to Facilitate Remittance Flows’ and the UN’s Sustainable Development Goal 10.c. These initiatives focus on reducing the average cost of international remittances, which is a mix of transaction fees for the sender, exchange rate margins, and at times, fees charged to recipients. Multiple cost comparison sites have emerged in order to bring a greater degree of transparency to this sector and to equip customers with the information they need to evaluate their options. While these sites have yet to fully incorporate new mobile money based international remittances instruments, the GSMA is working to fill this information gap and document the critical contributions mobile operators are already making to achieve the Sustainable Development Goals.

The promise of international remittances via mobile money

International remittances via mobile money has immense potential to significantly drive down costs for customers, as well as to provide valuable indirect benefits:

- Mobile money based international remittances is flourishing, expanding the range of options available to customers

Mobile money based international remittances is showing promising signs of growth; it was the fastest growing product by transaction volumes (+52%) for the second year in the row. Additionally, cross-border mobile money remittances (where mobile money is both the sending and receiving channel) flourished in 2015. The GSMA identified at least 29 live cross-border mobile money remittance corridors connecting 19 countries at the end of December 2015. Most recently, Orange announced three new corridors: mobile subscribers in France can now send remittances to Orange Money customers in Côte d’Ivoire, Mali and Senegal. According to Patrick Roussel, Commercial Director of Orange France, Orange plans to launch more corridors in future: “Our ambition is to open other corridors to Cameroon, Botswana and Niger, but we start with countries where Orange Money is already big enough.” Mobile money is thus propelling greater competition, applying a downward pressure on the cost of sending money globally.

Mobile money is also offering compelling partnership opportunities for traditional MTOs seeking to enhance their service offerings. For example, Western Union is now partnered with 13 mobile money providers across 12 markets. Additionally, many mobile operator groups have announced partnerships with global remittance hubs (e.g., HomeSend, TransferTo, MFS Africa) to accelerate mobile money based international remittances and provide greater value to customers. Another interesting partnership that gathered steam in the past few years is between mobile money providers and fintech companies (e.g., WorldRemit, PayPal’s Xoom), offering instant online transfers to mobile money accounts and providing an attractive alternative to traditional cash-to-cash models.

- Mobile money can be the most convenient method of sending and receiving remittances

For migrants and their families back home, using mobile money for remittances has key advantages, including time and cost-savings associated with sending or collecting money. Rather than spending a significant amount of the day traveling to an MTO or bank agent, they can spend their time more productively. Migrants can make a transfer from any location, at any time provided that they have a positive balance in their mobile money account. Equally, recipients can instantly use funds and do not necessarily have to cash-out immediately.

Similar to how mobile money precipitated a shift in domestic remittance behaviors, replacing infrequent lump sums with more frequent lower-value transfers, mobile money based international remittances is also likely to empower customers to adapt their sending behavior to best suit their needs.

Additionally, the ability to send remittances instantly from a mobile money account allows customers to check the total cost of sending (transaction fee plus the exchange rate) on more frequent basis, as opposed to checking the cost only by visiting an MTO or bank agent. Therefore, another advantage of sending funds by mobile money for migrants is the ability to send money when the exchange rates are most favorable.

- Mobile money reduces security concerns associated with carrying cash

Using traditional channels, senders and receivers have to bear the risk of carrying cash to or from an MTO agent or bank branch, making them vulnerable to theft. Sending and receiving remittances via mobile money minimises these cash-handling risks. Further, if recipients need to cash-out a certain portion of their money, they can travel to an agent to withdraw money. In December 2015, there were 3.2 million registered agents globally, which is impressive when compared with the size of traditional financial intuitions and remittance service providers. This is no longer just in East Africa—notably, the most remarkable growth in active agents came from West Africa, where active agent growth was twice as high as anywhere else in the world in 2015, facilitating the expansion of convenient and secure mobile money based international remittances services.

As mobile money services continue to mature across markets, we expect the potential impact of international remittances to further increase. We look forward to continuing to shine the spotlight on this important topic.

Upcoming activities

GSMA will work closely with regulators, payments industry players and other key stakeholders to create an enabling environment for mobile money based international remittances to flourish and scale, and to help support the achievement of the UN’s SDGs 1, 5, 9 and 10.

Continuing the focus on international remittances, join us on Thursday, 28th July for a dedicated session on international remittances at the Mobile Money Leadership Forum in Dar es Salaam, Tanzania. Learn more about the event here. Look out for further information about our initiative to highlight the role of the mobile money industry within the global remittances space and follow us @GSMAMMU.