In an earlier post I outlined the importance of the MNO’s c-level mandate for the product innovation needed to develop mAgri services. One of the tallest hurdles to gaining that c-level mandate is proving the business case and presenting mAgri as a compelling investment opportunity. This blog post attempts to outline how targeting unique subscribers could be a strong or leading element of a compelling mAgri business case. Future blog posts will introduce other core elements of the business case such as churn reduction, increasing SIM stickiness and converting over-the-counter (OTC) mobile money users into mobile wallet-based customers.

Late last year, GSMA Intelligence published a short piece entitled “Measuring mobile penetration” which explains the meaning and relevancy of unique subscriber penetration. Traditionally, MNOs would measure growth by how many connections exist within their network. However, as the trend of multiple SIM ownership becomes more and more prevalent, this measure of connections becomes less and less meaningful as it is a measure of CONNECTIONS, not PEOPLE, or unique subscribers. Further due to an imbalance in urban and rural penetration, the untapped rural opportunity is further less understood.

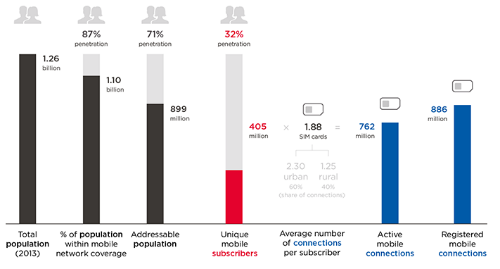

For example, in India, with a population of 1.26B, you’ll find about 886M active mobile connections which many interpret as 70% penetration. However, you might be surprised to hear that only 405M people actually subscribe to mobile services which yields only 32% of the population subscribing to a mobile service. This is the difference between CONNECTIONS and PEOPLE.

Investigating the numbers further we can define India’s addressable market for mobile subscribers to be approximately 778M (those above the age of 14 and within mobile network coverage area). This yields an untapped addressable market of 373M (405M are already on network).

The picture is pretty similar throughout the region. India, Pakistan and Bangladesh, for example, have a combined population of over 1.6 billion, but a unique subscriber penetration rate of only 36% on average. On the other hand, India’s BRIC peers are slightly ahead with Brazil, Russia and China having unique subscriber penetration rates of 56, 76 and 46% respectively.

Figure 1 – Defining mobile penetration in India: population, subscribers and connections, GSMA Intelligence

Now that we recognize this untapped market of 373M Indian people exists, we can begin to explore who they are and why they’ve not yet adopted mobile services. According to TRAI (Telecommunications Regulatory Authority of India) and GSMA Intelligence, urban markets are saturated leaving the vast majority of the untapped market in the rural areas many of whom live on less than $2 a day. World Bank data reveals 68% of India’s population resides in rural areas and tend to depend on farming and agriculture for their livelihood.

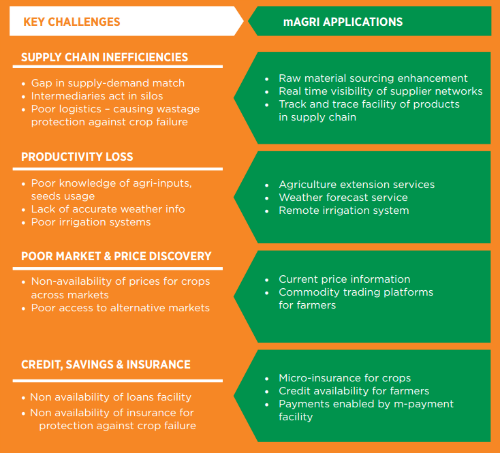

If we want to tackle this market, the next question to ask is why they haven’t taken up mobile services yet – this is the trickiest piece of the puzzle. A variety of reasons exist like network coverage and price. A 20$ handset plus airtime is pretty expensive for poor farmers. It is especially expensive when the total cost is compared to the value farmers receive from it. What I’m suggesting here is that maybe farmers do not have reasons enough to invest in a mobile device. There are not enough relevant use cases or apps for farmers. The basic services (SMS and voice) aren’t compelling enough (or they would be on the network by now). The use case for leisurely phone use we enjoy simply does not exist in the world of poor rural farmers. However, if that handset can provide access to services which can improve their agriculture productivity and income, then we’re talking about the handset as a capital investment. The GSMA Mobile Economy India Report for 2013 outlines a few critical use cases:

Figure 2 – mAgriculture Applications, GSMA Intelligence

In spite of the success we’ve seen from existing MNOs and Agri VAS operators, they’re still operating in the context of a largely untapped market. These services have scaled, however relative to India, they are certainly failing to reach the full potential of the market. Without a wider range of compelling use cases and value propositions, this segment will remain untapped. Unique Subscriber Penetration is a game changer by a significant factor and is one of the exciting hypothesis we’ll be testing via the mAgri Challenge Fund.