Last month, the GSMA hosted a workshop on international remittances during the Mobile 360 – Africa conference in Dar es Salaam, Tanzania. This workshop was an opportunity to bring together a wide range of stakeholders interested to expand the use of mobile money for international remittances across a greater number of markets. We had a full room of participants, coming from different background including a number of regulators, mobile operators, remittance players as well as international organisations and donors.

The workshop was moderated by Leon Isaacs, CEO of Developing Markets Associates (DMA). He opened the workshop with a few introductory remarks sharing key findings from a report produced by FSD Africa on ”Reducing costs and scaling up UK to Africa remittances through technology”. We then had the pleasure to listen to four great speakers who shared key insights on the opportunities and challenges to ramp up mobile money services to facilitate international remittances. Our speakers included:

- Alix Murphy, the Director of Mobile Partnerships at WorldRemit;

- Jacques Brun, the Project Director for Mobile Financial Services at Orange Group;

- Nicolas Vonthron, the Executive Vice-President for Africa at TransferTo; and

- Rachel Balsham, the Deputy CEO of MFS Africa.

The presentations were followed by a moderated discussion with the workshop participants. Here are some of the key take-aways from the discussion:

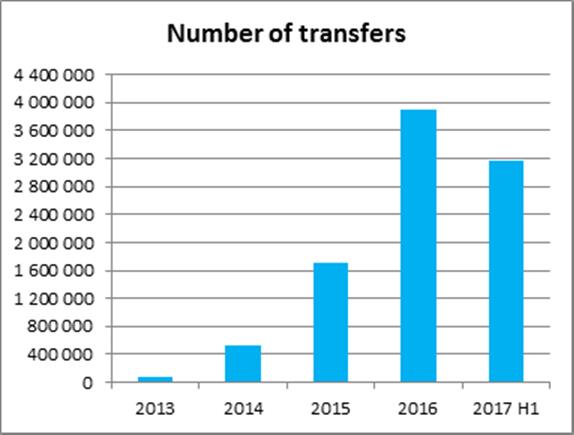

- The rapid uptake of international remittances through mobile money in markets where the service is available indicates a large latent demand. Data from WorldRemit indicates that in countries where people have the option to receive remittance via mobile money in addition to traditional cash pick-up methods, customers have been quick to adopt mobile money. This is particularly true in rural areas where mobile money tends to be the preferred method. In 2016, remittances to mobile money grew at more than double the rate of other receive methods. In countries such as Uganda, Zimbabwe and Ghana, mobile money is the preferred method chosen by the diaspora for their recipient to receive the funds. Thirty-five percent of WorldRemit’s 650,000 monthly transactions are now paid out as mobile money (up from 24% of 330,000 in January 2016). Finally, Jacques Brun shared an interesting graph which clearly illustrates the exponential growth of international remittances through Orange Money. Orange Money is now present across 17 countries in Africa and services over 32 million customers.

Number of international money transfers performed through Orange Money (2013-2017) (Source: Orange)

Number of international money transfers performed through Orange Money (2013-2017) (Source: Orange)

- International remittance hubs can play a key role to speed up the opening new corridors and scale the use of mobile money for remittances. An international remittance hub is a switching platform connecting and enabling transfers between two or more remittance service providers. The range of services provided by an IRH can change depending on each legal and commercial agreement, but typically hubs facilitate the clearing and settlement of balances between the connected remittance service providers and perform sanctions-screening on the sending and receiving customers with the information provided by the remittance service providers. For example, TransferTo operates a B2B cross-border mobile payments network for emerging markets, processing real-time transactions for money transfer operators, mobile operators, digital wallet providers, banks, NGO’s and merchants. Rachel Balsham further explained the importance of interoperability and noted that MFS Africa hub connects over 170 million mobile wallets and over 20 million banks accounts across 27 countries in Africa.

- Low prices remain a key benefit of mobile money compared to other remittance channels. The current cost of sending $200 from the UK to Africa is 9.4% on average; in their report, FDS Africa identified mobile money as a key tool to help reduce this cost below 3% which is one of the targets on the UN Sustainable Development Goals. For example, the average cost of sending international remittances through Orange Money is 2.7%. Recent research conducted by the GSMA on the cost of remittances also demonstrated that mobile money was on average more than 50% cheaper than using global Money Transfer Operators.

- Other benefits of mobile money were also highlighted, such as convenience, privacy and security. The fact that can send and receive remittances anywhere and at any time directly on their mobile phone means that they no longer need to travel to a remittance agent. Alix Murphy explained that the convenience factor was particularly important and that it was one of the key reasons why people preferred to receive international remittances on their mobile phone. In that context, Rachel Balsham also made the case that mobile money gives people more control over their financial decisions.

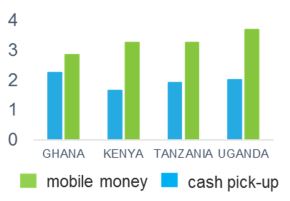

- The average value of international remittances sent through mobile money tends to be much lower than through alternative channels but transactions tend to be more frequent. Rachel Balsham explained that approximately 20% of people who start sending remittances through mobile money continue to make transfers once or twice a month while the value of intra-African remittances typically ranges from $50 to $80. The average value of international remittances sent through Orange Money is $100. Data from WorldRemit tells a similar story, as the graph below demonstrates:

Average number of transactions per user by type of pick-up method (Source: WorldRemit)

- During the discussion, there was a call for greater public-private dialogue on international remittances as well as between regulators themselves to share best practices and harmonise regulations where possible and unlock the opportunity to use mobile money for international remittances across a greater number of markets. Nicolas Vonthron gave examples of some of the key regulatory challenges TranferTo faces, such as the long approval processes and the reluctance to allow mobile money to be used for international remittances in certain countries. He also emphasised the risks of non-enabling regulations and of de-risking behaviours which encourage the use of unregulated, informal channels. Influencing policies and regulations to allow non-bank financial institutions to be able to pay out remittances was also one of the recommendations of the FSD report that Leon Isaacs presented. Finally, some of the regulators in the audience emphasised the importance of sharing best practices between them and highlighted the need to harmonise regulations in the area of international remittances, where possible.

- Finally, we discussed the importance of providing remittance services in a safe and responsible manner and the need for industry guidelines. Nicolas Vonthron stressed the importance of having very high compliance standards and called for the development of industry guidelines to help push the bar on private sector practices. Over the next few weeks, and with a view to contribute to the public-private dialogue on international remittances, the GSMA will be publishing a document that illustrates how the mobile money industry and its partners collaborate to ensure that international remittances are conducted in a safe and secure manner, consistent with global standards and local monetary policy and regulations.

Download the slide from MFS Africa

Download the slide from Orange