Most of his life as a farmer, Jaipal has relied on the advice of his peers, often elder and more experienced farmers, when making decisions about how to cultivate crops. Although peer advice allowed him to establish a successful farm by the age of 27 where he grows sugar cane, mustard, wheat and potatoes, Jaipal still found himself unprepared for the situations of fierce bargaining with a trader, making risky decisions about growing new unfamiliar crops and trying to mitigate harmful pests and diseases that could ruin his harvest – the main source of income for the family.

Just like many other small-holder farmers in India, Jaipal has a mobile phone and could easily dial a short number to access mKisan, an interactive voice response (IVR) advisory service for farmers. What makes Jaipal different from other farmers is that he knows about the mKisan service and uses it on a regular basis to learn about all those things he wouldn’t ask his peers, such as improved crop varieties, management techniques for new crops he is interested in, application of chemicals, current market prices, weather forecast and available subsidies for farmers.

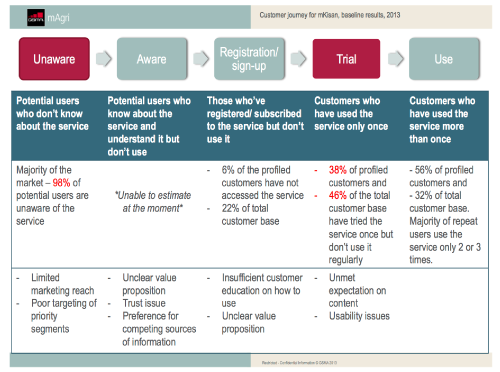

More than 300,000 users across six Indian states have already accessed the mKisan service since its launch in late 2012. However, not all of them have become regular users like Jaipal – some have subscribed but haven’t accessed the IVR component of the service (have not dialled the IVR although have been receiving short tips by SMS), and others have tried the service only once and don’t intend to dial back again. Although mKisan can deliver actionable and valuable information to smallholders, the vast majority of the potential market for this service (99% of the total market) is still untapped. So how can a service like mKisan maximise its impact within agricultural sector of India, and what are bottlenecks for delivering the valuable information to small-holders via mobile? We have used information from the baseline study for the mKisan service performed on a random sample of 1,000 users, combined with usage records, to better understand the service’s userbase, map out the customer journey and identify possible areas for improvement.

Baseline profiling suggests that:

- The majority of customers are male farmers, with women representing only 11% of the userbase – this is a modest share compared with similar services in East Africa where women represent a third of the userbase.

- About 20% of the users fall below the international poverty line of USD1.25 per person a day, which is likely due to a lower ability to pay for the premium services (above the network rate) and lower availability of handsets within the segment of poor smallholder farmers.

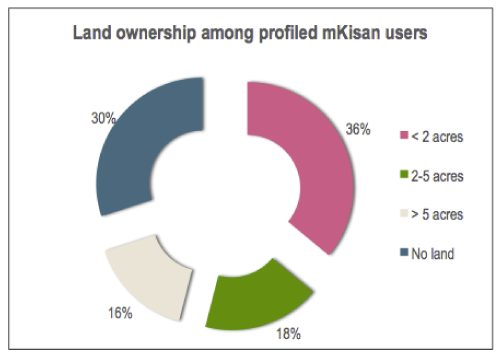

- The majority of profiled users own less than 5 hectares of land or are landless (some of the users without land turned out to be students or traders).

- The majority of profiled mKisan customers are young – 59% of sampled users are below the age of 25 years. The median age is 24 years, suggesting a slightly younger age profile than the national population (median age of 26.5 years). Just over a quarter (27%) of the users profiled are above 30 years old. This finding suggests that early adopters of mobile agriculture services come from younger generations of farmers.

So how are these users interacting with the mKisan service, what are their expectations and information needs and why don’t they all become regular users like Jaipal? We’ve found that although farmers could benefit from the service by making better informed decisions, whether choosing the right time for planting, selecting appropriate seed variety or negotiating a better price with the trader, there are still a number of bottlenecks on their journey from being a potential customer to becoming a regular user of mobile advisory services. We have mapped out the bottlenecks along the customer journey with an estimate for the percentage of customers ‘stuck’ at each stage and possible reasons for each of the bottleneck to exist. Two prominent bottlenecks are – a basic unawareness of the potential customers about the service and its value proposition due to the lack of significant marketing and – a ‘trial’ stage, when after initial trial customers do not come back to the service.

A few of the bottlenecks discovered could be offset by more targeted marketing with focus on priority customer segments such as poor small-holder farmers and women farmers. One of the proven marketing channels for reaching the BOP is establishing the on-the-ground distribution network of agents who would educate the customer on the value proposition of the service and demonstrate how to use mKisan. Unlike mobile operators, an independent VAS provider like Handygo has limited capacity for above-the-line marketing, struggles with branding and doesn’t have a distribution network/ agent network to leverage and relies on promotional SMS messaging and rare agricultural fairs to promote the service. mKisan has a strong need for distribution partners, such as cooperatives, NGOs, agricultural input dealers and other networks. If partnered with a distribution network with a good reputation and a recognised name/brand among farming population, mKisan could also mitigate the trust issue.

Understanding the usage patterns and expectations of the users should also become a basis for the key marketing messaging. Usage data suggests that customers prefer dynamic or time-sensitive information – requests for weather, market prices and agricultural news take up to 80% of all queries. At the same time, interviews with the users indicate a high demand for information on new types of farming that would allow them to diversify income: “I think that this idea can do well if the service tells the farmers about different crops and different varieties of existing crops. Most of the new crops are not done by farmers as they are worried about the issues like pests with the experimented crops.” (quote from a user) It’s important to communicate the value proposition to the farmers by featuring the most valuable information, but also help them discover parts of the service that meet their less immediate but long-term needs such as innovative farming technologies.

We will soon publish the executive summary of a baseline report for Handygo that explores each of the bottlenecks in more detail and outlines the usage behavior, demographics of the customer base in higher detail and provides insights into customer expectations, so stay tuned! Meanwhile, we welcome your comments on our findings and would happy to share our M&E framework and tools for mobile agriculture information services.

Contact us by emailing [email protected] (or leave a comment to this blog).