At GSMA mAgri, we are working with mobile operators to realise the opportunity to digitise agricultural value chains. The use of mobile phones in the so-called agricultural last mile – the final link in agricultural value chains between the buyers of crops and the smallholder producers – can unleash huge efficiencies.

Mobile phones allow farmers to access essential information (agricultural extension, information on certification standards, resources on skills development), support the creation of digital records for farmers and agribusinesses, and crucially enable digital payments for the procurement of crops via mobile money.

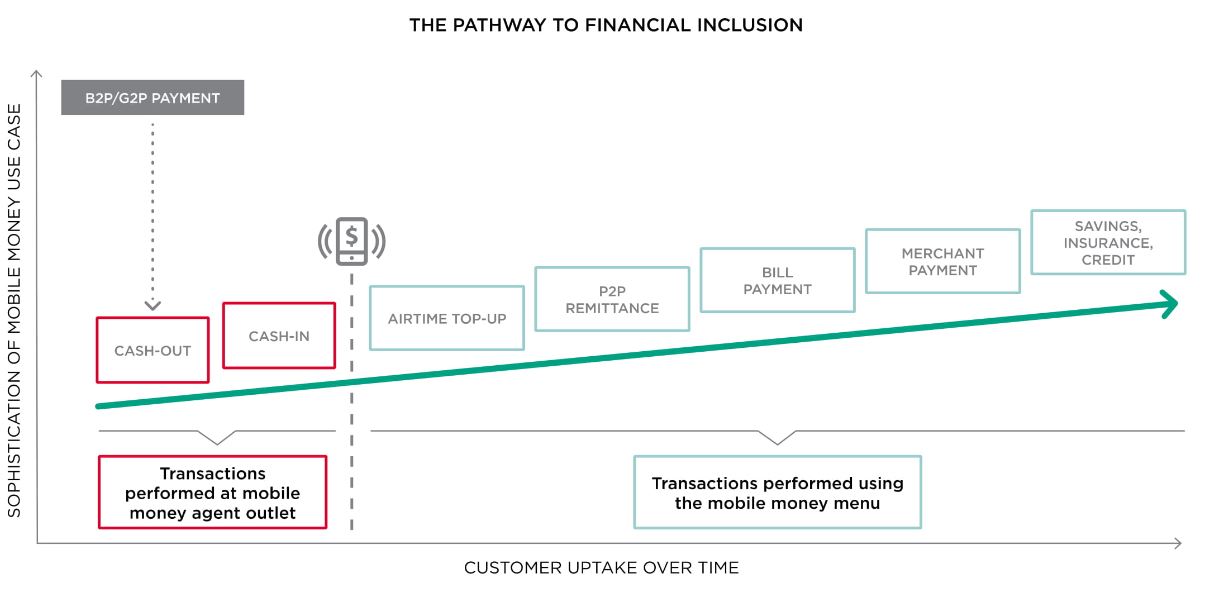

The transition from cash to mobile money for business-to-person (B2P) and government-to person (G2P) payments enables efficiencies for both agribusiness and farmers in terms of increased security, time reduction and (potentially) less costly payments. Crucially, it also supports the creation of an economic identity for farmers, opening up the pathway to financial inclusion for those who provide up to 70% of the food consumed globally.

The challenge of supporting liquidity in rural areas

The realisation of the opportunity to digitise agricultural payments requires appetite for investment and innovation on the part of mobile money providers to support liquid, functioning mobile money distribution networks.

Over time, as the mobile money ecosystem develops and users advance to more complex use cases (airtime top ups, merchant payments and financial transactions), the demand for liquidity will diminish. However, in the early phases of adoption, transactions performed at the mobile money agent outlet (cash-in and cash-out) will remain the main mobile money use cases for farmers.

In the early phase of adoption, mobile money providers cannot expect to drive consumer satisfaction and loyalty without sufficient agents available to support cash out. The availability and proximity of mobile money agents in rural areas, however, can be problematic even in the most advanced mobile money markets of East Africa. In Kenya, in 2017 there were 170,000+ registered mobile money agents, still in remote rural areas farmers willing to cash out may have to travel for a few miles to visit the nearest outlet.

After recruiting sufficient agents, mobile money providers must ensure that agents are actually active and able to support cashing out of agricultural payments. The demand for liquidity in rural regions is subject to the agricultural cycle, with peaks in activity at the time of post-harvesting followed by quiet times during growing seasons. The seasonality of agriculture determines spikes in demand and puts pressure on agents, as farmers are likely to access some or all of their income at the same time. Mobile money providers simply cannot afford to have agents turning customers away and potentially losing faith in the entire mobile money service.

Key strategies to address the liquidity challenge in rural regions

By working closely with mobile money providers to support last mile digitisation projects, at GSMA mAgri we have learnt that there is no one size fits all or secret recipe to address the liquidity challenge in rural areas. Rather, a successful strategy to support liquid, functioning mobile money distribution networks requires concerted action and the concurrent implementation of different initiatives. Mobile money providers must act at least at three different levels by:

- Ensuring adequate incentives, at least initially, for agents to support cash-outs;

- Focusing on master agents who can support distribution network expansion in rural regions;

- Coordinating communication between stakeholders involved in agricultural payments (agribusinesses, master agents and individual agents)

Strategy 1: Thinking agents incentives “out of the box”

Since agents are the backbone of mobile money services, the importance of adequate agent incentives cannot be overstated, however it is also clear that agent commissions are the single major OpEx element in the overall business model. It is unlikely that to stimulate rural uptake mobile money providers will be able to offer commissions that are more generous to rural agents. Still, there are available options to activate rural agents and support cash-outs for farmers.

Initiatives like training events to ensure that agents understand the commission structure and benefits on offer as well as the processes required to register new customer can be a good starting point. In addition, mobile money providers should consider linking commissions to quality parameters, for example customer loyalty and listening behaviour, to encourage agents to attract high-quality farmers.

Providing “soft” non-financial incentives to rural agents have also proved very effective, as shown by mobile operators who have successfully deployed marketing agents for Agri VAS. These include offering best performers the opportunity to move up the ladder and sell other products or providing agents with gadgets to give them a sense of pride and belonging in the service community.

Strategy 2: Early on-boarding of master agents

Master agents who buy float from the mobile money provider and resell it to agents have proved fundamental to the rapid expansion of the distribution network. They are key not only to liquidity management, for example by visiting in person rural agents to supply cash or e-money, but also for agent selection, recruitment, on boarding and training. To support the digitisation of B2P payments in the agricultural last mile it is essential that mobile money providers on-board early their master agents.

An example of a successful rural master agent strategy comes from MTN Zambia, which at the time of acquiring new agribusiness clients who want to pay their farmers via mobile money, provides details of the agreement to master agents in target rural areas, including the number of farmers who will be involved and the average value of payments. This way, master agents can see agribusiness recruitment by the mobile money provider as a business opportunity and commit to liquidity management.

Strategy 3: Effective communication at the time of agri payments

Finally, in our work with mobile money providers we have learnt the importance for the service provider to ensure a clear line of communication between all stakeholders involved in the process of paying farmers: That is when, how and which farmers are going to be paid.

To ensure that liquidity is available in target areas, MTN Ghana, for example, requires that its partner agribusiness Cargill communicates promptly its intention to make a B2P payment to farmers via the mobile money platform. As soon as the mobile money provider receives a notification, it contacts its network of master agents via WhatsApp. The master agents are incentivised to ensure individual agents have sufficient liquidity, even moving around to visit individual agents and rebalance their float. This official channel of communication, coupled with adequate incentives, is key the effective disbursement of B2P bulk payments.

You can find out more about strategies to expand mobile money distribution networks in rural areas in the GSMA mAgri toolkit Prerequisites visit digitising the agricultural last mile: Addressing the connectivity, liquidity and due diligence challenges.