This blog is the second in a two-part series on the State of Mobile Money in Sub-Saharan Africa.

In my last post, I looked at the growth of mobile money in Sub-Saharan Africa and introduced our new overview presentation for the region. This post looks at the future of mobile money and examines how it facilitates other financial services, future growth prospects and key considerations to realise this growth.

Facilitating other financial services and sectors

In the last decade, mobile money services have proven to be more than an accessible tool for payments. Other financial services, such as credit, insurance and savings have been rolled out in a number of markets, allowing people to better manage financial risks and household shocks. Credit services enabled by mobile money, in particular, have proliferated in the region: from six services in Kenya in 2011 to 39 services in 11 countries in 2016.

Mature mobile money markets, such as Kenya and Tanzania, have seen a high uptake of mobile credit accounts; as of June 2016, M-Shwari in Kenya had around 15 million accounts, while M-Pawa in Tanzania had around five million accounts – having only launched in 2014.

Mobile money has also generated a wide array of positive externalities for other industries, such as water and sanitation, education, energy and agriculture. For instance, the Dar es Salaam Water and Sewage Corporation increased revenue by 38% in 2013 by offering mobile money as a method of payment, and almost 1.7 million secondary school students (i.e., 99% of secondary school students) in Côte d’Ivoire paid their annual school fees via mobile money in 2015-2016.

Additionally, mobile money has improved service provision for rural areas and communities. Numerous households in East Africa have been able to access energy through pay-as-you-go solar home systems integrated with mobile money payments – with M-KOPA providing access to around 500,000 households and Fenix International providing access to around 100,000 households (as of 2017). In Liberia, paying teachers’ salaries via mobile money saved 15% of the cost of receiving the salary (such as the cost of bank fees and the cost of taking a bus to the nearest town with a bank).

Future growth and prospects

The opportunity for further mobile money growth across the region remains ripe, and mobile money providers in Sub-Saharan Africa could increase their active user base by 118 million in total by achieving a 40% activity rate across their existing GSM base. While this figure may appear ambitious, an increasing number of deployments have been able to reach and pass this figure.

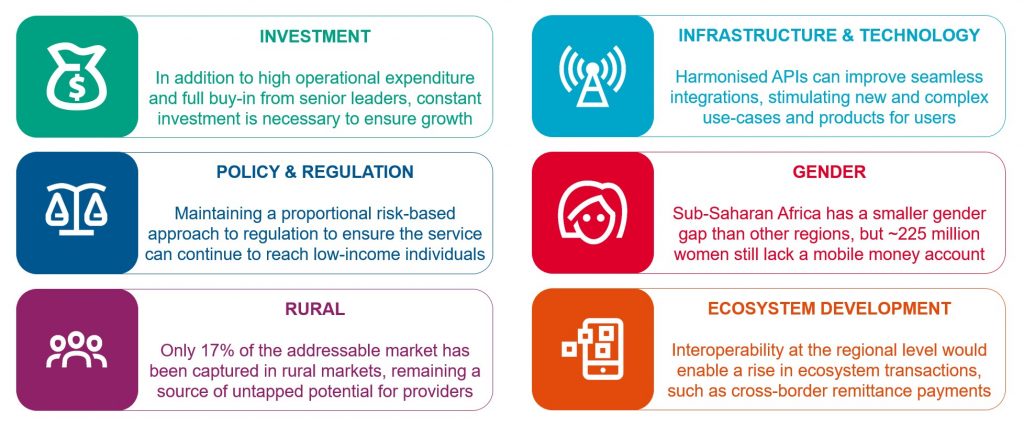

For mobile money providers to sustainably realise this growth potential, a number of factors should be considered by providers and stakeholders:

Investment:

Mobile money has proven to be a profitable business, but achieving success does not come without challenges. Setting up and maintaining a mobile money service requires significant on-going operational expenditure, as well as full buy-in from senior leadership and a clear roadmap to expand the digital ecosystem.

In the early phase, providers should expect to invest six to eight times the revenue units generated by mobile money with break-even possible in around three years. Where investment is lower or regulatory compliance barriers are high, this timeline could be longer.

A recent trend in Sub-Saharan Africa has seen a number of moves towards increasing consolidation. High profile examples include the Vodafone-Vodacom share swap in Kenya, Millicom merging with Airtel in Ghana and Orange buying Millicom’s operations in DR Congo. Whilst appetite for investment remains high, opportunities for further investment remain ripe.

Infrastructure and technology innovation:

Whilst payments ecosystems and a transition from cash to digital payments have grown over the last five years, third party integration is not yet seamless. However, using harmonised application programme interfaces (APIs) can lead to quicker product development and a new wave of growth and innovation.

In addition, financial infrastructure – such as switches and payments schemes – can accelerate mobile money interoperability. Tanzania has been a regional pioneer in interoperability, with the country seeing positive results from this initiative. However, many legacy systems are not yet suitable for mobile money integration. An appropriate governance structure, commercial model, and technical architecture to attract the participation of mobile money providers is critical.

Ecosystem development:

Ecosystem transactions in Sub-Saharan Africa quadrupled between 2011 and 2016, whereas global ecosystem transaction doubled during the same period. This growth has been attributed to increased partnerships between mobile money providers and different industries that rely on cash payments. An increase in bill payments and bulk payments has driven the rise in ecosystem transactions, yet the opportunity of increasing international remittances remains unexploited.

Interoperability at the regional level could enable a rise in ecosystem transactions, such as cross-border remittance payments. For instance, the SADC Bankers Association is currently in the early stages of planning a mobile money central transaction hub that may potentially allow users to transact across 15 markets.

Policy and regulation:

Regulators in the region have made great progress in enabling mobile money services, and 30 countries now have an enabling regulatory environment. A conducive regulatory framework allows for better competition and innovation, attracts investments from both banks and non-banks, and encourages providers to focus on operational efficiency. Research by the GSMA has found that the total mobile money transaction value was 5.4 percentage points higher in markets with enabling regulation, compared to countries with non-enabling frameworks – resulting in greater financial inclusion in the process.

Whilst existing frameworks have contributed to an increase in mobile money adoption, a proportional risk-based approach to regulation could enable services to continue reaching low-income individuals. By carrying out proper risk assessment and mitigation measures with operators, the level of financial exclusion could potentially decrease, attracting more customers towards services and channels that may then bear a lower level of risk.

Women and rural communities:

Sub-Saharan Africa has the lowest mobile money gender gap (19.5%) in comparison to other emerging regions of the world. In spite of this, there remains a substantial opportunity to empower and financially include women further, and 225 million women in the region do not have a mobile money account.

Mobile money has made strides in provide a secure channel for money transfers from urban centres to rural areas. However, individuals based in rural areas are likely to be late adopters of mobile money – with network access a key reason for this. Analysis by the GSMA found that providers have only captured 17% of the addressable rural markets. Resultantly, governments and operators are keen to prioritise GSM coverage and broadband access expansion, and need to collaborate on how to capture these demographics better.