This is a guest blog by Dr. Sebastian Groh, Managing Director, ME SOLshare, Mobile for Development Utilities Grantee

In September 2015, GSMA awarded the Bangladeshi start-up company ME SOLshare Ltd. (‘SOLshare’) a grant to trial its innovative bottom-up approach to building DC nanogrids, by connecting distributed solar home systems (SHSs). Not only would the nanogrids allow the owners of SHSs to trade energy amongst themselves, but they would enable those who did not own SHSs to join the nanogrid as buyers. SOLshare’s first pilots were recognised by the 2016 Intersolar Award and 2016 UN Momentum for Change Award, along with its partners IDCOL, UBOMUS and the CER/UIU. However, despite its great potential, this innovative concept was slow to take off as it was difficult to find a sufficient number of sites quickly and it became unlikely that SOLshare would achieve the necessary milestones within the grant timeline. Meanwhile, IDCOL officially announced a pilot to test the feasibility of an externally installed PAYG controller on batteries. Read on to find out about what has recently transpired in the world’s largest SHS market.

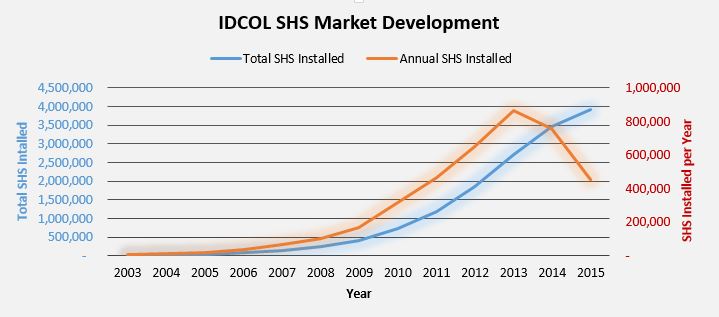

Bangladesh currently hosts the largest SHS market in the world. Over four million SHSs have been distributed since the state-sponsored Infrastructure Development Company Limited (IDCOL) began the its SHS programme in 2003 [IDCOL, 2016]. The market saw steady growth over the first ten years, peaking in 2013 with over 867,000 SHS distributed in a single year. However, strong competition from the unregulated ‘grey’ market, an ageing business model and a lack of consumer needs perception has resulted in the steady decline of annual growth [BNEF, 2016]. Further, it has become increasingly difficult to manage this degree of scale, especially from an institutional perspective.

Figure 1: IDCOL SHS Market Development, Data courtesy of IDCOL, Graph by SOLshare

Simultaneously, the mobile money market in Bangladesh has taken-off, with bKash Limited, Dutch-Bangla Bank’s Rocket, IFIC mobile money, and Sure Cash offering bank-based services. The time is ripe for further growth fuelled by new market entrants.

About a year ago, SOLshare saw the opportunity to bridge the SHS and mobile money sectors by piloting its SOLcontrol system in collaboration with Bright Green Energy Foundation (BGEF), a major Partner Organisation (PO) of IDCOL. SOLcontrol is an electronic battery lock enabling a seamless switch from post-paid to prepaid models, while also improving battery lifetime through smart charging and discharging. To improve payment efficiency, SHS customers pay their instalments by mobile and receive a code by SMS, which they enter through a keypad to unlock the SHS. This approach is fundamentally different from the inbuilt PAYG solutions that are most popular around the world. In Bangladesh, the PAYG controller has to be mechanically compatible with, and able to control, the charging and discharging of a wide range of battery models and capacities already used by SHS vendors in the mature Bangladeshi market. Further, PAYG requires a behavioral change in the market: customers have to accept that their systems will shut off if they do not make their payments on time.

Since the launch of the pilot, SOLshare has partnered with other key POs such as Grameen Shakti and UBOMUS. After six months of piloting, IDCOL has decided to launch PAYG countrywide from 1 March, 2017 onwards, switching the entire sector from post-paid to prepaid. This is a remarkable change to the world’s largest SHS market, requiring a shift in long-standing operations and user behaviour, a daunting task compared to starting in a green-field environment. Nonetheless, IDCOL is determined to find a lasting solution to the recent challenges it has faced. Reactions to IDCOL’s decision range from cautiously optimistic to enthusiastic.

Sohel Ahmed, CEO of Grameen Shakti, said: “The recent sharp decline of SHS installations through the IDCOL programme, for certain reasons that are unlikely to be resolved soon, has left POs with a good number of employees and sizable infrastructure underutilised. On the other hand, as one moves to curtail operations to rationalise expenses, it becomes inefficient to collect dues from the field. It is, in fact, an unplanned and unforeseen exit situation without any exit strategy. Hopefully, the adoption and acceptance of PAYG will help POs to buy some time to alleviate the criticality of the current situation.”

Dipal Barua, Founder and Chairman of the BGEF, stated: “I believe it is the perfect time for Bangladeshi SHS market to move forward with new technologies like Pay-As-You-Go for the SHS. With the help of this new SOLshare technology, online collections such as bKash and DBBL banking are adding strength to the collection process. To sustain the largest solar programme in Bangladesh, I welcome IDCOL’s decision of launching PAYG solution countrywide.”

The opportunity for SOLshare to operate in a new context and to generate interesting lessons led to the GSMA to support the company’s pivot from the original grant objectives and use the remainder of their grant funds to support a PAYG pilot. Thus far, SOLshare is one of only two IDCOL-approved vendors of the PAYG solution, and the support and flexibility of GSMA’s Mobile for Development Utilities grant has been pivotal in achieving this. SOLshare also continues to pursue the deployment of its nanogrids, but without further support from the GSMA.