In an article published last month, we discussed what people use mobile money for and which products were most popular. Today, I will try to answer the following question: How does building an ecosystem impact profitability and help create an efficient and affordable way to facilitate payments on a large scale?

Once the foundations of a mobile money service have been established, service providers can significantly grow the volume of transactions by developing a mobile money ecosystem around their platform. Ecosystem transactions involve a third party and are: bill payments, bulk payments, merchant payments, international remittances, transfers between mobile money accounts and bank accounts as well as off-net P2P transfers to unregistered users.

Why is ecosystem development important for mobile money profitability?

Building a digital financial ecosystem enables customers to perform more digital transactions, hence generating more transaction revenues for service providers before the cost of cashing out is incurred, which helps drive the overall profitability of the mobile money service.

To illustrate this, commissions to M-PESA agents are now the single biggest contributor of direct costs for Safaricom: in the first 6 months of the reporting year, 5 billion Kenyan shillings (USD 60 million) were paid out to agents, compared to voice and SMS interconnect costs of KES 3.09 billion and airtime commissions of KES 4.65 billion. By building the ecosystem, more (non-agent) transactions can happen between cash-in and cash-out to grow revenues without increasing costs, resulting in increasing ‘the velocity of money’ on the platform.[1]

How big is the global mobile money ecosystem?

In June 2013, 27.3 million transactions involving external companies were processed across mobile money platforms. These 27.3 million transactions processed in June last year represented a monetary value of nearly $1 billion USD. This represents 8% volume and 29% of value of transactions for the industry in June 2013, compared to 7% and 24% in September 2012.

Interestingly, transactions involving external companies are also growing faster than airtime top-up and on-net P2P transfer (CAGR of 219% and 197% respectively).

How do regions around the world compare?

- South Asia has the highest proportion of transactions involving external companies, driven mainly by bill and bulk payments.

- East Asia & Pacific has focused more on international remittances.

- Latin America is building out the ecosystem through integrating mobile money within the existing formal financial ecosystem.

Which ecosystem products are currently driving transactions?

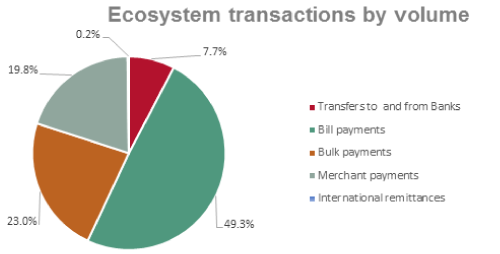

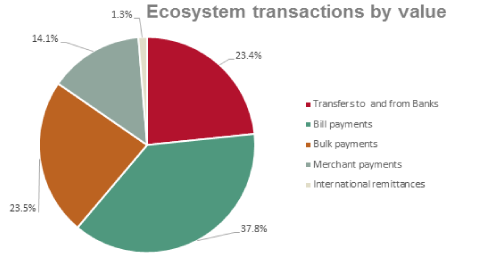

A closer look at payments generated by partnering organisations and merchants reveals no surprise that bill payments are most popular, accounting for 49.3% of volume and 37.8% in value. However, bulk payments and merchant payments have both taken a healthy share of the ecosystem pie.

Where are future transactions most likely to come from?

One of the most lucrative areas may be merchant payments. Industry insiders believe that the ratio of merchant payment transactions to P2P transfers is 16:1 in developed markets (how many more times do you pay a merchant rather than transfer money to someone?). In June 2013 the ratio for mobile money was 1:11 in favour of P2P transfers. Even if the ratio (merchant payments : P2P transfers) in developing markets is significantly less than 16:1, the dramatic difference indicates there is huge potential for growth in merchant payment transactions. This would explain why the likes of Kopo Kopo are investing significantly in building merchant networks in East Africa.

Conclusion

Given the low penetration of banking and card payments in a large number of markets, many companies are struggling to find efficient and affordable ways to accept payments and scalable billing options. Actively getting companies, merchants, and government institutions to use mobile money as a payment platform can generate very large transaction volumes for deployments that have already built a strong agent network and a large and active customer base, thereby increasing their profitability.

Download the 2013 State of the Industry Report here.

Download the presentation slides here.

[1] These insights were initially published as part of a blog post by Gunnar Camner published on MMU website on November 18, 2013, “Reading the M-PESA half-year results for 2013-2014”