Last week, Safaricom released their half year results for 2013-2014, and once again Safaricom continues to impress the industry with their achievements. Monthly active M-PESA customers now stand at an impressive 11.6 million and revenues from M-PESA constitutes 18% of total company revenues, 12.5 out of 69.2 billion KSh.

Some of the other numbers show a very interesting trend for M-PESA, and I think for the industry at large. What we’re seeing in the transaction volumes and growth per transaction type is a shift from a send money home product to a payments platform. The ‘send money home’ story is now officially on the way to be modernized.

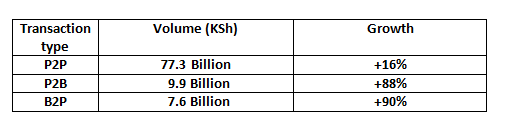

The rise of businesses using of M-PESA is now driving the growth of the product, 18.5% of value is business -to-person (B2P) or person-to-business (P2B). Since these numbers are an average over the past six months, it is most likely above 20%, or one payment transactions out of five on the M-PESA platform at this point. The monthly volumes of payments types and their growth:

What has been driving this? The lower margins of mobile money compared to other services offered by mobile operators can be clearly seen in this report. Commissions to M-PESA agents are now the largest individual contributor of Direct Costs for Safaricom, the first six months of the reporting year 5 billion KSh (60M USD) were paid out to agents, compared to voice and SMS interconnect costs of 3.09 billion and airtime commissions at 4.65 billion KSh. This shows that 1) many agents are continuing to make money from M-PESA, and 2) that the lower margins in mobile payments is reflecting on the company’s overall margins due to its high direct costs. To mitigate this potential ’margin dilution’, as Safaricom calls it in their presentation, there’s a need to increase usage and ‘the velocity of money’ on the platform, the number of (non-agent) transactions that happen between cash-in and cash-out to grow revenues without increasing costs.

Safaricom’s CEO Bob Collymore spoke at the MMU event in Nairobi this July, and announced in his speech that M-PESA has over 1400 bill partners, 500 bulk payment disbursers and is connected to 140 financial institutions. This is the start to move M-PESA from a ‘send money home’ platform to a versatile payments platform in the country.

M-Shwari, the savings and credit product from Safaricom and Commercial Bank of Africa (CBA), continues to grow and have now reached 2.4 million active users. These user have collectively deposited 1.8 billion KSh (21 million USD), and the loan balance stands at 800 million KSh (9.3 million USD). Non-performing loans have dropped to 3.8% of the portfolio, which is a good sign for the industry that their customer due diligence and credit scoring algorithms seem to be working well. The product have increased the number of deposit accounts at CBA from under 35,000 to over 5 million in less than a year, making CBA the second largest bank in Kenya in terms of customer accounts after Equity Bank.

Finally, it is worth noting that Safaricom aggressively grew their agent network by 73%, to a total number of 78,856 agents nationwide.

What was your reaction to the results presented? Please add your comments below.