ID systems in developing countries attract a lot of attention from the financial inclusion sector. And for good reason – in many cases they can be a key factor contributing to the uptake of mobile money. In recent months, there have been some big announcements in this space, notably India stating their intention to roll out a national ID system that would see each of their 1 billion + citizens provided with a biometric ID. And just this week Bruno Akpaka from MTN Ghana identified the low incidence of Ghanians carrying ID cards with them in public as a key barrier to the uptake of mobile money.

With this in mind, Dr. Nicola Jentzsch, Senior Research Fellow at the Technische Universität Berlin and the DIW Berlin, provides a snapshot of the existence and type of national ID systems around the world. Dr. Jentzsch currently serves as Head of Research of the European Credit Research Institute (ECRI) in Brussels, Belgium and has served as adviser to the European Commission, the World Bank and the GTZ. She has also acted as adviser to the Central Banks and market regulators of Indonesia, Mozambique, Tanzania, and South Africa. Her main interests are industrial organization of markets for consumer profiles, including behavior-based pricing, sharing of personal information and privacy (welfare effects of consumer protection).

How will ID systems shape the adoption and usage patterns of mobile money? Dr. Jentzsch’s post below clarifies the global landscape – share your thoughts on the implications below.

—

Background

KYC rules pose a particularly difficult challenge in countries with less developed civil registration systems and no (or underdeveloped) national ID systems. In a national ID system, the government issues ID cards to individuals starting at a specific age, based upon national laws or regulations. These systems can be either:

• Voluntary (i.e. individuals may apply for a card if they wish), or

• Compulsory (i.e. basically all individuals need to hold an ID card when they reach a specific age)

Current Landscape

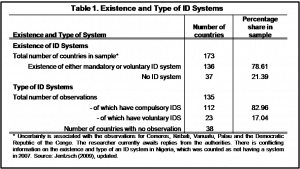

Recent research conducted by Jentzsch (2009) shows that of 173 countries (a sample based upon the World Bank’s Doing Business selection), a total of 136 countries (79%) had either mandatory or voluntary ID systems in 2007 and 37 countries (21%) had no ID system. There are also countries with substitute systems (i.e. Australia, Canada, U.S.A. and UK) where driver’s licenses or social security numbers are used for identification purposes, but these are counted here as having no national ID system.

Of the 135 countries where the type of ID system could be observed, 112 nations had compulsory systems (83% of the sub-sample) and 23 countries had voluntary systems (17% of the sub-sample).

Limitations and Looking Forward

Limitations and Looking Forward

The existence of a compulsory ID system does not imply that there is a complete coverage of the economically active population. For a number of reasons, the coverage might be incomplete. For instance, the geographical distance to authorities issuing the cards might be great and the ways to travel there too far, expensive or even hazardous. Further, civil registries are often incomplete (i.e. births may not be registered). This is particularly common in rural areas where children are often born outside of hospitals. Take two countries that both have compulsory ID systems – Pakistan and Cameroon. In Pakistan, the share of economically active persons that remain unidentified was 42% in 2007, in Cameroon 31%.

More and more countries are re-considering their implementation of KYC rules and experimenting with new approaches to move poor people into formal financial services. For this, identification thresholds must be lowered. These initiatives, led by Philippines, India and South Africa, for example, ought to be more supported in the future by the international institutions.