This post was written by Lynn Eisenhart from the Bill & Melinda Gates Foundation and Nat Kretchun from InterMedia. This blog is the third in a series on global OTC exploration, produced by the Bill & Melinda Gates Foundation and GSMA. Read the first overview post here.

In just a few short years bKash has made a significant impact on the financial landscape in Bangladesh. InterMedia’s Financial Inclusion Insights (FII) demand-side data reveals that over 20% of Bangladeshi adults [1] have used bKash at least once, and 5% of adults have registered bKash mobile money accounts. However, while the proportion of customers with registered accounts appears to be growing, data suggests that the majority of overall users still access the services via over-the-counter (OTC) transactions.

Informal OTC use in Bangladesh is an issue that is written about widely, but can be difficult to quantify. This is particularly true because different data sources for three key usage metrics: total user base, registered users, and OTC activity can be hard to reconcile. For instance, as of the end of August 2014, bKash’s own (supply-side) figures showed that the company had 13.4 million registered accounts on its system.[2] By contrast, the 5% of the adult population with registered accounts from the FII (demand-side) survey over the same time period would translate to only about 5.1 million registered, unique users. We asked the question: how could there be a gap of 8 million users when comparing supply-side to demand-side data? In order to truly understand what is going on in the Bangladeshi mobile money space, we need to understand what these differences mean to important market dynamics such as registration and OTC use.

Perhaps the most important factor to keep in mind when looking at demand-side data (in this case, coming from quantitative surveys conducted with unique individuals comprising a nationally representative sample) versus supply side data (in this case, coming from a mobile money provider’s system of record), is that demand-side FII figures are based on an aggregate number of unique individuals while bKash’s supply-side figures are based on the aggregate number of registered accounts. At the most fundamental level this is how the demand and supply side data can look so different and yet neither are technically “wrong.”

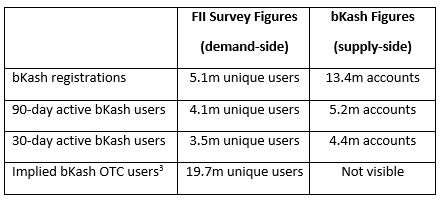

Let’s look at the numbers. Below is a side-by-side comparison of bKash figures with those from 2014 FII data as of the end of August 2014.

With a 1.27% margin of error associated with the FII survey, the demand vs supply side figures for 90-day and 30-day active users seem to line up, after factoring in differences that can be potentially explained by two key factors:

- Agents will occasionally open multiple accounts, which they use to conduct OTC transactions on behalf of their customers. It is difficult for providers to detect and minimize this activity.

- Just like many of us have more than one bank account, some individuals simply have multiple mobile money accounts and also happen to actively use each one.

But how do we explain the large difference in total number of registered users? The most likely answer seems to be a significant number of dormant accounts in bKash’s accounting of total registered users. Dormant accounts, in large part, are likely the result of:

- Incentivized registration efforts through which agents may have registered users who never went on to regularly use their accounts, and, as a result, may not have responded that they had a registered account in demand-side surveys.

- Individuals who have registered multiple accounts, but don’t actively use every account. Even a registered user who only uses one account may have registered multiple accounts due to factors such as high SIM card churn. A mobile operator in Bangladesh reported 25% SIM card churn in a two month period – equating to every customer replacing a SIM card on average every 8 months! Therefore it’s no wonder that you might open a new bKash account every 8 months as well, and that you would not appear to bKash as an active user even though you could be.

The same registration dynamics that likely lead to some level of dormant accounts also make it difficult for bKash to translate exactly how many unique individuals are associated with the number of accounts in their system because – despite ID requirements for mobile money KYC – providers do not currently have access to a government national ID database. Additionally, SIM cards are often sold without valid authentication. Therefore, it is incredibly difficult to truly identify duplicate accounts on the provider side. bKash’s own interpretation of its primary customer base is no doubt something close to its figure for 90-day active users rather than the full number of registered accounts currently in its system.

Resolving mismatches in supply and demand-side figures is important to getting a truer picture of the market. This clarity helps inform central bank oversight, consumer protection measures, and mobile money providers’ strategies for addressing churn and ARPU. Other markets likely have similar levels of demand vs supply side data mismatch; however we were able to observe this phenomenon more closely in Bangladesh thanks to InterMedia’s FII survey combined with the available data from dominant provider bKash.

Despite any of these data mismatches, however, there is no doubt that bKash has had tremendous success in bringing financial services into the hands of millions of Bangladeshis across the income spectrum. The ubiquitous presence of the bKash brand and the value customers report from using the service are clear evidence of its impact. This data exercise simply allows us to better understand the size and composition of the mobile money market and may suggest ways to help move a greater percentage of users from OTC toward active registered account usage.

Notes

[1] The adult population in Bangladesh is 113 million. 21.9%, or 24.7 million adults, have used bKash at least once.

[2] These figures allow us to compare figures side by side over the same time period. Today bKash has registered over 17 million accounts.

[3] Implied bKash OTC users: Total number of unique individuals who reported they have ever used bKash, less the number of individuals who reported they are registered bKash users.