This is the second post in our series on customer adoption leading up to the Mobile Money Summit in Barcelona. The previous post introduced the importance of driving service awareness and understanding as enablers of adoption. This post addresses the importance of ‘driving demand’, which is the second step in the adoption framework that will be presented at the MMU working group and in the Mobile Money for the Unbanked Annual Report. Specifically, we will focus on one key element – the importance of positioning mobile money so that the unbanked perceive it to be a ‘service for people like me’.

If the unbanked are to adopt mobile money, they must first believe that it is a service for ‘people like me’. Four focus groups were held in the Philippines with mobile money users and non-users during the CGAP-GSMA Mobile Money Market Sizing Study. An attitude expressed during these sessions by some prospective customers was that mobile money seemed interesting, but that they didn’t believe it was ‘a service for people like me.’ When asked to expand on this attitude, participants cited the fact that they’d seen advertisements outside fancy shopping malls, and that the service was endorsed by celebrities. This made it difficult for unbanked customers to identify with the mobile money offering.

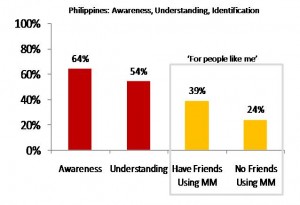

Deployments in the Philippines and Kenya have achieved impressive scale to date by targeting different types of customers. As operators in all markets increasingly target the unbanked, it will be important to ensure that the visuals and messaging used in marketing materials are designed in a way that resonate with this segment. Doing so can ensure operators achieve scale by accessing the largest possible target market. Consider the awareness, understanding, and identification figures in the Philippines – 64% of the unbanked mobiled are aware of mobile money, 54% understand that it can be used for money transfer, and less than 40% believe that it’s a ‘service for people like me’. Interestingly, the extent to which survey respondents identify with mobile money varies depending on whether they know someone else who uses the service.

In Kenya, Safaricom has proactively addressed this issue. Advertisements for M-PESA feature simple visuals of an urban worker sending money to a rural family member, presumably his mother. This reflects the primary use of M-PESA (regular support for family members) and to a large extent, the main demographic.

The final adoption driver will be posted Friday.