The Social Impact Lab (SIMLab) Credit project is part of the SIMLab Foundation, best known for their FrontlineSMS service. The Credit project (formerly known as FrontlineSMS:Credit) developed a software product called PaymentView, which currently works in tandem with Safaricom’s M-PESA mobile money service in Kenya. PaymentView is a mobile money management tool for ‘last mile’ organizations who cannot access or afford other types of management tools. PaymentView diverts the payment processes via the FrontlineSMS platform that utilises an M-PESA enabled (Safaricom) SIM card, a GSM modem, and a desktop computer to aggregate payments into the software interface. From here even users without an internet connection can conduct overview financial management and analysis, track progress on installment plans as well as generate manual and automated M-PESA payments, SMS reminders and financial reports. PaymentView is currently available in beta. A new version of the platform called ‘Payments’, sporting greater power, functionality and versatility is currently under development and will be launched as a beta product in early 2015 with plans to become a fully developed product soon thereafter.

Year Launched: 2009

Business Model: Donor, Open Source, Consumer (non-MNO led)

Targeted Device: Basic Phone, PC/Laptop

Primary Delivery Technology: SMS

Products & Services: Payments, Data Collection, Inventory Management

Markets Deployed In: Kenya

Estimated Total Number of Users: 600 PaymentView downloads, 50+ organisations directly suppported

BACKGROUND AND OPPORTUNITY

SIMLab Credit (aka FrontlineSMS:Credit) was originally conceived in 2009 by Ben Lyon, who later went on to become a co-founder of Kopo Kopo. Having witnessed great suffering, deprivation and oppression worldwide, Ben concluded that the primary common denominator that could have the greatest positive impact upon people in all these situations was better access to financial services.

Having seen the early success of M-PESA in Kenya, it was observed that while M-PESA had seen a lot of success with person-to person (P2P) transactions, there wasn’t much use among organisations and businesses because they lacked a suitable payment tracking and management systems. This often meant that using M-PESA became overwhelming and more daunting than reverting to cash payments. In response to this, SIMLab Credit was established in order to provide a software platform designed to better manage M-PESA transactions. This software, called PaymentView, works in tandem with M-PESA and diverts the payment processes via the FrontlineSMS platform that utilises an M-PESA enabled (Safaricom) SIM card, a GSM modem, and a desktop computer to aggregate payments into the software interface. From here even users without an internet connection can conduct overview financial management and analysis, track progress on installment plans as well as generate manual and automated M-PESA payments, SMS reminders and financial reports.

OBJECTIVE

The objective of SIMLab Credit is to improve the efficiency, transparency and accountability of mobile money use for business, including among the ‘last mile’ of users. It aims to improve efficiency by enabling mobile money payments and receipts to be processed through the software platform itself, thereby reducing the error-prone and time-consuming procedure of manually performing these functions on a mobile handset. It improves transparency and accountability by aggregating all payment actions in a single interface and providing overall improvements in payment tracking and visibility. Importantly, it also aims to improve access to these benefits specifically among base of pyramid (BoP) organisations using mobile money within low-income emerging markets. Importantly, like FrontlineSMS, PaymentView is designed to operate without the need for an internet connection, thereby making it as accessible as possible to the ‘last mile’ of users.

RESULTS

PaymentView has been downloaded over 600 times in Kenya, and the SIMLab Credit project provides direct support to over 50 organizations in Kenya.

PaymentView also acted as a beta test for the design and build of a more advanced Payments platform soon to be launched by SIMLab.

IMPACT

Among MFIs (Micro Finance Institutions) and SACCOs (Savings and Credit Cooperative Organisation) there is a huge incentive in the efficiency of using M-PESA for payments, but the organisations previously had no suitable tracking management systems. This often meant that using M-PESA became overwhelming and more daunting than reverting to cash payments with which they were familiar. The PaymentView software provides a solution to this issue by providing a control center for the payment processes. By using PaymentView, one small savings collective in Kenya, for example, was able save 85% of the time typically taken to process payments, and also increased average savings by 50%.

SIMLab Credit directly implemented PaymentView in a rural primary school and allowed the school to create flexible payment terms for parents, increasing access to education for low-income students. Another unintended but beneficial outcome within the school was decreased administrative costs and increased coordination and communication due to the use of SMS. Prior to PaymentView and FrontlineSMS, the school regularly printed hundreds of hand-outs on a monthly basis to communicate essential pieces of information with parents. Furthermore, the hand-outs rarely made it all the way home, leaving parents without any information about their children’s education.

LESSONS LEARNED

Mobile money is not the only solution – To date SIMLab Credit has operated solely in Kenya, where the mobile money market is well established and easily accessible. However, many countries do not have such a strong mobile money market, and in these markets, airtime top-ups and other mobile payments platforms often supplement traditional and informal currencies. SIMLab plans to research these mobile economies in 2014-15.

The BoP market is not ready for internet-based services – While there has been a push within the industry to move away from desktop solutions to online platforms, the SIMLab Credit project has consistently found that even in a place like Kenya where the mobile money industry is well established and connectivity is relatively high, a significant portion of the market is still not ready for the move to internet-based services.

Don’t underestimate the value of communication within service delivery – In some instances, the SMS components included within PaymentView have been as popular as the mobile money transfer technology, proving the value of SMS communications as a well understood and appreciated technology for improving efficiency at the organizational level.

APPROACH

SIMLab focuses on ‘last mile’ users first and specifically utilises technologies that are the lowest common denominator in terms of access and affordability. Many MNOs providing mobile money, such as Safaricom and Airtel, provide an internet-based solution where you can track and manage your business transactions. While there has been a push within the industry to move away from desktop solutions, the SIMLab Credit project has consistently found that even in a place like Kenya where the mobile money industry is well established and connectivity is relatively high, base of pyramid (BOP) organisations are still not ready for internet-based services. The Credit project and platform has been designed specifically with these limitations in mind.

For the initial design process the project worked closely with the financial sectors, but since then the team have realised that the platform can be used by schools and NGOs and similar organisations. The same basic set of transactions facilitate the activity of all these different organisations and institutions. In the design process the project is strongly informed by user feedback, and also utilises scrum methodology and agile software development to push out iterations a little at a time to test their value. This approach continues to inform the design and decision-making process at the project.

PaymentView has always been delivered for free in order to reach the widest audience. However, the new release of a redesigned ‘Payments’ platform is likely to be available for a subscription fee, to reflect its greater power and functionality and to align with a newly implemented business model for the Credit project that focuses on ensuring financial sustainability. However, it is important to the project mission that this platform remains completely accessible in terms of price-point and willingness/ability to pay, to the type of organisations that are currently informing the design process. The price-point schedule is also proposed to include a tiered pricing scale relative to the level of functionality required by a user. Though the software side of the project will continue to utilise donor funding throughout the design and build process of the new platform, after release it will ultimately become financially self-sustaining and independent from donor funding. At this time the SIMLab Foundation will continue to focus on implementation, policy and best practice in a consultancy capacity, while the technical team take the Frontline suite of products, including the new Payments platform into a new company.

USER CENTRIC ATTITUDES

User data entirely informs the decision-making process for the design of the SIMLab Credit project. The ongoing design of the new Payments platform is being strongly informed by the needs of a broad group of organisations currently using the PaymentView beta and working directly with SIMLab. The project is working closely with these organisations in order to ensure that relevant functionality with the end-user in mind is incorporated into the end product design. Part of the incentive for the organisations who have partnered with the project in this process is having the opportunity to influence the end design such that it incorporates the functionality that would be most useful to their work. The beta platform is still in active usage by many organisations, but is currently limited to the Kenyan market.

THE USE AND VALUE OF DATA

As part of standard project monitoring and evaluation, the project team are collecting information about the impact of PaymentView on the organizations using it, their relationship with their communities and customers, and the throughput of payments and messages. This information is being used to assess whether the software is making a difference, and also to help inform the design process for the new version of the system. Where possible, the project is also interacting with beneficiaries of the organizations using PaymentView and attempting to uncover reasons for adoption or non-adoption of mobile money. Collecting and exporting monthly log reports of all actions within the system has benefited many organisations using PaymentView, particularly SACCOS, by enabling better accountancy and finance overview management.

The development of the Payments platform is benefiting from user testing throughout each iteration of the software development and includes A/B testing of the interface, including load/capacity testing, and design and vocabulary-cues.

SUCCESS AND SCALABILITY

The main success metrics for the Credit project are in line with its objectives to increase efficiency, transparency, and accountability in mobile money management among BoP organisations.

Historically the ability of FrontlineSMS products to scale has depended on conventional hosting hardware – usually a laptop computer, phone or modem, and the user interface itself. This set up, while broadly accessible and designed for horizontal scaling, can actually act as an obstacle to vertical scaling under certain scenarios. SIMLab hopes to overcome this by ensuring that more complex payment models are easier to set up within the new Payments software. SIMLab is also researching the possibilities of running the service in the cloud, but must first assess the legal and regulatory landscape associated with hosting the service online. Nonetheless, SIMLab have previously proposed a model for further maximising the horizontal scalability of the platform through the incorporation of many hundreds of nodes for small-scale innovation that and personalisation. However, if managed and aggregated at higher levels by a single organisation this functionality could amount to vertical scalability.

Furthermore, the software design and build approach employed by the project utilises the SIMLab consultancy operations, which limit its scalability in terms of resource and practicalities. Again, solutions to these limitations are being built into the new Payments platform and the surrounding business model.

PARTNERSHIPS

In order to ensure flexibility and reduce barriers to setting up a service, the FrontlineSMS platform is designed to work without the need for MNO partnerships. The Credit project follows this core design, using mobile networks to operate services and therefore building on MNO offerings rather than working with them directly.

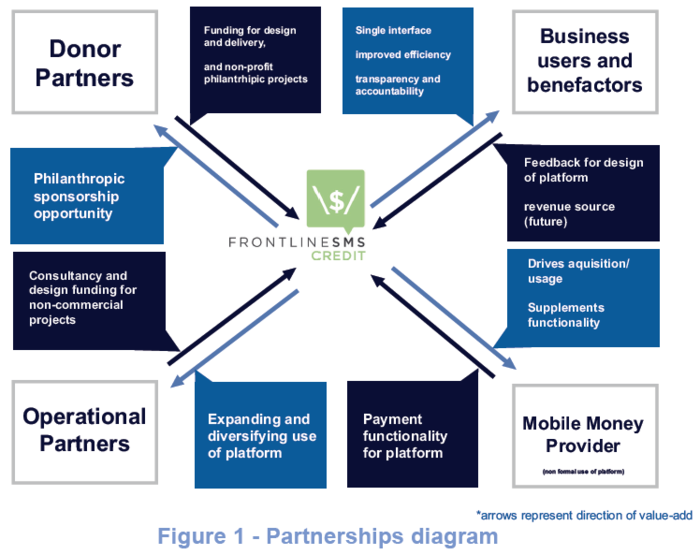

To date, the majority of the the SIMLab Credit project’s work has been enabled by donor funding, and such relationships should be counted as among the key partnerships that make up the project’s operations. Early funding came from the Vodacom Americas Foundation, and the project recently received a grant from the DFID Global Poverty Action Fund Innovation Program to roll out the software with 40 rural organisations – such as SMEs, SACCOs, MFIs and NGOs and schools – in Kenya. SIMLab’s close working partnership with users and the feedback they provide is crucial to the design of the new version of the Payments software platform, the build for which has also been enabled by this grant. Figure 1, below, maps out the different partnerships and their respective incentives for each party.

Figure 1: Partnership Map for SIMLab Credit

CHALLENGES

The monetary savings and improvements in efficiency from engagement with these systems are clear. However, the incentives to adopt them can be diminished by the resource demands placed on business end-users and their beneficiaries, through having to learn and engage with new technological platforms. SIMLab has faced the complexity of this issue throughout the delivery of PaymentView and asserts the importance of communicating the value proposition to end users and assisting them in the learning process in order to reduce barriers to adoption.

In terms of accessibility, many of the end-users of SIMLab Credit and their beneficiaries live in places where M-PESA uptake is not yet universal and where local liquidity (‘rural float’) is a common challenge. In this context, where many users trade using both mobile and cash, difficulties can arise because the current beta of PaymentView doesn’t allow for cash additions into the interface, which instead have to be processed manually. The prototype pilot has helped identify improvements to the software which are being built into the new Payments platform.

However, the main challenges will come when the project moves outside of Kenya to regions with less well-established mobile money sectors, or if the project is successful in expanding beyond traditional mobile money transactions. Here, the main challenge for the project will be in establishing partnerships of similar strength to the current use of M-PESA and its well-established user base in Kenya. However, challenges also exist in more mature mobile money markets, where solutions are readily available and the landscape is more competitive

FUTURE PLANS

SIMLab intends to expand the project’s focus beyond East Africa and into markets such as South America, Southeast Asia and to some extent the Middle East. Proposed solutions to the challenges involved in expanding beyond the Kenyan market include the incorporation of payment aggregators, and connecting with multiple MNOs and encouraging them to have more universal APIs that would be more easily compatible with the project platform. In more competitive landscapes, innovative solutions are key; the project hopes to pilot other types of mobile value exchange such as airtime exchange systems in order to attract mobile money and mobile network operators and gain their cooperation. Through working with the available infrastructure in ‘last-mile’ communities, SIMLab hopes to be able to penetrate more communities who, due to lacking infrastructure, might otherwise be excluded from mobile value transfer and miss out on business expansion opportunities. Such a mobile airtime exchange pilot could begin in a rural community without any mobile money systems, working with local vendors that already sell airtime to encourage them to work with the community to allow for airtime in exchange for cash or goods, helping to move value without the direct use of cash. The system could then be implemented elsewhere, including in more competitive landscapes.

The first users will begin to test the new Payments platform at the beginning of 2015, with the pilot phase continuing through to the end of 2015. Payments will be produced by a for-profit software company in support of SIMLab’s not-for-profit objectives. The two will still remain partnered in their mission, but the split will enable the flexibility of working with technology providers other than FrontilineSMS on the Payments software project. SIMLab hopes to open up the project to new partnerships including with credit, legal and governance bodies, NGOs, large development organisations and software companies.

The new SIMLab Credit Payments platform will be released as beta product in early 2015 with plans to become a fully developed product soon thereafter.

This document was originally produced as part of the former Mobile for Development Impact programme.