Globally, 1.2 billion people lack access to electricity. Current trends suggest Africa will not achieve universal access to electricity until 2080. In order to address this need, a new generation of entrepreneurial businesses have taken on the challenge of providing critical utility services (such as electricity, water and sanitation) to off-grid populations, by using a pay-as-you-go (PAYG) model. However, the majority of the customers that these PAYG businesses seek to serve do not have access to formal financial services and making regular payments from a remote location poses a big challenge for them.

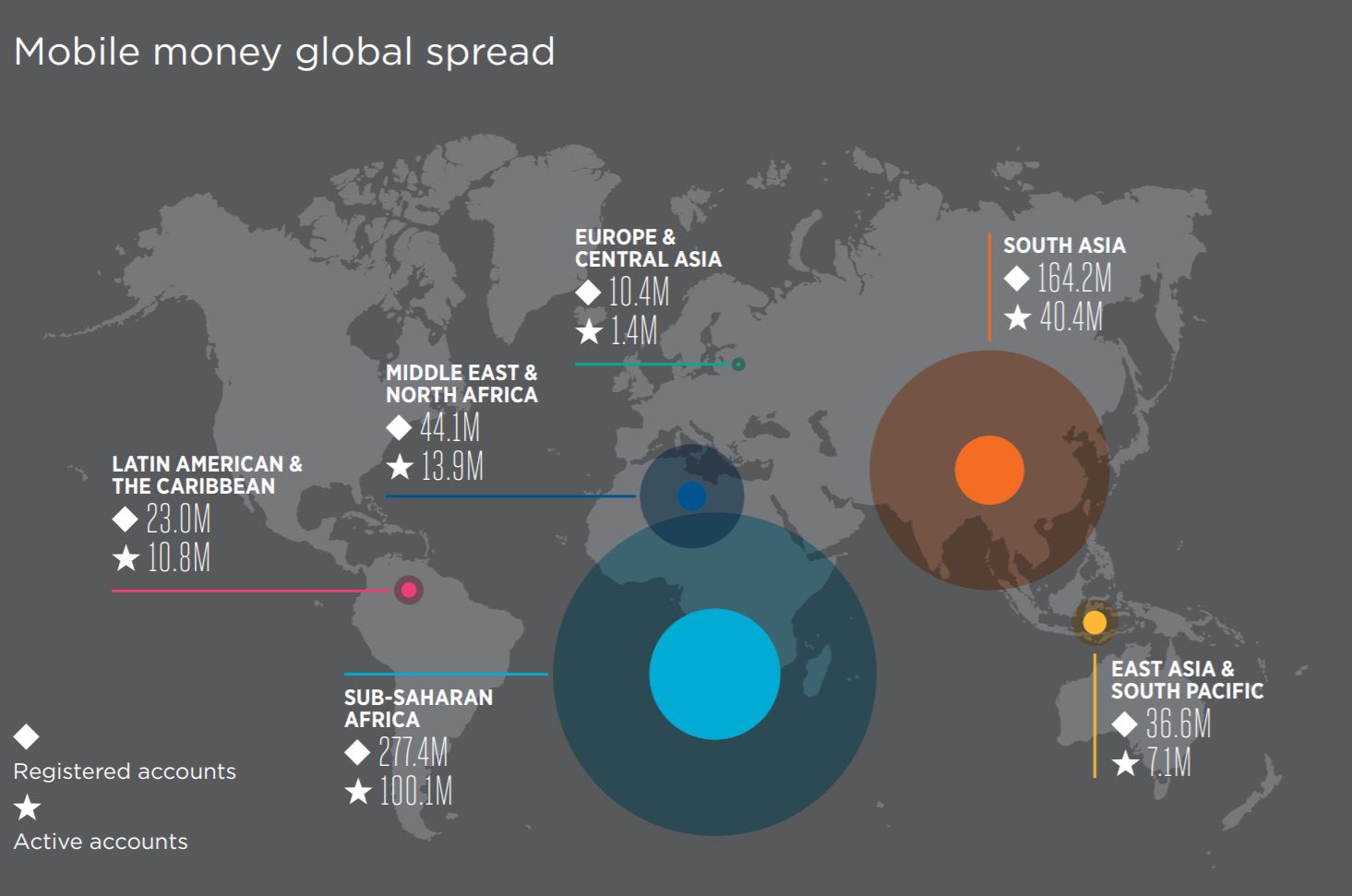

Mobile money represents a powerful opportunity to address this problem. As an industry with almost 700 million accounts, and a presence in two-thirds of the world’s low- and middle-income countries (Sub-Saharan Africa and South Asia accounting for the bulk of accounts), mobile money is strong in the very regions where the need for PAYG solutions is greatest. Furthermore, by providing a compelling use case for mobile money, PAYG providers are also driving mobile money penetration and usage, increasing brand loyalty, and contributing to revenues – underlining the strong synergy enjoyed by these two sectors.

Despite this obvious opportunity for collaboration, PAYG players and mobile money providers have not yet realised the full potential of their partnership. One of the biggest reasons is the need for service providers to undergo a technical integration with each mobile operator to accept payments from their customers. The current landscape for PAYG companies to connect with mobile money is overly complex. With 71 active and planned PAYG deployments and 151 mobile money providers (and counting), there is a staggering number of integrations to be performed in Africa alone. This presents a major bottleneck for the entire PAYG industry to flourish.

Prompted by this context, the GSMA’s Mobile Money and M4D Utilities teams (with support from the MasterCard Foundation) came together to create a service that can connect PAYG service providers to multiple mobile operators with just one integration. The hub not only enables small PAYG utility service providers to integrate easily with mobile operators, but also to helps them to serve their customers more efficiently by sending instant notifications of their payments made using mobile money, hence its name – the Instant Payment Notification (IPN) Hub.

It is important to point out that while the IPN Hub connects different PAYG providers and mobile operators, it does not actually process payments. PAYG providers must still forge contracts and settle funds directly with operators outside of the IPN Hub.

The IPN Hub was rolled out for testing in Rwanda on 1 December 2016. At the time of writing the report, the hub has been operational in Rwanda for 12 months, connects four entities (MTN Rwanda, Tigo Rwanda, BBoxx and Off Grid Electric) and has processed notifications for hundreds of thousands of payment transactions so far. While transactions data has been promising, we also conducted a rapid evaluation of the IPN Hub in Rwanda in April 2017 to better understand its impact on the ground. Testimonies collected from a range of stakeholders (including mobile operators, service providers and also end users/customers of PAYG solar services) indicated that the hub has had a positive impact, mainly through: smoother integrations for service providers; instant payments and service provision for customers; and reduced manual work for both operators and service providers.

The strong results posted by the IPN Hub in Rwanda and positive testimonies received from all project stakeholders provide powerful justification for scaling the hub to other markets where the PAYG solar industry’s growth is similarly constrained. As a result, the GSMA and the UK Department for International Development (DFID) have come together to jointly support the connection of the IPN Hub to many more PAYG service providers and mobile operators, primarily in Sub-Saharan Africa but also in South and South-East Asia.

The IPN Hub is meant to act as an industry utility, enabling small but life-enhancing PAYG energy transactions in a margin-sensitive business. Beyond the initial development and scale-up period, the hub will be run on a cost-recovery basis in order to ensure its long-term sustainability. As part of this, PAYG service providers connected to the hub will pay a small monthly subscription fee to support the ongoing costs. As the number of transactions increases, the unit cost per transaction will further decrease for each service provider.

The IPN Hub has clearly demonstrated its value in Rwanda. The next few months will see this industry asset rolled out in new markets and potentially for new use cases, fostering the growth of an ecosystem of PAYG providers that depends critically on mobile money. We are currently engaged in a sprint to connect new mobile operators and PAYG service providers to the hub.

If you would like to be integrated to the hub, please contact [email protected].

This initiative is currently funded by the UK Department for International Development (DFID), and supported by the GSMA and its members.