This post is co-written with Arunjay Katakam, MMU’s Market Intelligence Analyst.

In Nepal, two 3rd party initiatives are attempting to bring together the banks and offer the tools needed for them to successfully operate mobile money.

The banking sector in Nepal is fragmented with not one bank having double digit market share. This means the banks have limited footprint in the country as they are strong in different areas, and in order to increase their reach in the country they are looking at the mobile channel, particularly to increase their penetration in the unbanked communities. Most banks plan to deliver mobile money products for people currently without bank accounts as only 25% of the adult population (age 15+) have an account at a formal financial institution as per the Global Findex 2011. Given Nepal’s challenging geography, a mobile money offering can efficiently increase financial inclusion in the country.

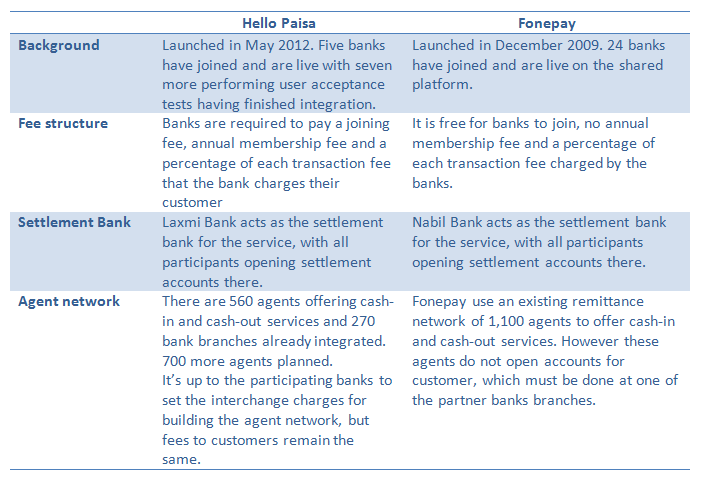

To accommodate the banks’ vision in mobile money and to address their limited footprint, Hello Paisa and Fonepay are offering membership to Banks to connect their mobile money efforts, so that each participant contributes to the development of the mobile money industry. This is a similar role to what Visa played in the credit card market in the early days when US banks were not able to operate across multiple states. The objective is to collaborate around infrastructure and compete in other areas. Having one central platform makes it easy for new banks to join either program and ensures interoperability between the achievements.

Like all industry collaborations, a big challenge is to find the right areas where to compete and where collaborate. As the transactions grow, the agreement framework and how successful they will be in settling disputes and other processes will determine Hello Paisa’s and Fonepay’s success.

Both Hello Paisa and Fonepay have chosen to have one dedicated settlement bank as both schemes have helps to keep down costs, but it also makes the services dependent on one bank’s solidity and availability. For Hello Paisa, the customer facing fees are set by the scheme, and therefore common to all banks, but interchange fees between banks are free to be set by each participant which could create a complex situation.

So far the program seems to be working for sending money, as off-net transactions are 4.5 times more common than on-net transactions. A challenge facing is to design a system that encourages enough investments in building out the agent networks. The current numbers are still small for a country the size of Nepal and an area that needs to grow rapidly to achieve the objectives of financial inclusion.

The model in Nepal is worth following as the industry is looking for models on how best to collaborate and how to achieve interoperability in mobile money.