The rise of integrated energy planning in low- and middle-income countries

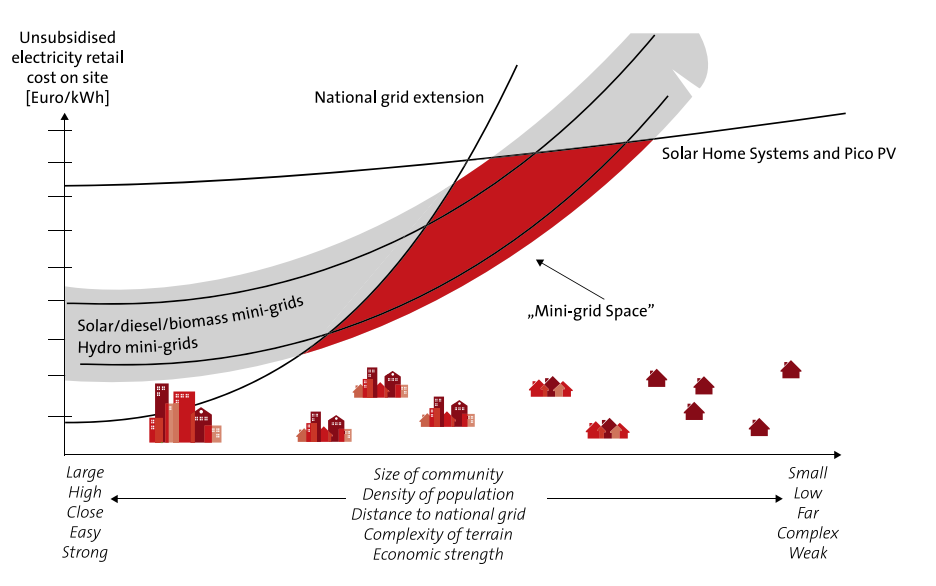

Data-driven integrated energy planning strategies have become a critical tool in coordinating and accelerating investments in energy access. These strategies also serve as a foundation for collaboration among different stakeholders with a joint interest in driving energy access such as governments, donors, enabling organisations, off-grid energy providers, and other private sector stakeholders. The aim of integrated energy planning is to identify the least-cost and most sustainable electrification strategy for a given settlement, set of settlements, region or country. An analysis generally involves a high-level comparison of the relative benefits of central grid expansion, mini-grids, and smaller scale off-grid solar solutions such as solar home systems (SHSs). However, it can also include more tailored and sophisticated modelling, drawing on a wider range of data and looking over multiple timeframes, parameters, costing models and other assumptions. For example, settlement X may not be viable to reach through a national grid extension given its current density, location and expected initial consumption levels. Yet, its energy needs over time may exceed the generation capacity of SHSs due to growing small business activity. The settlement may therefore be the most suitable for a mini-grid deployment (see chart below and this report by SE4All).

As policymakers devise integrated energy planning strategies, it is important for them to understand energy demand over time, customers’ ability to pay and the potential for income-generating consumption use cases. Doing this effectively requires a broad range of data.

High-level considerations underlying integrated energy planning

Source: EU Energy Initiative Partnership Dialogue Facility (2014). Mini-grid policy toolkit

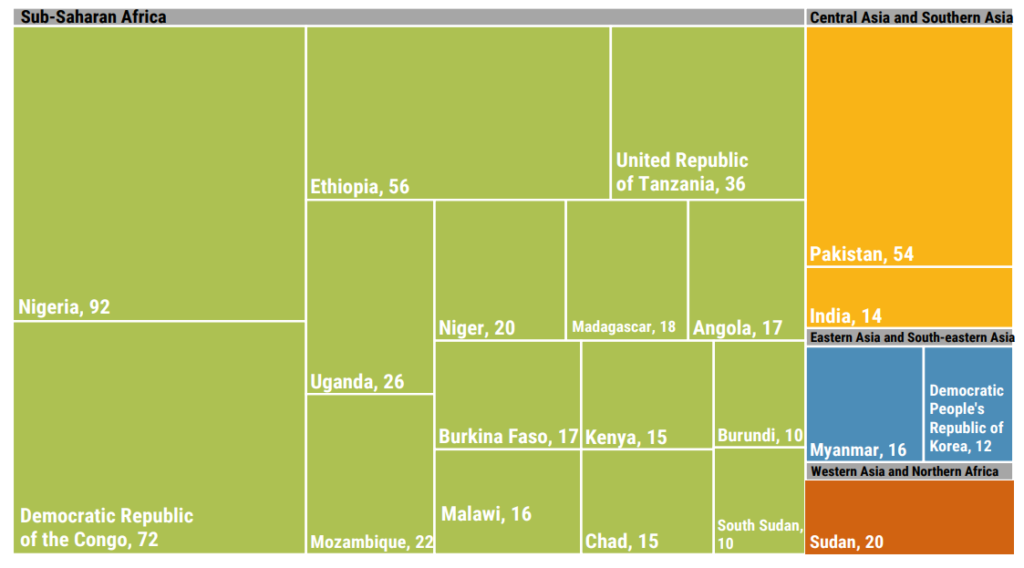

Effective planning can greatly reduce site and customer acquisition costs and accelerate and enable deployments from the energy access industry. Though the world has made considerable progress in extending access to energy, 733 million people continue to have no access to it. Over 75 per cent of those without access live in just 20 countries (see figure below), with the challenges in countries such as Nigeria, the Democratic Republic of Congo (DRC), Ethiopia, Tanzania, Uganda, or Mozambique being particularly acute. SE4ALL’s ‘Energizing Finance’ report highlights that far more investment needs to go to ‘high impact countries’ with the largest energy access gaps if the world wants to reach SDG 7.

Number of people without access to electricity in the top 20 energy access deficit countries (in millions)

Source: 2022 Tracking SDG 7 Report, World Bank

Integrated energy planning is often coordinated by rural electrification agencies and informs key public policy decisions such as energy subsidies and regulation. In Nigeria, this is exemplified by the Nigeria Electrification Project coordination by the Rural Electrification Agency Nigeria (REA) (see a case study in our recent report for further details).

Planning boosts confidence and identifies opportunities for private sector interventions, while also providing regulators with the key information they need to provide long-term regulatory clarity and ensure that private service providers are on track to meet public policy objectives. Off-grid solar providers such as mini-grid or SHS companies, and funders/DFIs with large energy portfolios are also becoming increasingly sophisticated at using data to inform strategy.

The emergence of data-driven planning initiatives has been enabled by an emerging ecosystem of geo-spatial analytics companies for the energy sector, exemplified by companies such as Fraym or Village Data Analytics. Meanwhile, technology platforms such as Odyssey Energy Solutions are providing web-based data platforms to standardise mini-grid data by connecting project developers, suppliers, financiers, and governments.

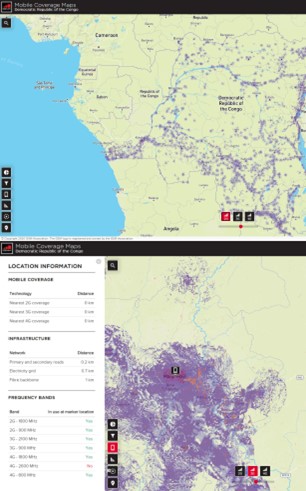

GSMA Mobile Coverage Maps – How mobile coverage data can help support integrated energy planning

Over the last decade, the GSMA Mobile for Development team has been advancing increased access to and adoption of innovative digital solutions in low- and middle-income countries. To help drive these objectives, the GSMA Mobile Coverage Maps[1] tool supports operators, policymakers and innovators to increase the efficiency of their mobile infrastructure investments in rural areas.

The maps, currently available for 17 countries in Africa, are primarily aimed at helping operators plan for network extensions and upgrades, but the underlying data is also relevant to other stakeholders in the development sector – the energy access ecosystem in particular. The coverage maps allow users to:

- Explore the availability of mobile technologies in every city or village;

- Estimate the number of people that can be reached through mobile tech; and

- Provide key information for the business case of expanding mobile coverage.

Given recurrent interest from the energy access sector and other development stakeholders to access the underlying data of the mobile coverage map tool, we have developed an API for accessing this data. In doing so it allows geo-spatial analytics companies in the energy sector to overlay mobile coverage data with other data sets, which is where we think tremendous value can be unlocked.

The GSMA Mobile Coverage Map for the Democratic Republic of Congo

Source: GSMA Mobile Coverage Maps

Being able to estimate what signal strength and mobile network quality would look like in a given settlement is crucial for digitally enabled energy solutions such as smart metering or pay-as-you-go (PAYG). Connectivity and mobile payments have been, and remain, some of the critical ingredients for the rapid scaling of the off-grid industry. This data also supports the identification of optimal sites for anchor-based client models (ABC models) – mini-grid deployments, which leverage telecom towers as anchor clients, while also providing energy to the surrounding settlement (see our report).

The VIDA-GSMA collaboration to support the Scaling Mini-Grid Initiative (SMG) in the DRC

The DRC has the second largest population in the world without access to energy. Given the size of its territory and the multiple intersecting development issues facing the country, there are significant challenges facing grid extensions. According to the World Bank, estimated on‐grid access from the state‐owned utility (‘Société Nationale d’Electricité’, SNEL) is a mere 10 per cent. Kinshasa is the city with the highest access rate (44 per cent), followed by Haut Katanga, Kongo Central and Sud Kivu province with access rates between 10 per cent and 30 per cent. The remaining 22 provinces have an access rate below five per cent. Where people do have access, electricity services are unreliable, with daily load shedding in most areas of Kinshasa. Under a business‐as‐usual scenario, around 84 million people – 80 per cent of the population, will still live without access to electricity in 2030.

Despite the DRC’s challenging investment climate, mini‐grids and off‐grid systems are emerging as a private sector–led solution to provide reliable access to unserved or underserved populations and cities.

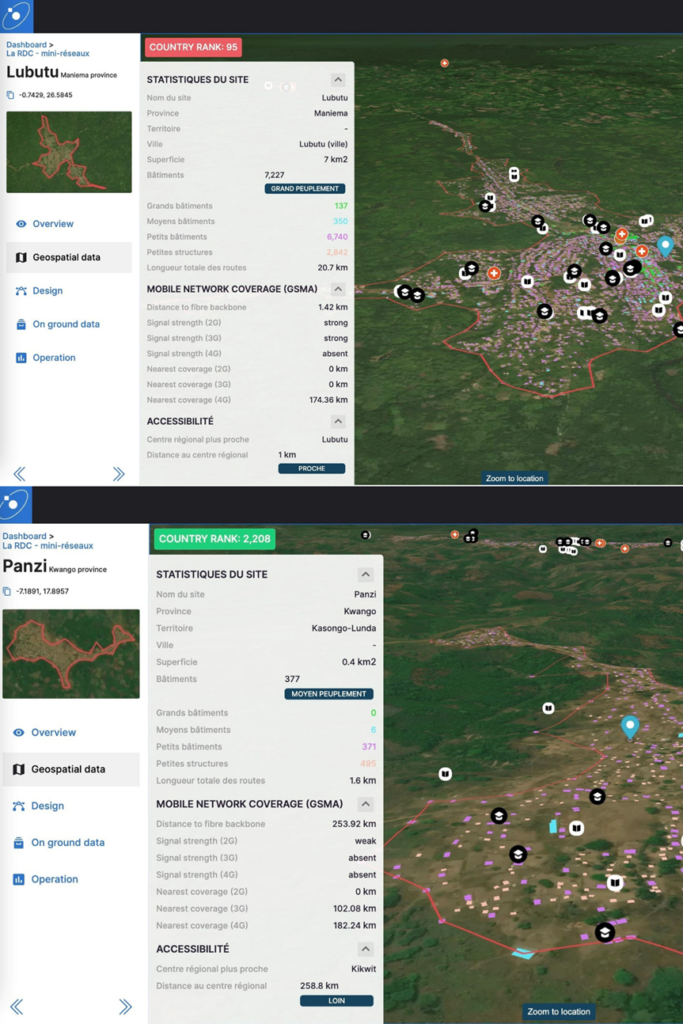

Following an initial pilot, the GSMA and Village Data Analytics (VIDA) have recently launched a collaboration to support a VIDA-led mini-grid demand assessment project (‘assignment’) in the DRC. VIDA is map-based software that enables development decision makers to plan and monitor investments. Under this collaboration, GSMA Mobile Coverage Map data will be added via the API to the VIDA analytics platform, complementing the other data layers developed by VIDA on the platform.

As highlighted by the GSMA Mobile Connectivity Index, mobile connectivity and network coverage continue to be important challenges in the DRC as only 75 per cent of the country is covered by 2G, and only 54 per cent is covered by 3G. Mapping signal strength and mobile network quality across different settlements within the country can be vital to support the deployment of off-grid solar technologies that rely on mobile network coverage. This fruitful collaboration will support VIDA’s assignment with the SMG in the DRC. It is a joint World Bank Group effort to support the preparation and design of the government’s mini-grid programme, capitalising on the SMG Programme by the International Financial Corporation, and leveraging the IDA-funded ‘Access Governance and Reform For The Electricity And Water Sectors’ project (AGREE, $600 million) by the World Bank. Components of the AGREE project envisage the development of mini-grids by the private sector via the top-down and bottom-up approaches, and VIDA’s analytics will provide the government with investor feedback in respect of tendering the mini-grid projects for the first two large provincial capitals in the DRC. These will represent the largest private sector led mini-grid transaction globally to date and will pave the way for a pipeline of bankable mini-grid projects in the country. VIDA is also conducting a full country analysis of potential mini-grid sites using geospatial imaging and machine learning. To date, more than 7,000 potential sites have been identified within the DRC. As such, the results of this work will also provide information on the national mini-grid market potential for: i) the Government to develop electrification plans via mini-grids, ii) to support prospective private developers and investors identify and develop sites more quickly, and iii) for development partners to prepare targeted investment plans and thus promote the national mini-grid programme in the DRC.

“The GSMA data is valuable to support electrification planning. It helps our clients understand areas in the country where they can roll out mobile payment-based energy solutions. They can also understand if there is a large mobile phone tower they could electrify, which can serve as an anchor load. Moreover, this is a good example of how our clients can add several data layers to the VIDA analysis.”

Statement by Village Data Analytics

The Village Data Analytics mini-grid site analysis for the Democratic Republic of Congo with mobile coverage data as an additional data layer

Source: Village Data Analytics

Looking ahead

The GSMA is proud to be collaborating with VIDA in the context of their mini-grid demand assessment with the SMG programme in the DRC, and we are looking forward to learning and sharing more about the utility of mobile coverage data for energy planning over the course of the project. We would also like to thank mobile operators in the DRC for collaborating with us on the initial mapping project. Beyond this project, we are keen to support other partners in the energy access ecosystem that could leverage this data to accelerate our progress towards Sustainable Development Goal 7.

We are also keen to support further collaboration between the mobile industry and the energy access sector, as there are important synergies between extending energy access and digital connectivity highlighted in some of our past research, and renewed interest in the potential of the ABC model.

Given that the API also opens access to historical mobile coverage data across African countries, it could also enable interesting research projects for researchers interested in the relationship between mobile coverage and electrification, as well as their joint impact on poverty reduction, drawing on previous research projects we have conducted with the World Bank.

Extending the coverage map tool to other countries and ensuring that the underlying data stays up to date will be critical going forward, and the GSMA is looking forward to working with mobile operators and other partners to continue to support this work. Please contact George Kibala Bauer, [email protected], if you would like to learn more about the role of mobile coverage maps in energy planning and you can learn more about the SMG programme here.

The Digital Utilities programme is funded by the UK Foreign, Commonwealth & Development Office (FCDO), and supported by the GSMA and its members.

[1] Please note that this tool differs from the GSMA’s Network Coverage Maps tool through which GSMA Members continuously update their network coverage and submit their latest coverage data to the GSMA.