In the past few weeks Vodafone has been very active in the mobile agriculture space. In May, the operator published the Connected Farming in India report with the support of Vodafone Foundation and Accenture. The study draws on the experiences of successful mAgri services in different parts of the world to assess the opportunity for mobile agriculture in India, by far the largest market for Vodafone. At the same time of the report publication, the operator announced the adoption of the Farmers’ Club, as a new brand and social business model for mobile agriculture, and its expansion from Turkey, where it first started in 2009, to India, Ghana, Kenya, and Tanzania.

These latest initiatives drive forward the operator’s global strategy for mobile agriculture, which was first outlined in 2011 with the Connected Agriculture report. Importantly, they show the increasing focus that the operator is putting on the rural segment to drive future growth. In addition, Vodafone’s statement on mobile agriculture highlights the role of mAgri services to generate important indirect business benefits, such as increased customer loyalty and brand awareness. It is evident that experimenting with social business models that have the potential to transform the lives and livelihoods of smallholder farmers is much more than a CSR effort.

As outlined in the Connected Farming report, in the four years since 2011 mobile agriculture services have expanded remarkably. Vodafone states that if rolled out at scale, the mAgri services described in the report – information services for the farming community, receipt services for agriculture supply chains, payments and loans, field audit services, services enabling transactions between smallholders and agri businesses and rich media services – could reach a potential market of 69 million users in India in 2020. Furthermore, the benefits generated by these services could bring $9 billion in additional income for farmers annually.

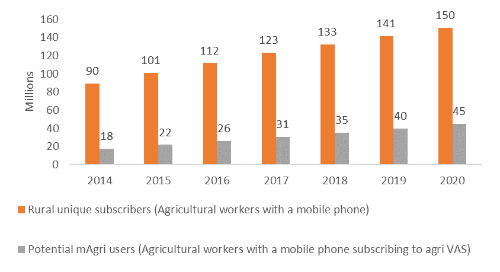

These are impressive numbers, showing the full extent of the opportunity to drive rural growth with mAgri services. As outlined in our recent blogpost about the role of mAgri for unique subscriber penetration, rural growth can only be achieved if operators are able to offer, besides pure communication services (voice and SMS), services that offer potential to improve agriculture productivity and income for rural communities. In spite of the impressive figures we have seen in India from existing operators and VAS providers, such as Bharti Airtel’s Green SIM service (1.3 million users) and Reuters Market Light (1.4 million users), the size of the untapped market, as highlighted by Vodafone, is huge. In our own GSMA forecast we estimate the potential base for agri VAS users– therefore including only subscribers to information services, such as weather and market price updates and agronomy information – at 45 million in India in 2020. In growth terms, we expect mAgri users compound annual growth rate (CAGR) in 2016-2020 to be as high as 15%, almost double the overall growth in rural unique subscribers (8% CAGR in 2016-2020).

Figure 1: Estimated users of agri VAS in India to 2020, GSMA Intelligence

Figure 1: Estimated users of agri VAS in India to 2020, GSMA Intelligence

The adoption of the Farmers’ Club brand, together with the adoption of the same social business model approach for multiple markets, is for Vodafone a key element in the effort to scale services, boost its position in local markets, and help create new opportunities for smallholder farmers. Building on the success of the Farmers’ Club in Turkey, which we have analyzed in a recent case study, Vodafone has embarked on a group-level effort to extend the service to other countries. Specific Farmers’ Club services offered in each country will vary, and will include information services, virtual marketplaces in which farmers can sell their product, and mobile financial services (MFS).

In Turkey, where the Farmers’ Club has been available for six years, the number of active users has reached 900,000+. Vodafone highlights that the service has been instrumental in decreasing monthly churn in the rural subscriber base. The operator estimates that Farmers’ Club members’ churn rate is on average 23% lower than the rate of the total customer base. Besides churn, the other main business KPI is brand awareness measured by Top-of-mind awareness (TOMA) surveys. In the most recent TOMA survey, brand awareness among Farmers’ Club members was 16% higher than awareness across the whole Vodafone Turkey GSM base.

Besides Turkey, the Farmer’s Club is now a live service in Ghana, where it was launched in June with the support of the GSMA under the mNutrition initiative, and in partnership with local VAS provider Esoko. It is also available in Tanzania (Vodacom Kilimo Club), where the operator has offered for some time, with the support of USAID and TechnoServe, the Connected Farmer agriculture value chain platform, which comprises farming advice, market price information and mobile money capabilities for transactions. In 2016, the Farmers’ Club will be extended to Kenya and eventually to India. Looking ahead, with many new initiatives planned, it will be interesting to see to what extent Vodafone will be able to replicate the success it has seen in Turkey. Without a doubt, we believe that a key to success will be the ability to extend the service portfolio to mobile money enabled financial services tailored to the needs of smallholder farmers.

Vodafone’s recent initiatives are encouraging steps to show the full extent to which the mobile channel is a key tool to improving the livelihoods of rural communities across emerging markets. The Connected Farming report has also the merit of showing the potential of mobile agriculture as a growth opportunity for operators. The opportunity is not confined to simply growing mobile penetration in rural areas, but extends to opening to new possibilities in mobile money and data services. The internationalization of the Farmers’ Club, as a bundle for the rural segment that incorporates information, market access and financial inclusion services, is a bold yet very promising initiative as the operator seeks to implement its vision globally.