The rural finance gap in emerging markets is huge. The vast majority of smallholder farmers, who represent 53 per cent of the population across the developing world and account for a majority (at least 70 per cent) of the food production consumed worldwide, are still unbanked. Without access to bank accounts, most smallholders operate in a cash economy, receiving cash payments for the sale of agricultural produce and for government subsidies.

The digitisation of business-to-person (B2P) and government-to-person (G2P) payments in agriculture is emerging as a new opportunity for mobile money service providers to drive rural growth, as they seek to expand the service beyond urban regions and into new segments. Digital payments into the mobile wallets of smallholder farmers reduce the time and cost associated with traditional cash disbursements by eliminating the need to travel long distances to receive and pay cash; this also results in improved security and transparency.

Crucially, digitising payments serves as an entry point for financial inclusion. For unbanked farmers, mobile money enabled agricultural payments offer the potential to create a financial identity (transactional records) that can open the door to a broader range of agricultural financial services, such as savings and credit.

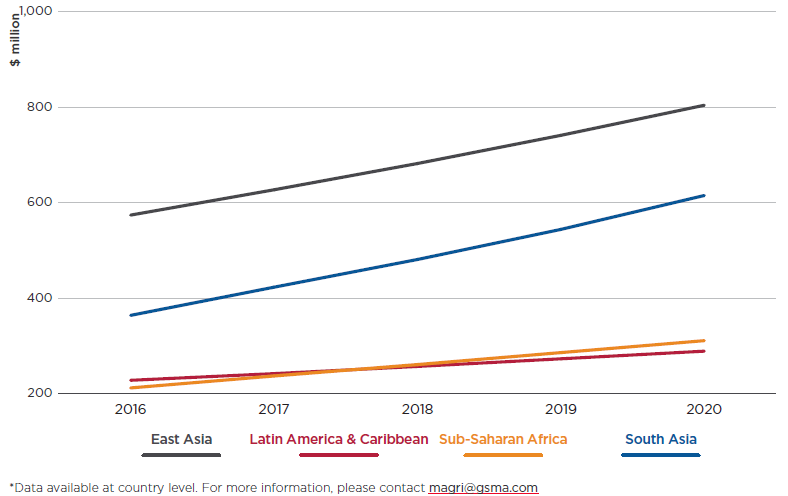

If mobile operators are interested in driving the adoption of mobile money in rural areas, it is time to move forward. In a recently released report the GSMA estimates that by actively approaching the digitisation opportunity B2P and G2P transfers within agricultural value chains, mobile money service providers could globally derive $2 billion and $202 million of annual revenue respectively by 2020. Only looking at the estimated $2 billion up for grabs in direct annual revenues from B2P in 2020, this represents 1.2 per cent of the total recurring revenues for mobile operators in that year.

Figure 1 – Potential direct revenue opportunity for B2P payments in agricultural value chains (Source – ‘Market size and opportunity in digitising payments in agricultural value chains’, GSMA mAgri November 2016)

In addition to the revenue opportunity, digitising agricultural payments shows potential to generate measurable indirect benefits for mobile operators. These include the acquisition of new mobile money users in rural areas, increased loyalty of existing users, growing frequency and volume of transactions, stronger overall activity on mobile money accounts and increased agent activity in rural areas.

The opportunity to digitise agricultural value chain payments is by no means a low hanging fruit. The revenue opportunity from B2P transfers will materialise only if mobile money service providers are able to operate in an enabling regulatory environment, allowing in particular agriculture-specific mobile money use cases (e.g. suitable limits for agricultural transactions). Crucially, mobile operators must be able to:

- Act quickly in view of potential competition from third-party providers and banks;

- Implement a suitable market entry strategy around value chain selection and business model to drive uptake;

- Ensure adequate mobile network coverage in target rural regions;

- Establish a robust cash-in/cash-out agent network, supported by training and incentive strategies for agents;

- Ensure adequate user education on the benefits of digital payments and the use of mobile money.

Despite the many benefits of mobile money payments such as increased efficiency and transparency, cash is widely perceived as a “cost-free” option by smallholders. In order to facilitate the adoption of mobile money payments in agriculture, it is crucial that mobile money service providers initially address the single most challenging obstacle to adoption – the cost to the end user (transaction and cash withdrawal fees).

To stimulate uptake, usage and boost ecosystem development, mobile money service providers pioneering agriculture payments have experimented with cost mitigation strategies, including reduced or zeroed transaction fees for farmers that have been enrolled in B2P payment schemes. It is the case, for example, of Orange Cote d’Ivoire, which has piloted mobile money payments in the cocoa value chain removing cash withdrawals fees for farmers. This is also true for Smart Money, a third party mobile money provider focussed on rural regions in Uganda and Tanzania, operating under a “no fee” model for farmers for both cash withdrawals and transfers. Other strategies include the adoption of hybrid B2P payments, such as in the case of MTN Uganda, which allows coffee farmers to choose the portion of their crop payment to be received via mobile money and via cash.

New initiatives to drive forward mobile money value chain payments, and bringing together mobile operators, agribusinesses, donors and tech providers offering bulk payment and farm management systems providers, are emerging. Particularly, Sub-Saharan Africa. Key East African mobile money markets (Kenya, Uganda, Tanzania and Rwanda) and other dynamic markets (Ghana, Ivory Coast, Haiti and Pakistan) are seeing strong traction.

As the momentum for agri value chain digitisation grows in 2017, we will be working with mobile operators and associated stakeholders to identify best practices and share key lessons to drive adoption of mobile money in rural contexts. If you are interested in discussing the potential for B2P and G2P payments specific to your market(s) in addition to guidance on realising the opportunity email us at [email protected].