Leading up to the Mobile Money Summit in Barcelona next week, I will be writing a series of posts on ‘adoption drivers’ that have emerged from the CGAP-GSMA Mobile Money Market Sizing Study. These drivers are part of an adoption framework that will be expanded on during my presentation at the MMU working group, and in the 2009 Mobile Money for the Unbanked Annual Report. The first post in this series examines two metrics that can be considered as basic enablers of mobile money adoption – service awareness and understanding.

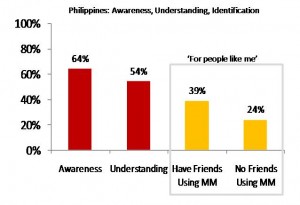

In the Philippines, 64% of unbanked individuals who own mobile phones are aware of the concept of mobile money. This awareness level is quite high relative to Telco and bank awareness amongst the unbanked, which are roughly 78% and 51% respectively.

Beyond driving basic awareness, mobile operators also focus on driving service understanding. The distinction between awareness and understanding is important – whereas prospective customers may be aware of the general concept of mobile money, they may not understand what the service can be used to do. This is especially true for sophisticated formal financial services which are often not widely used by the unbanked, like savings, insurance or credit. The CGAP-GSMA survey in the Philippines reveals that 54% of unbanked mobile phone users understand that mobile money can be used to ‘send a money transfer within the Philippines’. Fewer people understand that mobile money can also be used for other services like ‘overseas money transfer’ or ‘salary payments’. This may be a reflection of the priorities of these respondents (i.e. not having an overseas relative may make someone less likely to be aware of available offerings), but it certainly validates the importance of a topic that will be explored further in the upcoming MMU working group – the use of messaging in marketing materials.

Media has played a key role in driving both awareness and understanding of mobile money in Kenya as well as the Philippines, where 55% of people cite TV advertisements as a source of learning about the service. Given the importance of this medium, it’s important to get the messaging right. In Kenya, Safaricom used simple messaging and visuals to convey the primary function of M-PESA – the phrase ‘send pesa by phone’ features prominently in their advertisements. Combined with extensive point-of-sale branding and investments in marketing, this has driven both awareness and understanding of M-PESA in Kenya.

Media has played a key role in driving both awareness and understanding of mobile money in Kenya as well as the Philippines, where 55% of people cite TV advertisements as a source of learning about the service. Given the importance of this medium, it’s important to get the messaging right. In Kenya, Safaricom used simple messaging and visuals to convey the primary function of M-PESA – the phrase ‘send pesa by phone’ features prominently in their advertisements. Combined with extensive point-of-sale branding and investments in marketing, this has driven both awareness and understanding of M-PESA in Kenya.

The next adoption driver will be posted tomorrow.