This post was co-written by Chris Williamson and Francesco Pasti.

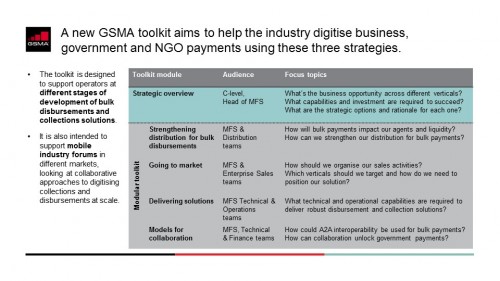

We are pleased to announce the launch of a new toolkit which aims to support mobile operators to develop and scale collection and disbursement solutions via mobile money for businesses, governments and NGOS.

Up until now, mobile money deployments have primarily focused on the needs of end consumers. However, there is a big untapped opportunity for mature mobile money deployments to develop payment solutions for businesses, governments and NGOs that digitise their collections and disbursements. We estimate that there could be a $16bn+ revenue opportunity for mobile operators in developing countries to digitise these payments. In doing so, they will enable a dynamic mobile money ecosystem and exciting new propositions for customers, securing their place in the financial lives of individuals and economies as a whole. Furthermore, digitising these payments represents the logical path to profitability and scale – reducing dependency on a costly cash-in/cash-out network by enabling more purely digital use cases.

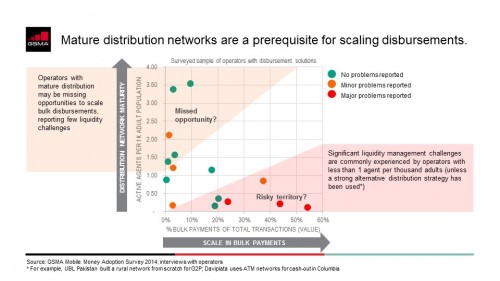

Although operators have made good progress on “bill pay” products for utilities like electricity and water, the industry is just beginning to scale broader collection and disbursement offerings. For example, at June 2014, bulk disbursements (including B2C, G2P and D2P transactions) represented only 2% of global mobile money transaction volume. As we outlined in a recent blog post, operators have struggled with challenges on distribution, building the right sales approaches and technical capabilities, and delivering on client’s needs for universal rather than fragmented solutions. However, there are promising signs of scale in some markets – providing valuable lessons for operators looking to scale these solutions.

The GSMA has developed a toolkit based on insights from the top performing deployments for collections and disbursements, combined with global insights from our 2014 Global Adoption Survey. The toolkit highlights the scale and nature of these different opportunities; strategic considerations around interoperability and enabling third parties to drive mobile money solutions; and insights and best practices on distribution and liquidity management, sales and marketing, delivering solutions and models for collaboration.

The toolkit is available on request to mobile operators; please email [email protected] if you would like to receive a copy.

Sample screenshots from the toolkit: