Smartphones will play an increasingly important role in the next generation of digital financial inclusion. Cheaper devices, innovative pricing models and data-ready mobile networks are contributing to an accelerated pace of smartphone adoption. In fact, in 2014 more than half of mobile money providers offered an app, and we expect an even greater appetite for app development in the coming years. The underlying trend suggests that for users, apps are becoming a basic necessity, not just an additional access option.

We believe the Latin American and Caribbean (LAC) region is a particularly interesting place to watch for mobile money app development because:

- By 2020, nearly 70% of LAC users will adopt smartphones, making this the developing region with the highest penetration of next-generation devices

- The region is a “mobile first” when it comes to early adopters and app usage–for instance, LAC leads worldwide engagement on social media and the average user has 18 apps on his or her smartphone

Unsurprisingly, mobile money providers in the region are investing in app development and raising the bar when it comes to user experience and functionality. We’ve highlighted some new app features that have the potential to accelerate ecosystem development for mobile financial services:

Barcode generation for merchant payments and P2P transfers

In Mexico, Telcel’s Transfer app allows users to generate a barcode for merchant payments to be scanned using a cashier’s barcode scanner, or through the app itself for P2P transfers:

This facilitates easier interactions with third parties and avoids disclosing the user’s mobile phone number in untrusted environments.

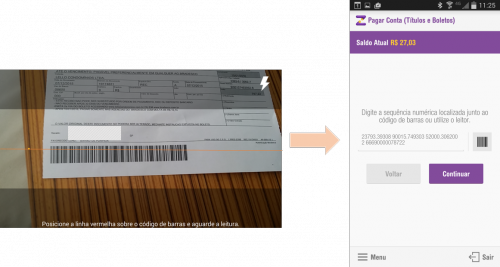

Barcode scanning for bill payments

Entering information for bill payments on an Unstructured Supplementary Service Data (USSD) stream can be time-consuming and error-prone. Brazil uses a unified bill payments banking system, which consists of a standard barcode and 47-number string as a unique identifier.[1] To facilitate adoption of this system through mobile money, Zuum’s app allows customers to use their smartphone cameras as barcode scanners. The process is made much simpler due to embedded barcode decoding software that converts the barcode directly into the unique number string. Other LAC countries, such as Argentina and Uruguay, also offer similar barcode bill payment capabilities and this trend seems set to continue.

Expanding mobile money accounts to all consumers, regardless of their mobile network operator

Mobile money services are often linked to a specific mobile network, either through a SIM card or USSD channel, and this can limit the number of addressable customers within a market. Using proper authentication methods, MNO-agnostic apps can help grow the size of the pie. For example, when a new customer subscribes to Zuum through the app, a logic checks which operator a particular mobile number belongs to.[2] Even if the customer falls outside of Vivo’s domain (Zuum’s MNO partner), the user is still able to use all mobile money features in the app.

Notes on app usability and security

As CGAP notes in its report, Doing Digital Finance Right, one of the key consumer risks for uptake of mobile money services is complex or confusing user interfaces. When designing apps, mobile money providers should take into account user experience best practices for small, touch-enabled smartphone screens. Other aspects such as optimised data access should also be considered.

As a starting point, app developers can refer to the GSMA’s Smarter Apps for Smarter Phones, a reference document aimed to equip developers with guidelines and recommendations for fit-for-purpose apps that are optimised for any potential network constraints or limitations on battery life.

Security is another critical aspect to developing a viable app. Applications introduce a security trade-off by moving from a “walled” operator-driven channel, such as USSD, to an internet-enabled channel on specific operating systems (OS). Malware, internet- and OS-based attacks could potentially compromise user data.

LAC taking the lead

LAC is taking the lead on creating secure and user-friendly mobile money apps. A recent study on mobile money and banking apps acknowledged Zuum’s app for its ability to preserve the integrity of customer transactions, showcasing high security standards. While Zuum heavily invested in the app’s development, they may have also benefited from Brazil’s strong financial and banking systems, which already rely on internet-based channels and as such, have developed a stringent set of security rules, particularly for apps.

Mobile money providers around the globe take customer security very seriously, and app development discussions involve compromises between user experience, security and development costs. As Zuum’s app has shown, a balance between these aspects can be found and we expect more mobile money providers to invest in and develop best-in-class apps.

See our related publications:

- Mobile financial services in Latin America & the Caribbean: State of play, commercial models, and regulatory approaches

- GSMA MMU Infographic: Mobile Money in Latin America & the Caribbean

- Smartphones & Mobile Money: The Next Generation of Digital Financial Inclusion

Notes:

[1] Fonseca, Carlos Eduardo Correa da. Tecnologia bancária no Brasil : uma história de conquistas, uma visão de futuro / Carlos Eduardo Correa, Fernando Meirelles, Eduardo Diniz ; coordenação editorial Sonia Penteado. – São Paulo : FGVRAE, 2010.

[2] Additionally, mobile money providers can identify which operators own or serve any particular mobile number. In Brazil, the number portability authority provides an API for consultation. Globally, the GSMA also provides a worldwide number lookup service through PathFinder.