The GSMA mAgri team started 2018 with the ambitious mission of hosting our first Field Focus Session dedicated to digitising agricultural value chains. The weeklong event took place in Uganda where we brought together 10 mobile operators from across Africa and South Asia and other practitioners from the agricultural sector. The objective was to expose our GSMA members and implementation partners to digital last mile solutions that support the operational needs of agribusinesses and cooperatives and benefit farmers by enabling access to financial services and agri-related information.

Why Uganda?

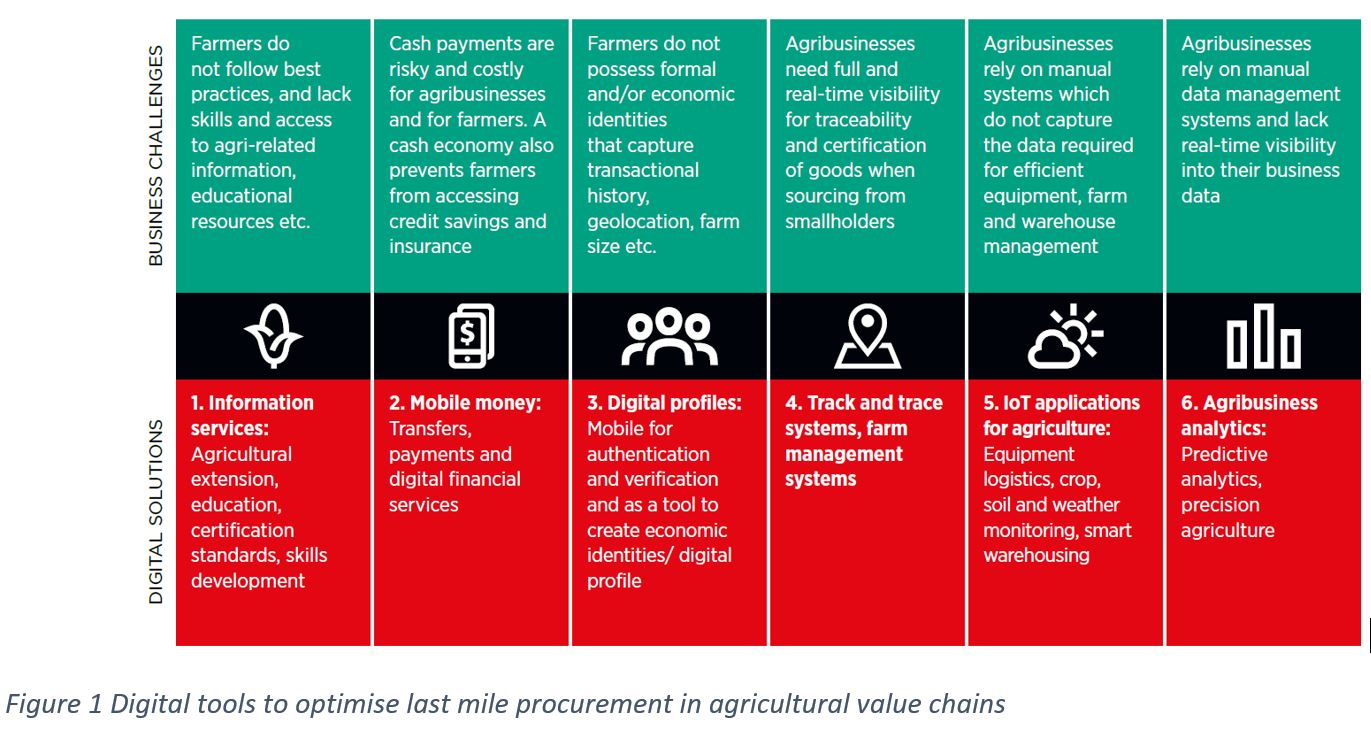

Uganda is home to many value chain digitisation initiatives. Most deployments have, so far, focused on mobile money business-to-person (B2P) payments from agribusinesses to farmers for the procurement of crops. Over the past year, large international agribusinesses buying cash crops from Uganda such as Olam and Neumann Kaffee Gruppe have formed partnerships with supply chain management tech providers for new pilots that seek to optimise procurement in agricultural value chains. Partners in these deployments have been the likes of SAP as well as specialised providers of agricultural sourcing systems such as TruTrade. As explained in recent blog posts, besides digital payments for the procurement of crops, a range of digital tools that enable efficiencies in the agricultural last mile are available in developing countries. In the course of four days, the group travelled nearly 1000 kilometres to visit two deployments that addressed different pain points of the last mile sourcing. In this blog post, we share some of their strengths and more broadly, look at how mobile-enabled tools can address of the last mile procurement (Figure 1).

Ibero and Field Buzz: Creating digital profiles and ‘track and trace systems’ to increase efficiency in coffee supply chain

In Mityana, central Uganda, we visited Ibero Uganda Ltd, the local exporter of the world´s largest coffee trading group, Neumann Kaffee Gruppe. Ibero is digitising farmer records and disbursing both fertiliser and micro mobile money loans to farmers, both of which are paid back through coffee deliveries during the harvest season (or through mobile money as well). The exporter launched its Farmer Financing Unit (FFU) in February 2017. The company has been working with Field Buzz*, a technology provider based in Germany and Bangladesh, to develop software that collects farmers’ data and tracks loan applications and disbursements as well as coffee deliveries.

Key learnings include:

- Ibero’s commercial objective to increase its supply of coffee production motivated the roll out of the FFU. A prerequisite for the project was the ability to register and collect data from Ibero’s farmer network. While it is still early days (so far Ibero completed two cycles of loans), since the launch of the FFU, the exporter has disbursed over 500 loans.

- The need to increase coffee production is the main reason for the coffee buyer to implement a digital system. However, these lending schemes can also serve to increase the loyalty of suppliers given that typically, in developing countries, there are no contractual agreements binding famers to a specific buyer. In the case of Ibero, the agribusiness found that coffee farmers lacked access to fertiliser inputs. Seeing that the cooperatives could not respond to this need, Ibero partnered with a microfinance consulting company (IPC GmbH) and a crop nutrition company (Yara International) to provide fertiliser advances. Because Ibero does not profit from the loans it offers, it is able to pass on the cost reduction from buying fertiliser in bulk to farmers who in turn benefit from increase in yields and good quality coffee. This outcome provides a strong incentive for farmers to continue working with Ibero and re-apply for loans.

- Field officers use a company smartphone and Field Buzz’s application to register and collect farmers’ data onto a database, issuing a QR-code ID card to each coffee producer. For farmers that remain largely unbanked, the code becomes a form of economic identity, potentially opening the doors to a broader range of financial services (credit, savings, insurance). Moreover, farmers are able to have a digital track record of their income history, which forms the basis of their future creditworthiness.

- Ibero is currently working with a third party mobile money aggregator that enables transactions through the main mobile money providers (MTN and Airtel). As an alternative to this model, there could be exclusive agreements with mobile operators who commit to ensure a reliable agent network distribution and meet liquidity requirements in targeted areas at the time of agricultural payments. In the case of using an aggregator, a ‘preferred network’ partnership model with a specific mobile operator may still be required to ensure liquidity when farmers cash out.

SmartMoney: Fostering a cashless and transparent digital payment ecosystem

After Mityana, we made our way to Kasese in Western Uganda, where the group visited SmartMoney, a mobile money provider offering mobile-based savings and payment services designed specifically for rural customers. The group interacted with a variety of stakeholders (merchants, schools, agribusinesses, farmers, cooperatives) who are supporting a local digital payments ecosystem.

Key learnings include:

- Strong education and dedicated training capacity for every stakeholder group involved is the foundation of a functioning cashless economy. SmartMoney has heavily invested in training materials, and door-to-door education, including the use of ambassadors such as famer cooperative leaders promoting the service, to sensitise and on-board users. While time-consuming, this kind of below-the line marketing generates trust in the service and can result in further benefits such as ‘word of mouth’ recommendations.

- Providing a channel for digital payments is not enough, service providers need to focus on creating relevant use-cases for rural users. Originally, SmartMoney was an agricultural payment solution for agribusinesses but the company quickly realised it needed to spend more time understanding the needs of farmers. As SmartMoney realised that farmers use the mobile wallet to store value (savings) and to make low value payments within their community, it completely re-thought its value proposition and charging model.

- SmartMoney developed a ‘zero fee’ pricing to end-users (e.g. farmers, shoppers, merchants) for deposits, withdrawals and person-to-person transactions, sustained by revenue generated from transaction fees charged to enterprise and institutional customers (e.g. agribusinesses, cooperatives, schools, churches) for sending money. This allows digital money to compete with cash for low-value digital transactions (e.g. paying school fees and medical expenses, buying food and household items).

- To counter the liquidity challenges, the company relies on a community exchange model where anyone can be a SmartMoney agent. Because there are no agent commissions, any account owner can make withdrawals and exchange digital cash to ‘real’ cash and vice versa. SmartMoney has developed and field-tested repeatable training and servicing methods to overcome the operational and logistical challenges that come with scale. Overall, their solution illustrates the need for mobile operators to think ‘outside the box’ and challenge traditional operations of mobile money in rural communities.

Our Field Focus Sessions are an opportunity to experience first-hand agricultural value chain digitisation initiatives and to build relationships and partnerships between mobile operators, technology enablers and agribusinesses with the support of the GSMA mAgri programme. If you would like to find out more, visit our webpage on last mile agricultural value chain digitisation or contact us.

*Field Buzz is part of the GSMA Ecosystem Accelerator Innovation Fund portfolio. You can learn more here.

This project was funded with UK aid from the British people.