Tax policy and digital development are closely linked. High taxation contributes to the cost of mobile services and can make usage and access unaffordable, particularly for poorer citizens. It also reduces the financial ability of operators to invest in infrastructure that can be crucial to develop a country’s digital footprint. Colombia recently passed a fiscal reform that saw VAT levels rising from 16% to 19% and introduced a new excise duty on consumption of mobile data. Despite this challenging fiscal background, however, the government also introduced a VAT exemption for handsets that cost less than 654,000 Colombian pesos (around $227) recognising the prevailing affordability concerns for the bottom of the economic pyramid. This exemption will make it easier for lower income citizens to take the first step towards accessing the internet, by purchasing a low- or mid-range smartphone.

This move follows the abolishment of a 1.2% luxury tax that was previously imposed on handset sales in Colombia. Similar changes have also been observed in other countries. For example, in 2009, Kenya exempted mobile handsets from VAT. In the three following years, the VAT reduction was followed by an increase in handset sales of 200% and penetration increased from 50% to 70% between 2009 and 2011, above the 63% average across Africa. Prior to 2015, Bangladesh replaced a 1% surcharge on handsets with a fixed fee of 100 BDT, while in Argentina luxury tax on handsets was decreased from 25.2% to 20.5%.

However, like many developing countries, Colombia is facing a challenging macroeconomic environment raising the government’s revenue needs. With the country’s debt credit rating just above speculative levels, the government may look to use fiscal reform in order to avoid any downgrades. Government revenues have been suffering lately due to falling oil and coal prices while, at the same time, a significant part of government debt matured in 2016, taking a toll on fiscal accounts. These developments led Finance Minister Mauricio Cardenas to commit to a ‘path of fiscal adjustment’ in early 2016 which materialised in a tax reform increasing VAT across the economy and introducing a mobile-specific tax, among other measures.

The main feature of the reform was an increase in VAT from 16% to 19%, affecting the consumption of mobile services and the purchasing of mobile devices. Additionally, a 4% surcharge for mobile data plans above 47,789 Colombian pesos (around $16.6) has also been introduced. This surcharge comes along an already existent 4% surcharge that applied to voice services. As a result, consumers of mobile services will face higher prices and, particularly so, those who consume data above the price limit. Moreover, consumers purchasing non-basic smartphones, will also be facing higher prices to obtain a device. Affordability barriers will increase and will likely drive down both usage and the uptake of mobile services.

The reform introduces a clear contradiction as it encourages ownership, for the bottom of the economic pyramid, but at the same time it “penalises” consumption through the increased VAT rate and introduction of a special surcharge. Unlike fixed line services, where some low income consumers are shielded from the VAT increase for certain levels of usage, there is no such protection embedded for low income users of mobile services.

The increase in VAT from 16% to 19% applies economy-wide and is expected to raise around $2 billion, a sizeable portion of government revenues which now stand at around $53 billion. The impact on mobile would be an increased VAT contribution by more than $150 million from a current contribution of $1.36 billion. Considering the monetary impact of the telecom-specific reforms, GSMA estimates that a maximum of $60 million will be imposed from the new excise tax on data (impoconsumo 4%) while a maximum of around 83$ million would be saved from the VAT exemption on smartphones of less than 220$ in value.

While the mobile-specific measures in question appear to leave an overall positive monetary footprint, discriminatory taxation can have several unwanted implications. Discriminatory taxation of the mobile sector in Colombia can exacerbate the affordability barrier and prevent access to the mobile internet for many. A 2016 GSMA/Deloitte report finds that the benefits of connectivity were not enjoyed by around one third of the Colombian population, excluding several people from access to life changing mobile services and impeding the development of a digital society. Promoting connectivity would both facilitate exchanges across the wider economy and boost the sector’s contribution to government tax revenue.

As part of this reform, the Colombian government targeted the highly contentious issue of over the top (OTT) providers’ taxation. Colombia is one of the first countries to address the issue and to introduce a tax targeting such entities which, in most cases, have an offshore basis and are thus difficult to tax. The solution devised by the government was to circumvent the challenge of taxing offshore entities and, instead, to target the payment process directly. This was achieved by requiring banks processing card payments for digital services to collect any tax due before the payment reaches the beneficiary. Effectively, this applies the newly introduced 19% VAT to OTTs that were previously unaffected by VAT. Introducing this type of payment requirement contributes to a more level playing field for all parts of the mobile ecosystem.

Higher taxation on mobile services compared to other sectors, was identified as a risk of limiting connectivity for the poorest Colombians in the report by GSMA/Deloitte. For example, the 4% Consumption Tax on voice services, applying on top of the standard VAT rate drives up prices for mobile services, making them less affordable and restricting digital inclusion. The new reforms also impose this affordability barrier on the consumption of data above the $16.6 monthly threshold. The OECD is opposed to such “luxury” taxes on the sector in its recent assessment of Colombia’s telecommunication policy.

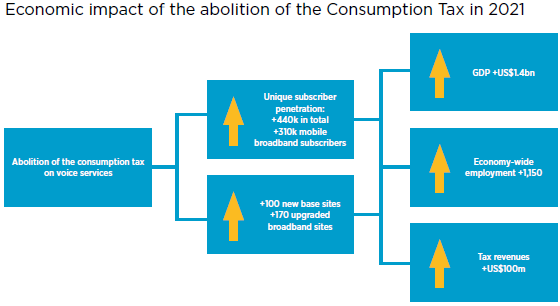

Deloitte estimates that removing the Consumption Tax could increase the affordability of mobile services and spur digital inclusion for the poorest Colombians. Over a five-year period after the reform, an estimated 440,000 new unique subscribers would contribute to increased economic growth of $1.4 billion in Colombia’s GDP. The boost in economic growth would also create more than 1,100 new jobs and would result in an increase of overall tax contributions by around $100 million.

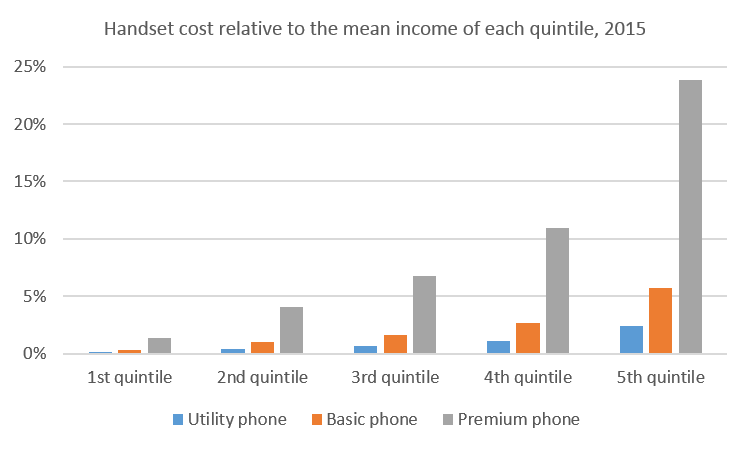

The report illustrated the severity of the affordability issue for the poorest Colombians. For the poorest 20% of Colombians, the cost of a basic smartphone represents 6% of the annual income of the poorest quintile while a premium smartphone represents approximately 24% of income.

The introduced VAT exemption will make basic smartphones more accessible and will enable more people to connect to the mobile internet, allowing them to reap the benefits of digital inclusion. Despite Colombia’s fiscal challenges necessitating some negative tax measures, the VAT exemption highlights the government’s recognition of the affordability issue facing its poorest citizens.