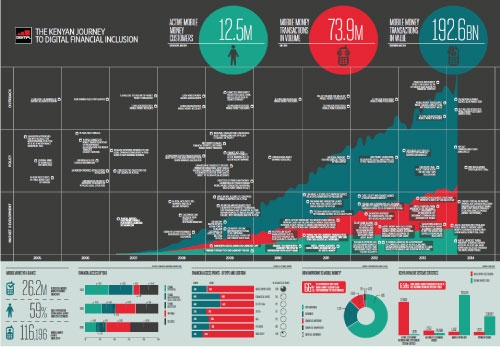

Today, GSMA has released a new infographic on how mobile money has contributed to the digitisation of Kenya’s retail payments systems, fostering financial inclusion and the growth of the mobile ecosystem in the country. This infographic builds on a previous version released last year, updated with new data and insights on market development, innovation and policy interventions, and showing the effect that uptake of mobile money has on the lives of millions of Kenyans.

In the past year Kenya has begun a new phase of its journey toward the digitisation of its payments system, mostly due to issuance of the National Payments System (NPS) Regulations, changes to the business model occasioned by the Competition Authority of Kenya ruling disallowing exclusive dealings with agents, and the entry of new players in the market.

This infographic shows that mobile money continues to register phenomenal growth. In March 2014 the values and volumes transacted had reached KES 192.69 billion and 73.98 million transactions respectively, representing an increase of 43.32% in value and 41.20% in volume from the previous year.[i] The “financial access strand” shows how this has contributed to deepening financial inclusion and the efficiency of the financial sector. Out of 26.2 million registered mobile money accounts [ii] we estimate that 12.5 million (47%) are active on a 30-day basis.[iii]

NPS value throughput: An accurate measure of mobile money prevalence

A new data point we have introduced is the NPS value throughput which measures mobile money against other payments instruments. According to data from the Central Bank of Kenya (CBK), mobile money contributes to 6.59% of the total national payments throughput value (including gross and retail).[iv] In comparison, the Kenya Electronic Payments and Settlement System (KEPSS) [v] and the Automated Clearing House (ACH)[vi] together process 88.09% of the total NPS throughput value.[vii] Therefore even as mobile money contributes just less than 7% of the NPS throughput value, it commands a staggering 66.56% of the total NPS throughput volume. This data suggests that while mobile money has widespread acceptance and usage nationally, contributing significantly to improve the efficiency of the NPS and benefiting economic growth, mobile money issuers are not systemically important institutions. The regulatory approach of the CBK has thus been functional (regulating by type of product and allowing different type of institutions to enter the market) and proportionate, encouraging innovation and growth whilst avoiding an overly prescriptive or burdensome approach (such as giving mobile money the same treatment as the higher risk profile savings and credit products offered by commercial banks).

The data comparison of the NPS value throughput provides a more accurate measure of mobile money prevalence, correcting a previous statistic suggesting that 31% of the country’s GDP is channelled through mobile money services. As Dr. Susan Johnson notes in her blog, this is an inaccurate way of reporting data and she suggests the use of other alternatives that compare the ‘flows of payments’. The GSMA agrees with Johnson that “these alternative more robust comparisons, which compare flows of transactions through mobile money with other flows of payments, put the figures in a rather more sober light while reflecting a more realistic view of the progress of mobile money payments in the payments landscape.”

This new Infographic is a rich amalgam of data from various reputable sources, including the Financial Sector Deepening (FSD) Kenya – FinAccess National Survey; the World Bank’s Global Findex database; the Bill & Melinda Gates Foundation FSP Maps; InterMedia’s Financial Inclusion Insights; the Alliance for Financial Inclusion and the Central Bank of Kenya.

A detailed case study on Kenya will be launched in October fleshing out this infographic with a narrative and additional insights as we have done for Tanzania. We hope this infographic will enable readers to easily compare data published in the Tanzania infographic, as they both share the same format.

Notes:

[i]Transaction volumes dropped significantly in March 2014 following a highly charged General Election on 04 March 2013 whose results were disputed in the courts through an Election Petition. During the period of the Election Petition, many businesses (including mobile money agent outlets) remained closed fearing post-election violence. This down-turn effect was felt across the national payments systems as other payments instruments registered similar down-turn in transaction volumes and values. While the post-election violence fears provide the most plausible reason for the significant drop in transaction volumes and values, we cannot rule out the possibility that the market’s reaction to the imposition of Excise Duty on charges levied on mobile money transactions (and the subsequent rise in the costs of transactions) which took effect in February 2013 may have contributed to the drop in values and volumes.

[ii] According to CBK Payments Statistics.

[iii] We define an active customer as one who has transacted in the last 30 days.

[iv] Central Bank of Kenya Payments Statistics, January – December 2013.

[v] KEPSS is the Real Time Gross Settlement System launched by the Central Bank of Kenya (CBK) in July 2005.

[vi] The ACH is a retail Clearing House owned by the Kenya Bankers Association which works with the CBK to operate it. In June 2009, the CBK introduced cheque value capping which placed a KES 1 million cap on the cheque value that could be cleared through the ACH. According to the CBK, it was necessary to reduce risk of settlement, increase KEPSS usage and facilitate the implementation of failure to settle mechanism in the Clearing House. This intervention helped reduce the systemic importance of the ACH and increased the stability and soundness of the payment systems by moving all large value payments to the KEPSS.

[vii] The banking system processes the bulk of the value transacted nationally.