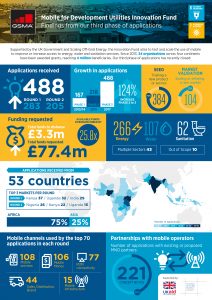

In February and July 2017, we welcomed applications for the third and final phase of our Mobile for Development Utilities (M4D) Innovation Fund. What followed was our most competitive selection process to date, with 488 applicants across the two rounds, a 124 per cent increase in applications since our last round of funding in 2015. Our fund was more than 25 times oversubscribed with applicants requesting a total of £77 Million.

This blog will cover a number of interesting sector trends that emerged from the application pool, which, while not a comprehensive snapshot of the industry, can be considered indicative of broader sector trends toward future innovations. Over the next few days, we will be announcing the first seven organisations selected for our new Innovation Fund portfolio, who will be piloting and scaling their projects across Africa and Asia over the next 18 months. A further two organisations who are part of our first round will be announced at a later date.

About the M4D Utilities Innovation Fund

Supported by the UK Government and the Scaling Off-Grid Energy: A Grand Challenge for Development, our Innovation Fund aims to test and scale the use of mobile to improve or increase access to energy, water and sanitation services. Launched in June 2013, the fund has completed two previous phases of funding and has recently closed its third and final round of applications. So far, grant funds amounting to £6 million have been competitively awarded to 34 organisations across four continents, reaching four million beneficiaries. In this new round of applications we are awarding a further £3.3 million in funding.

Findings from our applications rounds in 2017:

Innovation is spreading beyond East Africa, but patterns remain similar

Geographically Africa continues to dominate in the number of applications (75 per cent), but the focus is broadening beyond East Africa, which has traditionally been the primary hub for digital innovation on the continent. Traditional markets like Kenya, Tanzania and Uganda continued to receive a high number of applications, but new ‘hot spots’ for innovation have begun to emerge in West Africa. Nigeria received the highest number of applications overall in the second round, and an increased number of applications came from Ghana, Senegal and Zambia. In line with previous phases, only 25 per cent of applications were from Asia, similar to the previous two rounds. India received the highest number of applications, followed by Bangladesh and Pakistan.

The use of mobile channels varied geographically between African and Asian applicants. 75 per cent of the top 70 African applications reported using mobile money, while only 56 per cent of the Asian ones did, although this demonstrates a slight growth from 2015, when only 44 per cent of Asian applicants included mobile money. On the other hand 50 per cent of organisations in Asia planned to use M2M connectivity compared to only 41 per cent in Africa. Availability and widespread adoption of M2M technology could explain differences in demand for M2M services between Africa and Asia. A recent report by GSMA Intelligence shows that about half of MNOs in Asia offer M2M services, compared to only a third in Africa. Moreover, Asia accounted for 42 per cent of all M2M connections globally in 2014.

Traditional mobile channels continue to be used but new business models are emerging

Traditional mobile services (voice, SMS, data and USSD) remained the most common mobile technology cited in the applications, with SMS and mobile apps being used almost twice more than the other channels. This trend particularly held true for water and sanitation applications. This reflects the needs of these sectors, as many of the water and sanitation services are aimed at improving existing service delivery through communicating information to multiple stakeholders, building capacity of operators and users and operational management of infrastructure, which often require mobile services to relay information and build accountability.

Mobile payments were a close second, crucial for remote payment collection via mobile money. Yet since the last round of applications, we saw growth in the proposed use of mobile payments for water and sanitation services, in addition to the consistently high use of mobile payments in the energy sector, where mobile money forms the basis of the PAYG solar model. For example, WASH applications proposed to use mobile money for bill-payment collections through water ATM models or rent-to-own schemes for household toilets.

Beyond traditional uses of mobile technology and assets, the fund also saw a diversification in the business models proposed in our application pool. This might be, in part, driven by the fact that in this phase of funding we excluded standard PAYG solar home system models in East Africa, to ensure we continue to support emerging innovation. It has become clear that another key mobile asset that can be leveraged is customer data (with customer consent) for creditworthiness assessments for models that involve perpetual payments, or rent-to-own.

Mobile partnerships are increasing and changing

The applications demonstrated a high demand for partnerships with mobile network operators (MNOs) with 45 per cent (221) of all applications including an existing or proposed partnership with an MNO. We also saw an increased number of mobile-operator led applications, primarily concentrated in the energy sector, but also emerging in water and sanitation. In our first round of selection, we have awarded three mobile-operator led services, our highest number of MNO grantees to date. We are excited to see MNOs embracing the business opportunity behind utility services. These MNO-led grants will test the potential for MNOs to be the driving business entity behind launching and scaling these models, and help us better understand true commercial value these services generate for MNOs.

Check back in the next few days to find out who we selected for our first round of the M4D Utilities Innovation Fund in 2017. Our second round of selections will take place in February 2018.

This initiative is currently funded by the UK Department for International Development (DFID), and supported by the GSMA and its members.