In 2013, we launched the Mobile for Development (M4D) Utilities Innovation Fund to trial and scale the use of mobile to improve or increase access to energy, water and sanitation services. To date, we have awarded Seed and Market Validation grants to 34 organisations in 21 countries. We are publishing a series of blogs and case studies containing the final learnings from the 21 grants in the second phase of our Innovation Fund. Our objective is to develop an evidence-base across mobile-enabled utility solutions that can inform ecosystem players and accelerate the growth of the sector.

Background

Brighterlite Norway AS was awarded a Seed Grant by the M4D Utilities Innovation Fund in May 2015 to launch their solar home systems (SHS) in Myanmar on a pay-as-you-go (PAYG) basis. The aim of the grant was to test the viability and impact of PAYG solar in a mobile greenfield market (referring to PAYG markets beyond East Africa) and to provide off-grid electricity access to low- and middle-income households in urban and peri-urban areas. Ultimately, market conditions led the board to decide to close the business, however, Brighterlight’s experience leads to important industry insights.

Brighterlite was already operating its PAYG solar service in Pakistan. The business model there was based on a fee-for-service model, as customers leased the SHS against a deposit, and made regular fee payments towards usage. Brighterlite was the first to pilot mobile-enabled PAYG solar in Myanmar, a large untapped market where Brighterlite gained first mover advantage. In 2014, only 34 per cent of the population in Myanmar was grid-connected, leaving about 35 million individuals off-grid. Brighterlite’s baseline survey showed that the typical households used kerosene (12 per cent), lead acid batteries (40 per cent) and diesel generators (14 per cent). To carry out the pilot, Brighterlite established a partnership with Telenor Myanmar that leveraged the operator’s assets for payment collection and customer acquisition. Telenor holds the largest share of Myanmar’s mobile market, with 52 per cent of the total market.

Through this partnership, Brighterlite tested the viability of airtime payments for fee collection, as mobile money was not yet available in Myanmar at the time of the pilot. In the future, Brighterlite planned to integrate mobile money payments. Customers could make payments by sending an SMS and having the cost deducted from their airtime credit. The solution integrated a cloud-based service with automated SMS – once a customer paid, a receipt was automatically sent to Brighterlite’s payment server, which noted the number of days of access purchased, and returned an eight digit code to the customer to unlock the SHS. Brighterlite also sought to leverage Telenor’s brand and agent network to boost sales and expand its distribution network.

By December 2016, Brighterlite had met its sales target of 500 units, reaching 2590 direct beneficiaries with clean, reliable energy. The usage of the systems was reportedly high, as the paid usage rate, or per cent of days paid for, amongst Brighterlite’s customers was between 99 per cent and 85 per cent, beyond the level required to break even.

In February 2017, Brighterlite’s board of directors decided to end the company’s operations in Myanmar. The decision was based on a series of factors, including unclear policies regarding subsidies for SHSs in Myanmar. Under the National Electrification Plan (NEP), the Myanmar Department for Rural Development, supported by the World Bank, rolled out a subsidy scheme for off-grid electrification. In January 2017, this scheme was applied to regions in which Brighterlite conducted its commercial operators. These subsidies, which allow customers to purchase SHS at 10 per cent or 20 per cent of the price, had the effect of crowding out the private market for off-grid solar appliances, providing a cheaper alternative for the end user. Brighterlite therefore exited the market.

Despite the closing down of operations, this grant yielded some valuable insights about implementing mobile-enabled PAYG solar in a greenfield market in partnership with a mobile operator, which are covered in this blog. Check back in the next few days to read lessons on the energy profile and consumption of the Brighterlite customers in a further blog.

1. Significant uptake of digital payments in greenfield markets is possible, but some challenges remain on customer education and mobile coverage.

Brighterlite introduced a mobile payment solution in October 2016 allowing customers to make payments via SMS and having the cost deducted from their airtime balance. This solution aimed to reduce the operational cost of cash collection for monthly or weekly payments done by the retailers, and increase the ease of payment for customers.

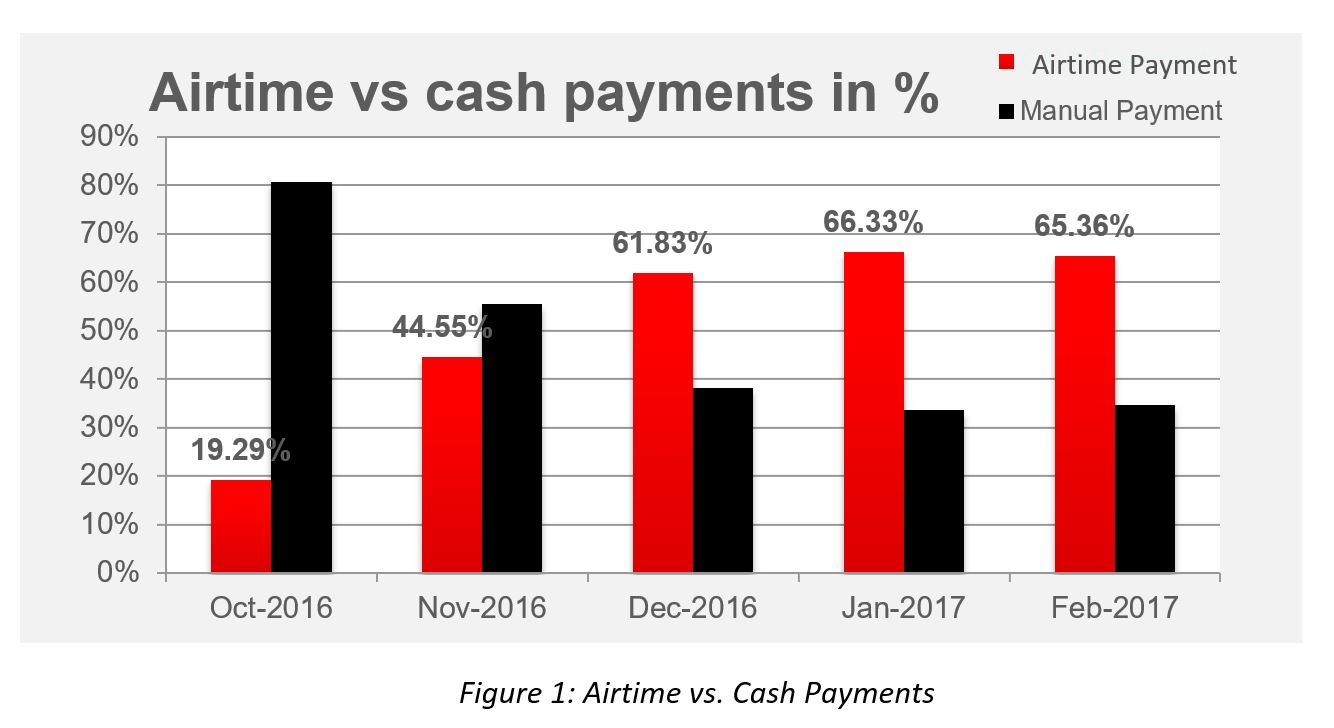

Despite being in a greenfield market for mobile, airtime payments saw a rapid uptake amongst customers, surpassing the number of manual cash payments by December 2016. The share of customers who were using digital payment had reached 65 per cent of payments by February 2017 (Figure 1), when operations were ended by the board. Following this, Brighterlite offered customers the opportunity to purchase the SHSs at a discounted price, and the 71 per cent of customers who bought their system all did so through airtime payment. Satisfaction with the mobile payment service was high, on average rating 8.56 in the endline customer service.

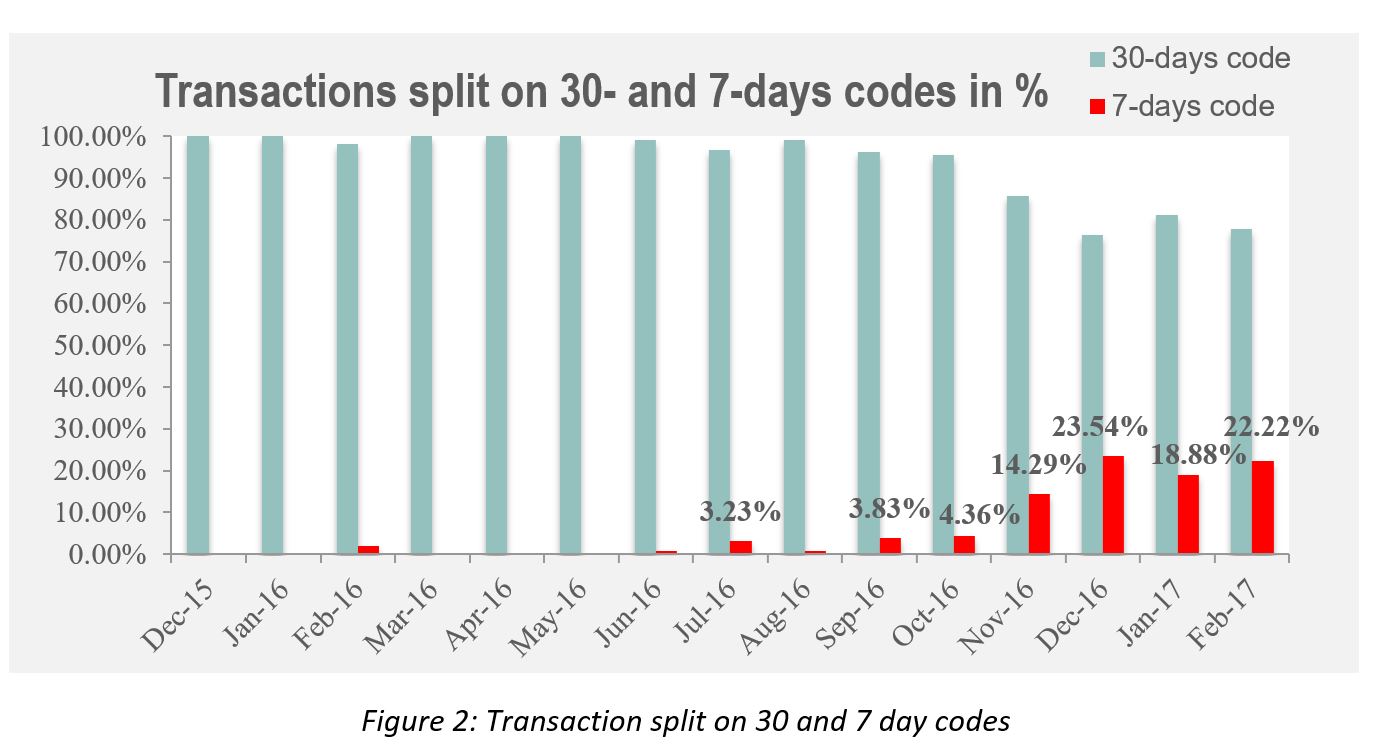

A further interesting finding around the uptake of airtime payments was a significant shift in customer preference for a 7-day top-up of their SHS instead of a 30-day top-up. 7 day codes were introduced to ease customer’s liquidity challenges, but had originally seen low uptake. The split of transactions for 7 day codes increased from 4.36 per cent in October 2016 to 22.22 per cent in February 2017 (Figure 2) and over 90 per cent of the seven day codes were purchased through airtime payment. Airtime payments hence encouraged greater flexibility of payment options for customers, as well as reduced operational costs of collection for Brighterlite.

Brighterlite identified the largest barriers to the uptake of digital payments as knowledge of how to make mobile payments, knowledge of how to use SMS or mobile phones more broadly, and levels of network coverage.

To address the first issue, Brighterlite produced a flyer explaining the process and implemented training through customer service representatives for both field staff and directly for customers. The qualitative analysis on customer adoption found that “customers’ confidence to try out the new technology is the biggest barrier…the basic literacy of technology is also limited… Consumers rely on other people like retailers and the young people of the households”. Brighterlite concluded that more training was needed to further increase uptake, and reduce the number of customers receiving assistance in making the payment. Addressing the second challenge of digital literacy, however, was considered a more difficult and time consuming task outside of Brighterlite’s scope. The third challenge to uptake was low Telenor coverage in some areas of operation. Airtime payment usage levels are higher if areas with practically no Telenor coverage are excluded from the average.

2. Increased availability of phone charging and the use of airtime payments can lead to greater mobile usage.

Brighterlite investigated the hypothesis that SHS would increase their customer’s phone usage based on access to charging. 90.7 per cent of customers reported they now charged their phone directly at home, a 30 per cent increase from the baseline survey, and were making large savings on the cost of phone charging. A customer reported, “ It (Brighterlite’s SHS) costs 170 Kyat (0.13 USD) per day. It takes 200 Kyat (0.16 USD) to charge one phone in the village”. The combination of reliable charge and additional savings could correlate to increased use of voice, SMS and data services.

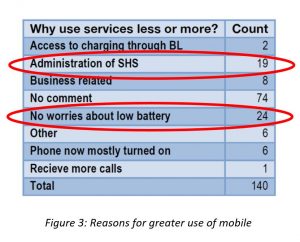

While the majority of customers reported using their phone as much as before, a number reported greater usage levels, in particular on voice and SMS services. 31 per cent of customers reported making or receiving more calls on their phones, and 26 per cent using more SMS services than before having a SHS. Common reasons were lower concerns around battery running low, and use for administration of their solar home system, including making payments (Figure 3).

Telenor data was examined to substantiate these findings and quantify changes in telecom consumption. The data demonstrated only marginal changes in phone services usage in regard to incoming and outgoing, voice and revenue. One significant change was that the percentage of customers using SMS increased by 7 per cent as customers signed up for Brighterlite, likely due to the training on using SMS for digital payments increasing their ability and confidence to use SMS for other purposes as well.

Telenor data was examined to substantiate these findings and quantify changes in telecom consumption. The data demonstrated only marginal changes in phone services usage in regard to incoming and outgoing, voice and revenue. One significant change was that the percentage of customers using SMS increased by 7 per cent as customers signed up for Brighterlite, likely due to the training on using SMS for digital payments increasing their ability and confidence to use SMS for other purposes as well.

3. MNO Partners can be leveraged for their brand and local distribution networks to boost sales.

Brighterlite signed a memorandum of understanding with Telenor Myanmar, which covered payment collection, marketing support, SHS distribution via Telenor’s retail network and guidance on pricing models, commission structures and business practices in Myanmar. Telenor offered Brighterlite valuable soft knowledge on target markets, identifying off-grid areas based on energy consumption of their GSM network.

Brighterlite benefitted from the co-branding of its product with Telenor, involving the use of the Telenor logo and opportunities to appear on Telenor marketing material. The Telenor partnership was used as a sales point in new districts for Brighterlite, relying on Telenor’s trusted brand and its quality ‘stamp of approval’. Qualitative data demonstrates the positive response to the mention of Telenor during a sales pitch, as customers were more likely to have previously heard of Telenor than Brighterlite.

“The link to a well-known, solid, quality brand such as Telenor was helpful for Brighterlite because customers would then infer that Brighterlite is also a solid, quality provider of solar electricity as a service”, said Jorund Buen, Strategic Project Manager of Brighterlite Myanmar.

Brighterlite also sought to leverage Telenor Myanmar’s retail network for the distribution of its SHSs, as cooperating with Telenor’s numerous distributors would reduce the initial cost and risk substantially. However, the cooperation with Telenor’s distributors did not scale up as Brighterlite expanded geographically, mainly because there was too limited overlap between areas already served by Telenor’s distributors and Brighterlite’s strictly off-grid target areas. Brighterlite hence focused on a distribution model based on contractual relationships with local retailers and franchisees, which distributed the Brighterlite product in exchange for a commission.

Replicating PAYG services in Greenfield markets, particularly where digital payment systems are in their infancy, can be challenging. Partnerships with mobile operators can facilitate deployments by quick mobile money integration and in some cases branding, marketing and distribution.

Monitoring and evaluation methodology and design were provided by Alexandra Tyers from Tyers Consulting, and the qualitative survey was conducted by Kantar TNS, an independent research agency.

This initiative is currently funded by the UK Department for International Development (DFID), and supported by the GSMA and its members.