Mobile Money and

International Remittances

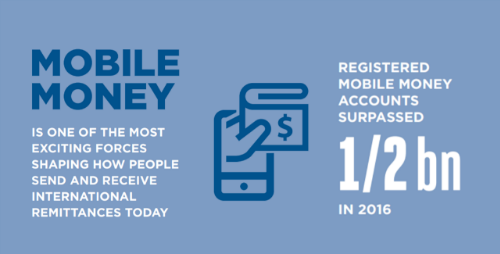

International remittances are critical to the livelihoods of hundreds of millions of people in the developing world, and mobile technology is one of the most exciting forces shaping how people send and receive them today. Around the world, people are increasingly shifting to digital channels, including mobile phones. The revolution that mobile money brought for domestic payments and cash transfers is now being repeated in international transfers.

This digitisation is helping to reduce the costs of sending money internationally, bringing us closer to the achievement of the United Nations Sustainable Development Goal 10. C, as well contributing to the achievement of other UN SDGs, such as reduction of poverty, gender equality, and climate resilience. In total, international remittances via mobile money contribute to 14 of the 17 SDGs.

Our Insights

Because of its reach and growing use among underserved people, mobile money is uniquely positioned to transform formal remittance markets and to advance financial inclusion. Mobile money providers are at the forefront of domestic payment services in many emerging markets, enabling the recipients of international remittances to pay for goods and services digitally, in turn creating a payments history that could enable them to access credit or insurance in the future. Mobile money has thus established itself as a critical tool for facilitating international remittances, while reducing remittance costs and maximising the impact of remittances on development.

For more information on mobile money and international remittances, read our latest blogs and resources or email us at [email protected].

Hear from industry experts

Relevant Blogs

Thursday 27 June, 2019 | Blog | Building the financial ecosystem | English | Global | Mobile Money | Policy and regulation

Mobile money: promoting the use of faster, safer and cheaper international remittances

Friday 14 June, 2019 | Blog | Building the financial ecosystem | English | Financial inclusion for women | Gender | Global | Mobile Money | Policy and regulation | Uncategorized

How do mobile money-enabled remittances contribute to achieving the SDGs?

Friday 15 June, 2018 | Blog | Building the financial ecosystem | English | Europe | Mobile Money

GSMA Mobile Money celebrates the International Day of Family Remittances

Thursday 8 June, 2017 | Blog | Global | Mobile access and use | Mobile Money

The GSMA endorses the International Day of Family Remittances

Thursday 16 June, 2016 | Blog | Building the financial ecosystem | Global | Interoperability | Mobile Money

Sending and receiving remittances with mobile money: Customer benefits and the potential to drive down cost