The GSMA Mobile for Development (M4D) Utilities Programme was pleased to join over 3,300 water and sanitation professionals from 130 countries at World Water Week in Stockholm from 25 – 30 August. We hosted a session on, ‘Scaling mobile-enabled water and sanitation models for inclusion’, featuring several M4D Utilities Innovation Fund grantees that are leveraging mobile technology to unlock more affordable and reliable water and sanitation services. In this blog, we share some key take-aways from World Water Week, and highlight why we are excited about the future of digitally-enabled water and sanitation services.

Senior Market Engagement Director Ilana Cohen moderates a panel featuring M4D Utilities Innovation Fund grantees – KCCA, CityTaps, Safe Water Network and Loowatt

Mobile solutions are becoming integral to water and sanitation service delivery

A welcome takeaway from this year’s World Water Week was that discussions about digital solutions in water and sanitation shifted from theory to practical examples. Several water and sanitation sector providers emphasised that digital solutions play a key role in their journey to scale, while investors and donors stressed how they make service delivery models more sustainable across a range of different use cases. In this context, we were pleased to launch our first quarterly Mobile for Development Utilities Perspective, a report which focuses on the digitisation of water utilities in Africa and Asia.

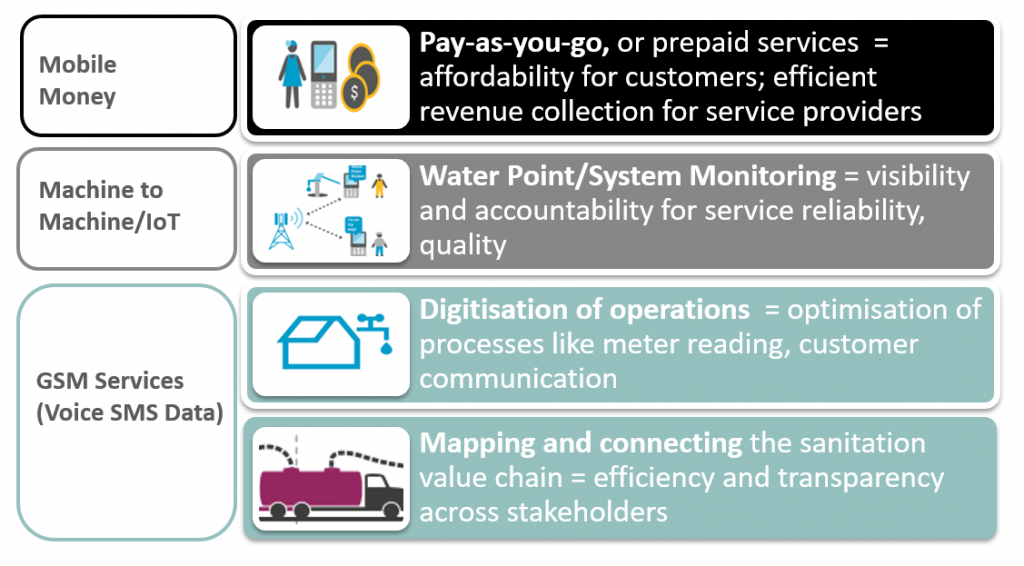

In our panel session, which featured Grégoire Landel, from CityTaps, Charles Yeboah from Safe Water Network, Mary Roach from Loowatt, and Dr. Najib Lukooya Bateganya from Kampala City Authority, we focused on the role mobile-enabled innovations play in service optimisation and scale (see Figure below). In the water sector, real time monitoring and control of water services, combined with mobile money, are essential to offering a scalable and sustainable prepaid service. In the sanitation sector, several service providers are starting to see benefits from mobile apps that use GIS to optimise the logistics of collection, transport and treatment of faecal sludge. In all of these models, and particularly sanitation, the cost savings from mobile is vital to scale.

Small water and sanitation enterprises are joining forces to scale

Acquiring access to technical platforms, market insights, or appropriate hardware can be a costly undertaking for small enterprises operating in the water and sanitation sector, which is generally defined by very low profit margins. Instead of investing in some of these assets individually, several water and sanitation service providers are joining forces to share the costs by creating shared platforms and jointly establishing best practices.

In the water sector, this is best exemplified by Safe Water Enterprises (SWE), a coalition of donors and decentralised water service providers that provide metered, pre-paid services (via kiosk or household connections). SWE not only seeks to establish best practices in the sector but is also collaborating to create a knowledge base for the continued growth of the sector on questions such as the demand for safely-managed water among low-income consumers, or the efficiency of aspirational marketing campaigns.

In the sanitation sector, the Container Based Sanitation Alliance (CBSA) represents service providers from Ghana (Clean Team), Kenya (Sanivation and Sanergy), Haiti (SOIL), Madagascar (Loowatt), and Peru (X-Runner). In November 2017, CBSA received a grant from the M4D Utilities Innovation Fund to develop a mobile application and web-based platform (VeriSan) to support agent logistics and customer management for household sanitation services across multiple countries. With multiple CBSA members scaling, CBS is increasingly seen as a legitimate option for municipal governments seeking to extend safely managed sanitation services to the urban poor:

- Sanergy, in Nairobi, Kenya, has safely collected and treated over 70,000 tons of waste, and provides access to safe sanitation to over 116,000 urban residents (see Figure below);

- Sanivation, in Nakuru, Kenya just announced plans for Kenya’s first city-wide faecal sludge treatment plant serving over 300,000 people.; and

- Loowatt is not only expanding operations in Antanarivo, Madagascar, but is also replicating (and now scaling) its innovative service delivery model in partnership with Laguna Water Utility in Manila, the Philippines, following a successful pilot.

By collaborating on web-based tools, adapting their business models based on new insights, and providing transparency to donors, government, and investors, CBSA and SWE are ensuring that service providers reaching the underserved can scale.

Financing – How can public and donor funding most effectively catalyse innovation and inclusion in the water and sanitation sector?

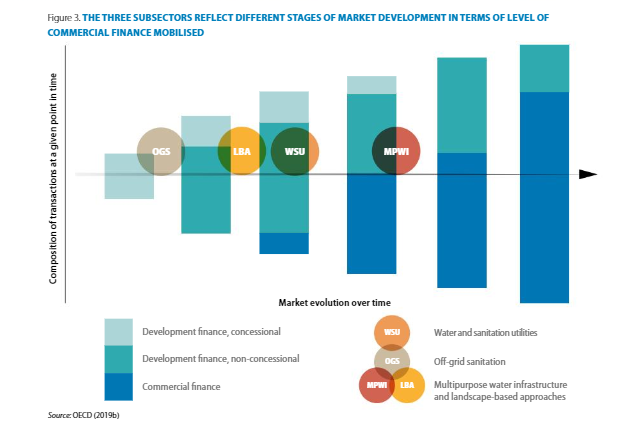

Achieving the goal of safely managed access to water and sanitation for all by 2030 will require more public investment and donor support in the sector, but the sector will also have to attract more commercial financing (see Figure below). According to a newly released report by the OECD, the annual investment needed to meet SDG 6 is $114 billion from now until 2030.

Source: OECD (2019)

This poses a few questions to define the most appropriate role for public and development finance in the water and sanitation sectors:

- Should the primary role of public finance be to provide seed funding to disruptive innovations in the sector? As stressed by economist Maria Mazzucato and others, disruptive innovations have required public funding at early stage before reaching the scale and maturity required to become commercially viable. Several high-risk technologies such as Artificial Intelligence (AI) or the Internet of Things (IoT) have the potential to add value to the sector, but use cases are still being piloted, particularly in low-income settings, and thus require public support.

- Should development finance institutions focus on de-risking private investment? By providing credit lines, guarantees, or by co-investing, development finance institutions can make commercial investments in water and sanitation more viable. The amount of commercial finance mobilised by blended finance for water and sanitation is limited compared to sectors such as energy or construction, but this could change as the sector works together to learn lessons in scale and financial sustainability. IW+, a new initiative by water service providers and donors, seeks to de-risk private investment by facilitating the replication of proven use cases through equipment leasing and digital payments.

- Should public finance focus on subsidising access to water and sanitation for those at the bottom of the pyramid, which tend to have a low willingness or ability to pay for service delivery? According to a World Bank report released at World Water Week, excluding China and India, global subsidies to the water and sanitation sector are estimated at around $289 – $353 billion per year, or 0.5 per cent of these countries’ combined GDP. If only low- and middle-income economies are considered, that figure rises to between 1.5 and 2 per cent! And yet, across the 10 low and middle-income countries the report examined: 56 per cent of subsidies benefit the top 20 per cent of the population, while only six per cent of subsidies benefit the bottom 20 per cent. Though shocking, it is not entirely surprising since subsidies are currently designed to benefit those that are already connected to formal piped water and sanitation services (i.e. the rich and upper middle classes). There is tremendous scope to find innovative ways to make subsidies in the sector more targeted and smarter, to ensure that they enable wider sector reform ambitions.

- Should public finance focus on rewarding private service providers that are operating in last-mile contexts with performance-based subsidies? Results-based financing instruments such as development impact bonds (also known as pay-for-success bonds), where repayment is contingent upon specified social outcomes being achieved, can play an important role in the water and sanitation sector. Small water and sanitation enterprises that use mobile technology are well placed to benefit from such financing as they are becoming increasingly sophisticated at digitally measuring social impact and operational data. At World Water Week, the Toilet Board Coalition stressed, in an interesting session on “a new financing approach to catalyse the circular economy”, impact bonds could help donors meet their goal of extending access to safely managed sanitation to the urban poor, while allowing CBS providers to reach the scale required to make their waste-to-energy, or waste-to-fertiliser production activities commercially viable. Meanwhile, Uptime, a consortium of researchers, donors, and rural water service providers, including our M4D Utilities Innovation Fund grantee, Uduma, recognises that while user payments for rural water services are an important contribution to operational cost-recovery, the full long-term costs of service provision cannot be achieved through local revenues alone in the near-term. To continue to improve financial and operational performance in ‘last mile’ contexts, Uptime seeks to provide real-time operational and impact data to attract results-based financing.

Ultimately, the water and sanitation sector will require a combination of different financing instruments across different contexts, but it is critical for donors and national governments to continuously scrutinise established wisdom, and coordinate to maximise impact.

From our perspective, providing the right financial support to innovative partnerships that exploit synergies between municipalities/centralised utilities and decentralised service providers (as highlighted in this great video on Water ATM provider and M4D Utilities Innovation Fund grantee, Drinkwell) will prove particularly impactful and vital for achieving SDG 6.

We would like to end this blog by thanking SIWI for organising and hosting such an ambitious and wide-ranging conference, and look forward to continue to support and learn from stakeholders in the sector and upcoming World Water Weeks.

The GSMA Mobile for Development (M4D) Utilities programme is funded by the UK Department for International Development (DFID), USAID as part of its commitment to Scaling Off-Grid Energy Grand Challenge for Development and supported by the GSMA and its members.